Gold Price Forecast: XAU/USD rebounds from $1,660 but still inside the woods, US GDP buzz

- Gold price is displaying topsy-turvy moves as investors await the release of the US economic data.

- The US GDP is expected to deliver positive growth despite an extreme hawkish environment.

- Advancing core CPI has failed to deliver a decline in demand for durable goods.

Gold price (XAU/USD) is broadly auctioning in a bounded territory as the market participants are awaiting fresh impetus for a one-sided move. The precious metal witnessed mild selling pressure at around $1,670.00 but has rebounded from $1,660.00 and has got back inside the woods. The balanced auction profile is plotted in a range of $1,660.00-1,671.20.

Meanwhile, the US dollar index (DXY) has sensed a mild buying interest of around 109.60 but is still in a rangebound structure. The 10-year US Treasury yields have rebounded marginally after testing waters below the psychological support of 4%. The market mood is extremely quiet as investors have shifted to the sidelines ahead of the US Gross Domestic Product (GDP) and US Durable Goods Orders data.

Despite accelerating interest rates by the Federal Reserve (Fed), the US GDP is expected to report a growth rate of 2.4% in the third quarter of CY2022 vs. a de-growth of 0.6% reported earlier.

Also, the US Durable Goods Orders are expected to outperform by delivering an increment of 0.6% against a drop of 0.2%. It is worth noting that core inflation data is escalating for the past few months and still a progressive demand for durable goods indicate solid demand from households.

Gold technical analysis

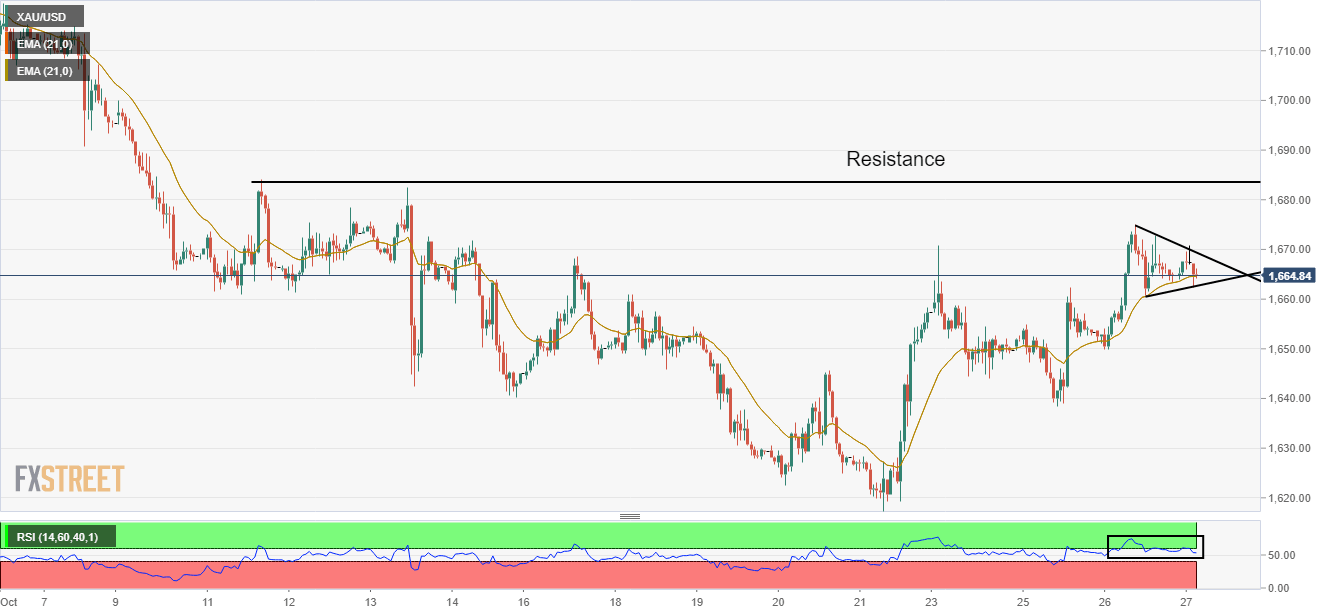

Gold prices are oscillating in a Symmetrical triangle that signals a sheer contraction in volatility. An explosion of the volatility contraction pattern will result in wider ticks and heavy volume. Horizontal resistance is placed from October 11 high at $1,684.05.

The 20-period Exponential Moving Average (EMA) at $1,633.16 is acting as major support for the counter.

The Relative Strength Index (RSI) (14) has dropped from the bullish range of 60.00-80.00, however, the upside bias is still solid.

Gold hourly chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.