Gold Price Forecast: XAU/USD records minimal gains around $1885, though remains down in the week

- The yellow metal prepares to finish the week with losses near 0.60%.

- High US Treasury yields, led by the 10-year, around 3.12%, keep gold prices pressured.

- Gold Price Forecast (XAU/USD): Failure at $1890 would send gold prices tumbling towards $1835 (200-DMA).

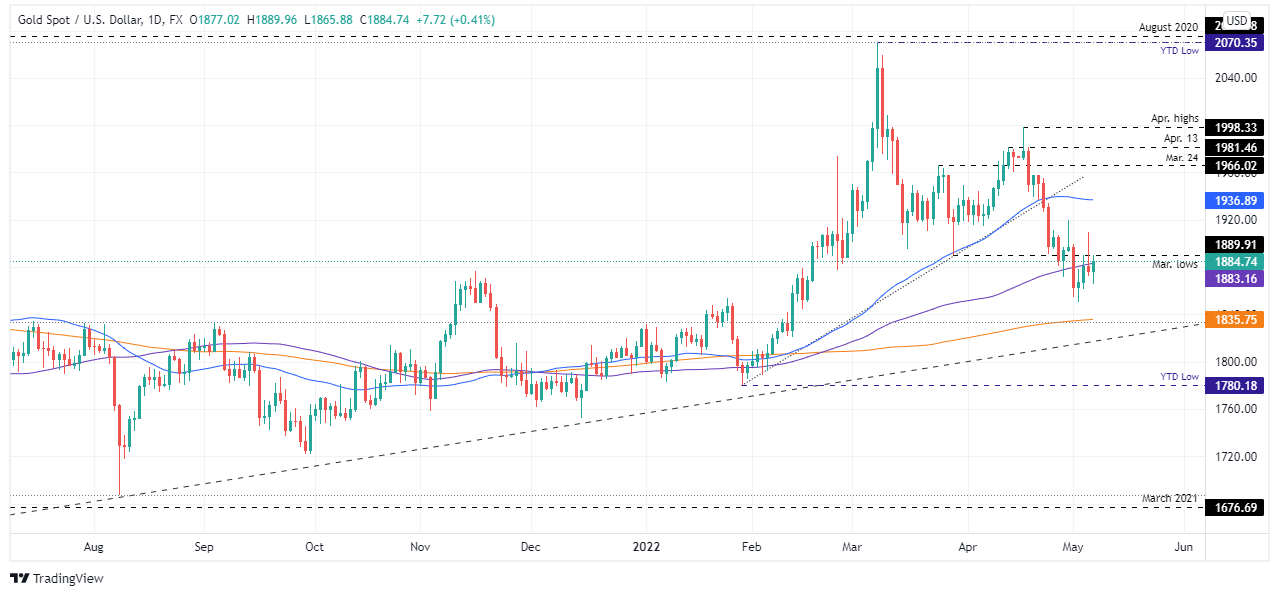

Gold spot (XAU/USD) persist downward pressured, and it seems that it would finish the week with losses of around 0.60%, extending its fall from April’s swing high at around $1998.30s, below March’s lows around $1890. At $1884.74 a troy ounce, Gold Prices reflect the greenback’s strength.

Gold set to extend its weekly losing streak to three, as US Nonfarm Payrolls smashed expectations

The gold push above the $1900 figure proved short-lived. It lasted no longer than some hours, shedding earlier gains post-Fed hike on Wednesday, retreating below solid resistance around $1890, so the yellow metal is ready to print its third weekly loss in a row. It is worth noting that the dip in XAU/USD is courtesy of higher US Treasury yields, led by the 10-year benchmark note, which rose to a daily high near 3.12%, closing to the 2018 year high at 3.24%.

Headwind for gold was also generated by a firm US dollar in the week. Albeit printing losses on Friday, down 0.03%, is up 0.29% in the week, as shown by the US Dollar Index, sitting at 103.511.

On Friday morning, the US Department of Labour reported the Nonfarm Payrolls report for April, which showed an increase of 428K jobs added to the economy, beating the estimations of 391K. The Unemployment Rate remained unchanged at 3.6%, and according to the report, it was led by gains in leisure, hospitality, manufacturing, transportation, and warehousing.

Regarding Average Hourly Earnings, on private nonfarm payrolls rose by 0.3% m/m. Meanwhile, the annual-based measure increased by 5.5%, almost unchanged, compared to the previous month’s reading of 5.6%.

Analysts at Commerzbank, in a note, commented that the labor market is robust, and it puts the US decline in GDP for the Q1 in perspective. They added that “this decline was due exclusively to significantly higher imports and lower inventory buildup. By contrast, domestic final demand increased strongly.”

“Employment growth remains high. In addition, companies still offer more than 11.5 million open jobs, indicating unchanged robust demand for workers. This demand is drawing from an increasingly empty pool of available labor, which is likely to keep wage pressures high,” added Commerzbank analysts.

Still, Commerzbank expects that the Federal Funds Rate upper bound would be 3.00% by the end of the year.

Gold Price Forecast (XAU/USD): Technical outlook

XAU/USD is still neutral-upward biased, but as long as it struggles to reclaim $1890, that could open the door for further downward pressure. Additionally, the 50 and the 100-day moving average (DMAs), with the latter at $1883.16, below the former, are resistance levels that cap higher prices.

Upwards, XAU/USD’s first resistance would be March’s lows around $1890. A break above would expose the $1900 mark, followed by May 4 swing high at $1909.66. On the flip side, gold’s first support would be the 100-DMA, at $1883.16. Once cleared, the next support would be May 3 cycle low, around $1850.34, followed by the 200-DMA at $1835.77.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.