Gold Price Forecast: XAU/USD hangs near one-week-old trading range support, just above $1,775

- Gold is retracing the Asian rebound despite weaker DXY, yields.

- Fed’s anxiety over inflation fears and next policy move keep investors on the edge.

- Gold Weekly Forecast: Sellers look to retain control following uninspiring rebound

Update: Gold struggled to capitalize on last week's modest gains and edged lower on the first day of a new trading week. The precious metal remained on the defensive through the mid-European session and was last seen hovering near the lower end of a one-week-old trading range, just above the $1,775 level. The downtick was exclusively sponsored by a modest US dollar strength, which tends to undermine demand for dollar-denominated commodities, including gold.

Despite mixed signals about the US inflation, investors remain concerned about the potential for an early move by the Fed to tighten its monetary policy. This, in turn, continued acting as a tailwind for the greenback and further weighed on the non-yielding yellow metal. That said, a fresh leg down in the US Treasury bond yields, along with the prevalent cautious mood around the equity markets might help limit any deeper losses for the safe-haven gold.

Investors might also refrain from placing any aggressive bets, rather prefer to wait on the sidelines ahead of Friday's release of the closely watched US monthly jobs report (NFP). Even from a technical perspective, the XAU/USD has been oscillating in a range over the past one week or so. This further makes it prudent to wait for a sustained break through the recent trading band before determining the next leg of a directional move for gold.

Previous update: Gold price is retracing the rebound seen earlier in the Asian session, unable to take advantage of the renewed weakness in the US dollar and the Treasury yields. The bulls turn cautious amid increased uncertainty over the Fed’s next monetary policy move after last week’s mixed messages from the officials of the world’s most powerful central bank. Meanwhile, weaker-than-expected PCE Price Index data failed to douse inflation fears. Investors are also monitoring progress on the negotiations over a US infrastructure deal.

In absence of any relevant US economic data, the broader market sentiment and the dollar’s dynamics will be closely followed for gold price action. The main event risk for this week remains the US Nonfarm Payrolls due on Friday.

Read: Gold price analysis: Gold is sideways at $1770/oz – $1790/oz

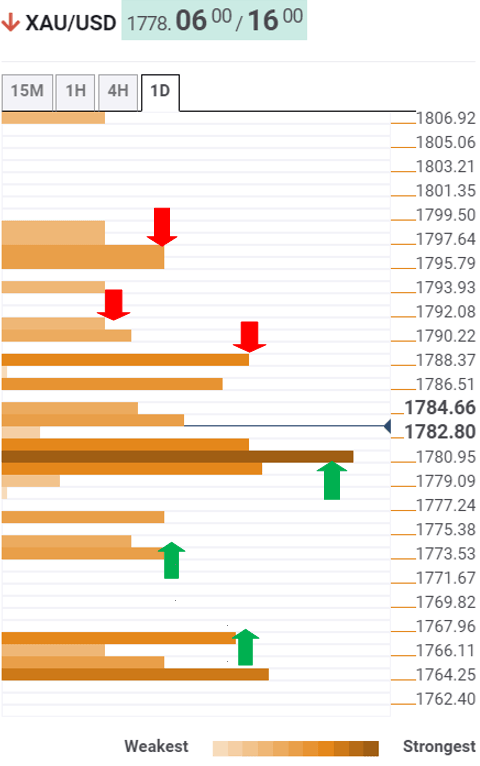

Gold Price: Key levels to watch

The Technical Confluences Detector shows that gold price has faced rejection at $1786, which is the convergence of the Fibonacci 23.6% one-day, SMA50 four-hour and previous high four-hour.

Given that, gold price has accelerated its retreat below a dense cluster of critical support levels around $1780.

At that point, the Fibonacci 61.8% one-day, SMA5 four-hour and SMA100 one-hour coincide.

Sellers now target the previous day’s low of $1774, below which the previous month’s low of $1766 remains on their radars.

On the flip side, recapturing the $1786 hurdle is needed to unleashing the additional upside towards the previous day’s high of $1791.

Further north, the previous high at $1795 could challenge the bullish commitments.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.