Gold Price Forecast: XAUUSD pressures daily highs around $1,950.00

- Gold Price snapped a three-day downtrend to bounce off a 13-day low.

- Mixed headlines coming from the Russia-Ukraine front weighed on the market's mood.

- XAUUSD is technically bullish, faces strong resistance around $1,960.

XAUUSD advances slowly but steadily as investors continue to dump the greenback. The bright metal is trading near a daily high fo $1,949.78 a troy ounce, still down for the week as it started it at $1,988.44. Beyond the broad dollar’s weakness, Wall Street is also providing support to Gold Price, as the three major indexes trade in the red. Market participants are disappointed by the lack of progress in Russia-Ukraine peace talks, as if the crisis continues, it could have long-lasting effects in growth, while pushing inflation higher.

A hawkish stance from the US Federal Reserve is also taking its toll on equities, as the US central bank has pointed out to possible six more rate hikes this year, pretty much one in each monetary policy meeting, while hinting at the reduction of the balance sheet as soon as next May.

Nevertheless, the focus remains on the Eastern Europe conflict. So far, peace talks have not been enough to prevent Russian attacks on its neighbor country, which continue to escalate. The latest on the matter indicates that Ukraine and Turkey are working on setting up a meeting between Volodymyr Zelenskyy and Vladimir Putin. Additionally, the UK announced is halting all tax cooperation with Russia and Belarus by suspending exchanges of tax information with them.

In the meantime, demand for the greenback remains subdued, amid easing US government bond yields. The yield on the US 10-year Treasury note retreated further and is currently at around 2.14% after peaking at 2.24% following the US Federal Reserve monetary policy announcement on Wednesday.

Also read: Gold Price Forecast: Acceptance above 21-DMA is critical for XAU/USD for additional recovery gains

The talks of a diplomatic compromise between Russia and Ukraine initially triggered the risk-on mood during Wednesday’s North American session before news suggesting a deadlock on the proposed neutrality of Kyiv. Also, Russia was ordered by the International Court of Justice in The Hague to suspend the invasion of Ukraine, which in turn may raise barriers for successful talks. Recently, Ukrainian President Volodymyr Zelenskyy hoped for the allies' assistance on control of air traffic for Russian military planes.

Elsewhere, a softer COVID-19 daily count from China tames virus woes from the dragon nation and adds to the upbeat sentiment. On the same line were headlines suggesting the government’s readiness to propel economic growth, by China Vice Premier Liu He.

It should, however, be noted that the US Federal Reserve’s (Fed) 0.25% rate hike and expectations of seven more such rate lifts during 2022, coupled with upwardly revised inflation forecast, challenge the risk-on mood. Moving on, gold traders will pay major attention to the headlines from China and Ukraine for fresh directions.

XAUUSD Technical Outlook

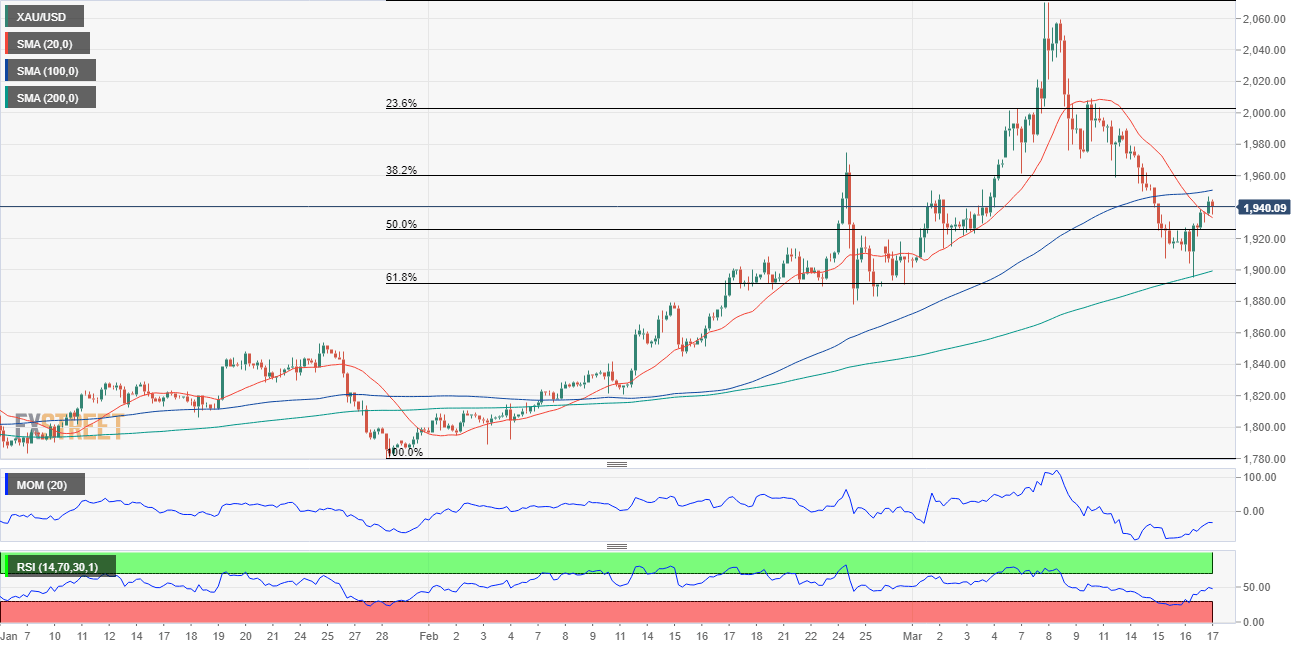

XAUUSD is up for a second consecutive day, recovering from near the 61.8% retracement of its 2022 rally from $1780.15 to $2070.50. The next Fibonacci resistance level comes at around $1,960, and a break above it should hint at renewed bullish strength.

Gold Price is technically bullish according to technical readings in the daily chart. The 100 and 200 SMAs remain well below the current level with mildly bullish slopes. Technical indicators are recovering after nearing their midlines, gaining bullish momentum, without signs of exhaustion.

The 4-hour chart shows that Gold Price holds onto the previous day’s rebound from the 200-SMA, although below the 100 SMA currently at around $1,950.

In a case where gold rises past $1,960, a three-week-old horizontal area surrounding $1,970-75 will act as the last defense for bulls. On the contrary, the previous resistance line from March 08 and the 200-SMA, around $1,912 and $1,895 in that order, will challenge the short-term downside of gold.

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.