Gold Price Forecast: XAU/USD retests $1,800 ahead of NFP

- Gold re-takes $1,800 amid a renewed weakness in Treasury yields.

- DXY holds steady at higher levels, global tightening rethinking supports gold.

- Gold is sideways waiting for Nonfarm Payrolls.

Gold price is trading close to fresh five-day highs of $1,800, as a downbeat market mood boosts the underlying bullish momentum, with the focus now shifting towards the much-awaited US Nonfarm Payrolls data.

Resurfacing concerns over the indebted Chinese property sector combined with pre-NFP cautious trading has weighed down on the investors’ sentiment, underpinning the traditional safe-haven gold.

Meanwhile, a renewed downtick in the US Treasury yields across the curve amid risk-aversion has also collaborated with the latest leg up in gold price.

Gold price looks to extend Thursday’s upsurge well past the $1,800 barrier, helped by the market’s reassessment of the global tightening expectations.

Both the Federal Reserve (Fed) and the Bank of England (BOE) stood pat on interest rates at their respective November policy meeting, lifting the sentiment around the non-interest-bearing gold.

Gold traders now await the US payrolls data for gauging the next direction in the metal. The headline NFP is seen at 425K in October vs. 194K booked in September.

A solid jobs report would revive the Fed’s rate hike expectations, capping gold’s upside attempts while a disappointment could offer extra zest to gold bulls, with $1,814 back in sight.

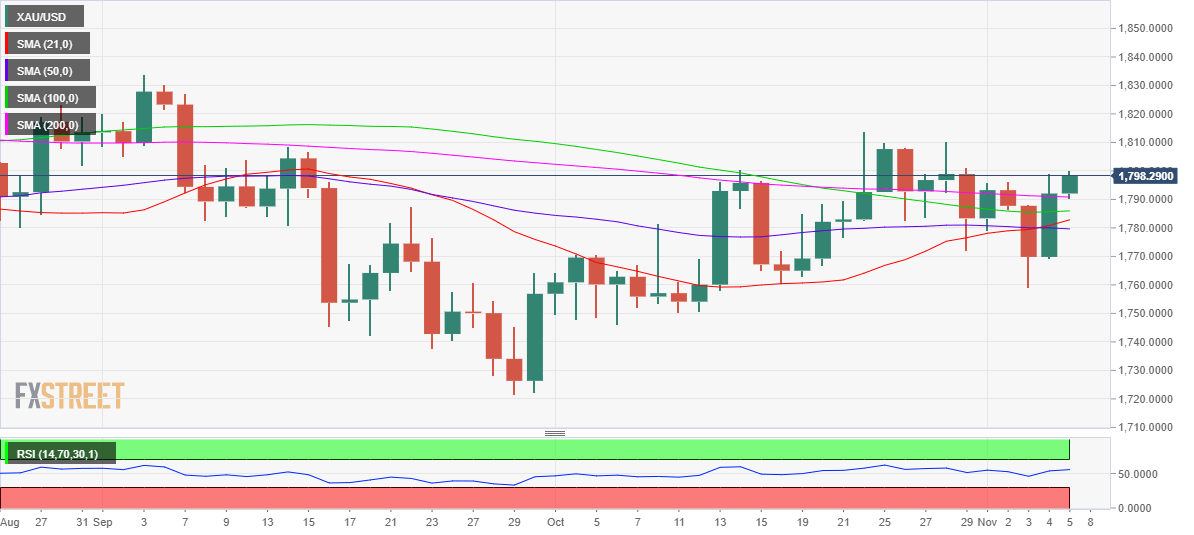

Gold Price: Technical outlook

Gold price is eyeing a sustained move above the $1,800 mark to unleash the additional recovery rally towards the previous week’s high of $1,810.

The 14-day Relative Strength Index (RSI) is pointing north above the 50.00 level, suggesting that the bulls will likely remain in control in the near term.

Gold: Daily chart

On the downside, immediate support is at the 200-Daily Moving Average (DMA) at $1,791, below which a strong cushion appears around $1,784. At that level, the 21 and 100-DMAs hang closer.

Further south, the horizontal 50-DMA at $1779 could be challenged.

All in all, the path of least resistance appears to the upside, as gold price closed Thursday above the critical 200-DMA barrier.

Gold: Additional levels

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.