- Gold Price clings to mild gains at five-month low while paring weekly losses amid lackluster markets.

- Pullback in yields, US Dollar joins cautious mood ahead of Jackson Hole speeches to trigger XAU/USD’s corrective bounce.

- Confusion between China stimulus hopes and debt woes also prod the Gold sellers.

- Key technical upside hurdle, fresh hopes of higher central bank rates prod XAU/USD recovery.

Gold Price (XAU/USD) bears take a breather at the lowest levels in five weeks, allowing intraday buyers to stay happy with mild gains amid a sluggish trading day.

The yellow metal’s latest corrective bounce could be linked to a retreat in the US Treasury bond yields and the US Dollar, as well as hopes for China stimulus. That said, the US bond coupons remain pressured after challenging the multi-year high the previous day while the US Dollar Index (DXY) also consolidates the fourth weekly gain in a row as market players brace for the next week’s annual event at the Jackson Hole Symposium where the top-tier central bankers speak.

Elsewhere, China’s second-large realtor, as well as the world's most heavily indebted property developer, Evergrande filed for protection from creditors in a US bankruptcy court on Thursday, per Reuters, which in turn propelled the market’s fears. However, the concerns about Chinese policymakers’ readiness for more stimulus to defend the economy from debt woes seem to have challenged the pessimists and the Gold sellers of late.

To sum up, the Gold Price portrays a dead cat bounce while staying below the key upside hurdle, which in turn keeps the XAU/USD sellers hopeful of witnessing a fresh multi-month low past $1,900.

Also read: Gold Price Forecast: XAU/USD rebounds but 200 DMA appears a tough nut to crack

Gold Price: Key levels to watch

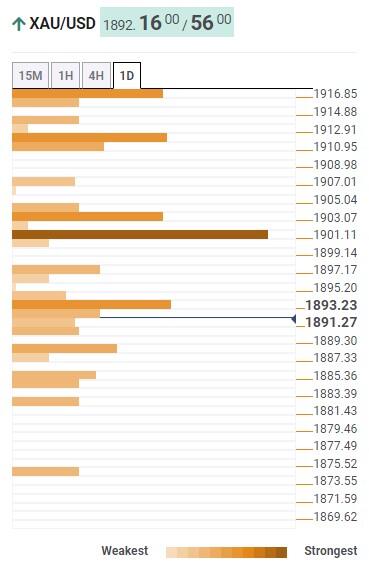

Our Technical Confluence indicator signals that the Gold Price stays well beneath the $1,902 resistance confluence comprising Pivot Point one-day R1 and one-week S1, as well as the upper line of the Bollinger on the hourly play. Also restricting the immediate upside of the XAU/USD is the convergence of the previous monthly low and Thursday’s high of around $1,905.

In a case where the XAU/USD rebound crosses the $1,905 hurdle, the Pivot Point one-day R2, 200-HMA and the upper line of a Bollinger on the four-hour play, close to $1,913, could test buyers.

Following that, the Pivot point one-month S1 around $1,917 will act as the final defense of the XAU/USD sellers.

Meanwhile, the Pivot Point one-week S1 restricts the immediate downside of the Gold price near $1,888, a break of which could drag the commodity to the lower band of the Bollinger on the daily chart, surrounding $1,884.

It should be noted that the Gold Price weakness past $1,884, could quickly drag the XAU/USD toward the Pivot Point one-day S2, near $1,875.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD treads water just above 1.0400 post-US data

Another sign of the good health of the US economy came in response to firm flash US Manufacturing and Services PMIs, which in turn reinforced further the already strong performance of the US Dollar, relegating EUR/USD to the 1.0400 neighbourhood on Friday.

GBP/USD remains depressed near 1.2520 on stronger Dollar

Poor results from the UK docket kept the British pound on the back foot on Thursday, hovering around the low-1.2500s in a context of generalized weakness in the risk-linked galaxy vs. another outstanding day in the Greenback.

Gold keeps the bid bias unchanged near $2,700

Persistent safe haven demand continues to prop up the march north in Gold prices so far on Friday, hitting new two-week tops past the key $2,700 mark per troy ounce despite extra strength in the Greenback and mixed US yields.

Geopolitics back on the radar

Rising tensions between Russia and Ukraine caused renewed unease in the markets this week. Putin signed an amendment to Russian nuclear doctrine, which allows Russia to use nuclear weapons for retaliating against strikes carried out with conventional weapons.

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.