Gold Price Forecast: XAU/USD rebounds toward $1,800 amid US Dollar sell-off

- Gold price jumps, as US Dollar tracks USD/JPY sell-off post-BoJ decision.

- US Treasury bond yields rocket, limiting the upside in Gold price.

- Gold price bounces-off 200DMA support once again, will it regain $1,800?

Gold price has caught a fresh bid over the last hour, as it jumps back toward the $1,800 mark. The US Dollar has come under massive selling pressure after the USD/JPY pair plunged over 2% following the Bank of Japan (BoJ) monetary policy announcements.

The Japanese Yen rallied hard and smashed the USD/JPY pair after the central bank kept the rates unchanged but tweaked the operational functions of the yield curve control (YCC) framework. The sudden slump in the pair dragged the US Dollar sharply lower across the board, lifting the USD-sensitive Gold price.

However, a further upside in the bright metal appears elusive, as the BoJ’s YCC tweak has shot up the US Treasury bond yields through the roof, as it underscores the widening Fed-BoJ policy divergence. The benchmark 10-year US Treasury bond yield is up 3.50% on the day at 3.705%, as of writing. Higher yields tend to weigh on the non-interest-bearing Gold price.

Meanwhile, risk-aversion could put a floor under the US Dollar slump, keeping a check on the upside in Gold price.

Looking ahead, the sentiment around the US Dollar and the yields will continue influencing the precious metal ahead of the US Housing data and the Wall Street opening.

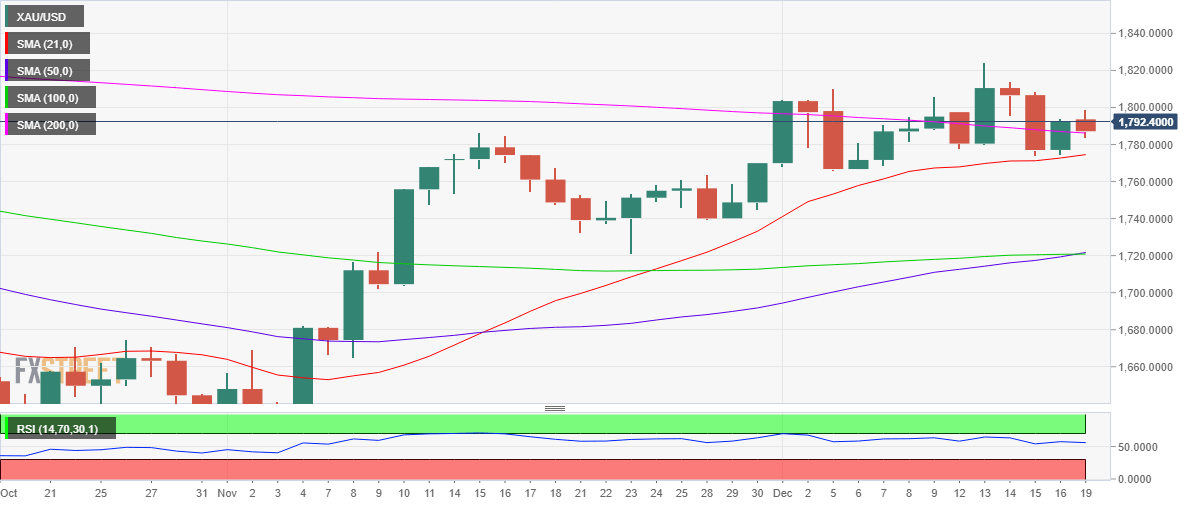

Gold price technical outlook: Daily chart

On the daily sticks, Gold price has bounced off the critical 200-Daily Moving Average (DMA) yet again, as it now looks to recapture the $1,800 mark.

The next relevant stop for Gold bulls is seen at the December 15 high of $1,809. The 14-day Relative Strength Index (RSI) inches higher above the midline, supporting the upswing.

On the downside, a breach of the 200DMA will reopen floors toward the bullish 21DMA at $1,777. Further south, the $1,750 psychological level will be back on sellers’ radars.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.