Gold Price Forecast: XAU/USD remains subdued around $1,960 as investors expect consecutive skip from Fed

- Gold price has remained subdued around $1,960.00 as the US Dollar Index has attempted a recovery.

- In spite of a decline in price pressures, Fed Waller delivered a hawkish commentary.

- Gold price is gathering strength for further upside after a stalwart rally.

Gold price (XAU/USD) is demonstrating a subdued performance around $1,960.00 in the early New York session. The precious metal is struggling to deliver a decisive move as investors are hoping that the Federal Reserve (Fed) might skip the policy-tightening regime one more time this month.

After recognizing a consistent decline in inflationary pressures, Fed chair Jerome Powell skipped its policy-tightening spell in May but remained doors open for more rate hikes. June’s inflation report conveyed that price pressures have softened more than expected as prices of second-hand automobiles have dropped sharply.

Meanwhile, S&P500 is expected to open on a mildly bullish note amid a risk-on mood. The US Dollar Index (DXY) has delivered a short-lived pullback to near 100.00, however, the downside bias is still favored as fundamentals are still not supporting. The yields offered on 10-year US Treasury bonds have rebounded to near 3.79%.

In spite of the decline in price pressures, Fed Governor Christopher Waller delivered a hawkish commentary. Fed Waller is confident that two more interest rate hikes are appropriate this year to bring down inflation to 2%.

Gold technical analysis

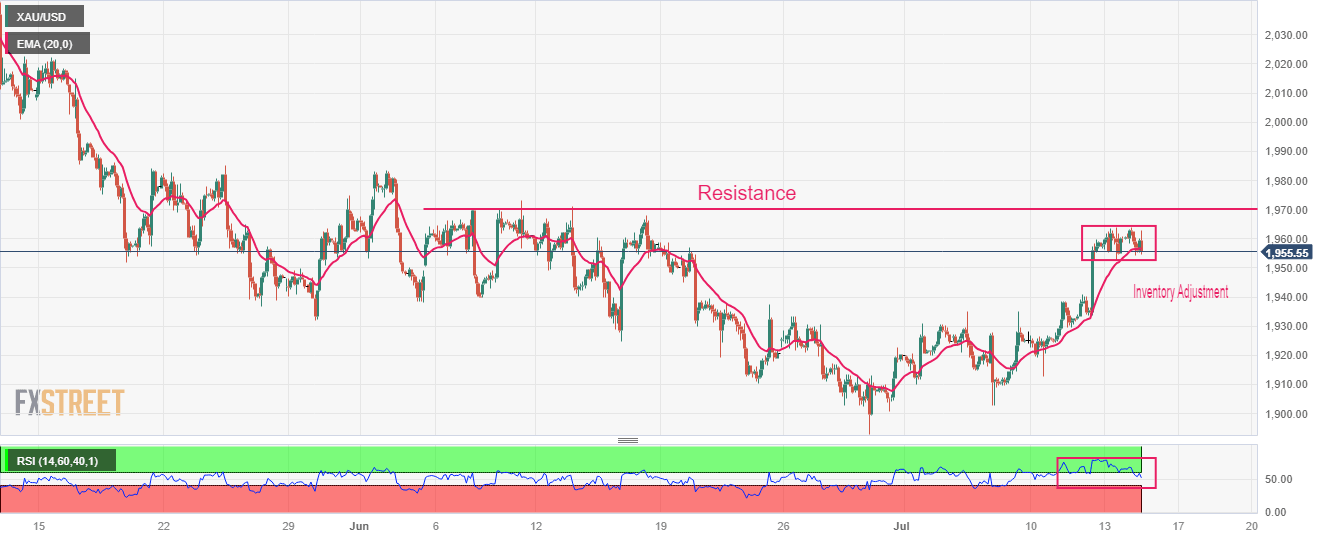

Gold price is gathering strength for further upside after a stalwart rally on a two-hour scale. An inventory adjustment is under process as inventory is exchanged between institutional investors and retail participants. Potential resistance is plotted from June 07 high around $1,966.70.

Upward-sloping 20-period Exponential Moving Average (EMA) at $1,956.33 is providing support to the Gold bulls.

The Relative Strength Index (RSI) (14) has slipped below 60.00, which indicates exhaustion in the upside momentum.

Gold two-hour chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.