Gold Price Forecast: XAU/USD records a fresh two-week high at around $1860s amid US dollar weakness

- Gold (XAU/USD) begins the week on the right foot, up 0.54% in the week.

- A softer buck and concerns of the US falling into a recession courtesy of an aggressive Fed lifts the prospects of the yellow metal.

- Gold Price Forecast (XAU/USD): Bulls need to reclaim the 20-DMA, if not a re-test of the 200-DMA is on the cards

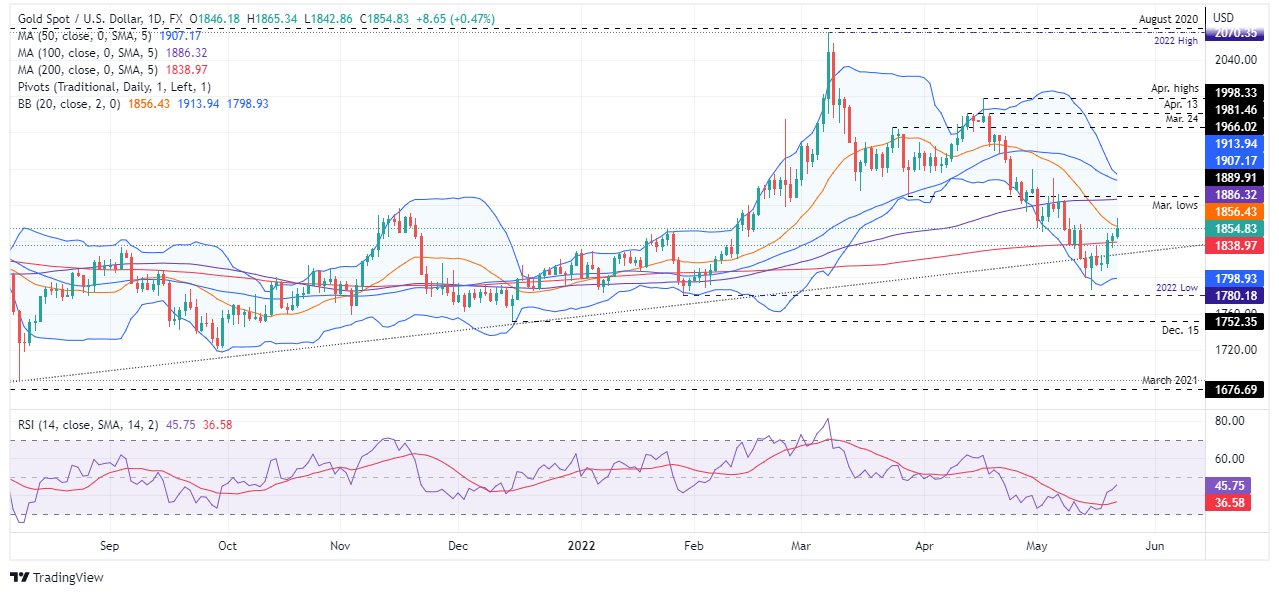

Gold spot (XAU/USD) advances for the fourth-straight trading day and begins the week with an upbeat tone but retreats at the 20-day moving average (DMA) at $1856.45. At $1854.78, XAU/USD reflects the weak appetite for the greenback, albeit higher US Treasury yields, which are pairing last Friday’s losses.

The market sentiment remains upbeat, one of the factors that weighed on the US Dollar, which is trading at four-week lows. The US Dollar Index is plunging almost 1% and clings to the 102.000 mark, a tailwind for Gold prices. The buck’s weakness is courtesy of growing concerns of a US economic slowdown that could trigger a recession, as the Federal Reserve hikes rates aggressively to bring inflation down from above 8%. Investors’ focus would be on Friday’s Personal Consumption Expenditure (PCE), the US Fed’s favorite gauge of inflation

In the meantime, US equities are higher as the New York session begins to wind down, though they remain at risk of resuming the ongoing bear market correction. That would carry on towards the Asian session, which could witness the second straight session with a positive appetite. Reports that the US may consider lifting some trade tariffs on China was a piece of news cheered by traders, which turned to equities and lifted the major global indices.

Elsewhere, Atlanta’s Federal Reserve President Raphael Bostic said that the quick response in financial markets to tighten monetary policy offers hope that other parts of the economy may adjust more quickly.

On Monday, XAU/USD began its week of trading, just shy of the R1 daily pivot around $1858, and rallied towards the daily high at $1865.34, $25 short from testing March lows at around $1889.91. Furthermore worth noting that once the daily high was reached, the yellow metal retreated below the 20-day moving average (DMA), and it is settling around the $1850 area.

Gold Price Forecast (XAU/USD): Technical outlook

XAU/USD is neutral biased once traders lifted the non-yielding metal above the 200-DMA at $1838.97, opening the door for further gains. However, although Gold is rallying for the fourth consecutive day, it remains exposed to further selling pressure. At the time of writing, the daily chart shows that XAU/USD bulls failed to reclaim the 20-DMA at $1856.46, a level that, once conquered, could open the door for a re-test of March’s low at around $1889.91.

If that scenario plays out, XAU/USD’s first resistance would be the 100-DMA at $1886.33. Break above would expose March’s low at $1889.91, followed by the $1900. Mark. On the flip side, XAU/USD’s first support would be the 200-DMA at 1838.97. Once cleared, the next support would be $1800, followed by the YTD low at $1780.18.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.