- Gold Price stays defensive at five-month low, keeps week-start rebound.

- Risk aversion, firmer Treasury bond yields challenge XAU/USD recovery ahead of mid-tier catalysts.

- Central bankers’ defense of hawkish policy at Jackson Hole eyed to keep Gold bears on the table.

Gold Price (XAU/USD) portrays bearish consolidation at the lowest level in five months while defending the week-start rebound amid mixed sentiment.

US Dollar’s downbeat performance allows the XAU/USD to pare previous losses at the multi-day bottom. However, the firmer Treasury bond yields and fears surrounding China, one of the world’s biggest Gold customers, prod the recovery moves amid a light calendar.

That said, the mostly upbeat US data and looming fears about the US banking industry, especially after the recent credit rating downgrade from Moody’s and the S&P Global, underpin the market’s cautious mood and the bond coupons, which in turn weigh on the Oil price. Furthermore, China’s efforts to defend the post-COVID economic recovery, via a slew of stimulus measures, fail to impress market optimists and exert downside pressure on the risk profile.

Against this backdrop, US Dollar Index (DXY) renews its intraday low near 103.20, down for the second consecutive day, as market players brace for Friday’s speech for Fed Chair Jerome Powell at the Kansas Fed’s annual event called at the Jackson Hole Symposium. Furthermore, the US 10-year Treasury bond yields refreshed the highest level since November 2007 earlier in the day to 4.36% before easing to 4.34% at the latest. On the same line, the S&P500 Futures print mild losses to reverse the previous recovery from a nine-week low.

Also read: Gold Price Forecast: XAU/USD recovery seeks daily closing above $1,891, Fedspeak eyed

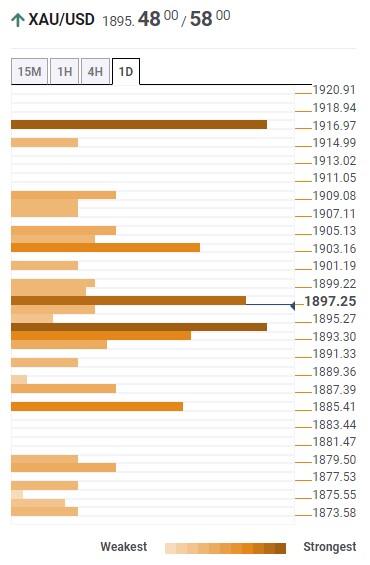

Gold Price: Key levels to watch

Our Technical Confluence indicator suggests the sluggish recovery of the Gold Price even as it recently poked the mid-tier resistance confluence surrounding $1,895 comprising Fibonacci 38.2% on one day, 100-HMA and the middle band of the Bollinger on the hourly chart.

However, a convergence of the Fibonacci 38.2% on one-week and the upper band of the Bollinger on the four-hour (4H) play prods the immediate upside of the Gold Price near the $1,900 round figure.

Following that, the previous monthly, 10-DMA and 200-HMA will together challenge the Gold buyers near $1,905.

Above all, the joins of the Pivot Point one-month S1 and the previous weekly high of around $1,920 acts as the final defense of the XAU/USD bears.

On the contrary, a downside break of the aforementioned $1,895 resistance-turned-support could quickly fetch the Gold price toward the lows marked in the previous day and during the last week around $1,885.

In a case where the XAU/USD remains bearish past $1,885, the Pivot Point one-week S1 and one-day S2, near $1,878 will hold the gate for the bear’s ride towards the early March swing high of around $1,858.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD remains below 1.0500, traders await release of key US economic indicators

EUR/USD maintains its position after the recent losses registered in the previous session, trading around 1.0480 during the Asian hours on Wednesday. Traders await the US Personal Consumption Expenditure (PCE) Price Index and quarterly Gross Domestic Product Annualized scheduled to be released later in the North American session.

GBP/USD strengthens above 1.2550 ahead of US PCE inflation data

The GBP/USD pair trades on a stronger note near 1.2570 on Wednesday during the early European session. The Pound Sterling (GBP) consolidates despite US President-elect Donald Trump announcing more tariff measures.

Gold price sticks to modest intraday gains, bulls seem cautious ahead of US PCE data

Gold price builds on the overnight bonce from the $2,600 neighborhood, or a one-week low and gains some follow-through positive traction for the second straight day on Wednesday.

Ripple's XRP sees decline as realized profits reach record levels

Ripple's XRP is down 6% on Tuesday following record profit-taking among investors as its percentage of total supply in profit reached very high levels in the past week.

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.