Gold Price Forecast: XAU/USD rebound appears elusive below $1,950 as yields drive US Dollar higher

- Gold Price pares recent losses at weekly low after five-day losing streak.

- XAU/USD bears the burden of strong US Dollar, China woes.

- Mostly upbeat United States data, Federal Reserve talks propel yields, US Dollar and weigh on the Gold Price.

- Risk catalysts, mid-tier US data and Fed signals eyed for fresh impulse as bearish bias prods previous two-week rebound.

Gold Price (XAU/USD) portrays a corrective bounce from one-week low to $1,918 amid the initial hours of Thursday’s Asian session, after declining in the last five consecutive days. In doing so, the bright metal seeks more clues to defend the latest downside despite being bearish amid firmer US Dollar and the United States Treasury bond yields, not to forget fears emanating from China.

Gold Price drops as United States data, Federal Reserve signals favor US Dollar

Gold Price remains on the back foot as market players rush towards the US Dollar amid firmer United States data and hawkish Federal Reserve (Fed) signals. The same portrays the brighter odds of the US soft landing versus the fears of hard landing elsewhere in the major economies and increases the Greenback’s allure, weighing on the XAU/USD.

The US Dollar Index (DXY) rose to a fresh high since March 15, after Wednesday’s initial retreat, close to 105.00 by the press time.

On Wednesday, US ISM Services PMI rose to a six-month high of 54.5 in August versus 52.5 expected and 52.7 prior. Further, the final readings of the S&P Global Composite and Services PMIs eased to 50.2 and 50.5 for the said month compared to the initial estimations of 50.4 and 51.0 in that order. It should be noted that all three major constituents of the ISM Services PMI, namely Employment, New Orders and Prices Paid rose notably beyond the previous readings and helped the US Dollar to reverse early-day pullback.

Earlier in the week, the US Factory Orders for July dropped to the lowest since mid-2020 but the details about the orders excluding transport, shipments of goods and inventories were impressive to defend the hawkish Fed bias.

Elsewhere, Federal Reserve (Fed) Governor Christopher Waller defended hawkish monetary policy during a CNBC interview and Cleveland Federal Reserve President Loretta Mester ruled out rate cuts. However, Federal Reserve Bank of Boston President Susan Collins cited the risk of an overly restrictive stance on monetary policy to suggest the need for a patient and careful, but deliberate, approach.

Furthermore, the Fed’s Beige Book also pushed back expectations of witnessing either a policy pivot or rate cut while stating, “US economic growth was modest amid a coolinglabor market and slowing inflation pressures in July and August.”

While the US data and the Fed signals suggest brighter odds of the soft landing in the US and favored the US Dollar, as well as weakened the XAU/USD, economic fears surrounding China, the Eurozone and the UK seem to also direct the market players toward the Greenback and amplify the bearish bias about the Gold Price.

China woes also favor XAU/USD bears

Apart from the United States data and the Federal Reserve (Fed) signals, downbeat concerns about China, one of the world’s biggest Gold customers, also weighed on the precious metal.

Early-week disappointment from China Caixin Services PMI joined the market’s lack of confidence in the Dragon Nation’s stimulus to weigh on the concerns about Beijing, as well as the Gold Price. On the same line could be the US-China tension surrounding the trade conditions and Taiwan.

Late on Tuesday, US Commerce Secretary Gina Raimondo ruled out expectations of witnessing any revisions to US tariffs on China imposed during President Donald Trump's administration until an ongoing review is completed by the US Trade Representative's (USTR) Office, reported Reuters while citing the CNBC interview of the diplomat. These comments flag the continuation of the US-China tension and joined the fears about China’s economic recovery to weigh on the sentiment, which in turn underpinned the US Dollar’s run-up and weighed on the Gold Price.

Against this backdrop, the US 10-year Treasury bond yields rose to a two-week high of around 4.30% and the two-year refreshed weekly top above 5.0%, which in turn offered notable strength to the US Dollar and favored the Gold sellers. Further, the Wall Street benchmark closed in the red for the second consecutive day and challenged demand for riskier assets like Gold.

Multiple catalysts to watch for clear directions

Looking ahead, multiple Federal Reserve (Fed) speakers are scheduled to deliver speeches and can infuse volatility into the markets, making it more important to watch for Gold Price moves. Further, the weekly US Initial Jobless Claims and the quarterly readings of Nonfarm Productivity, as well as the Unit Labor Costs for the second quarter (Q2) will also be important to watch for clear directions. Additionally, headlines about China and recession woes in the major economies outside the US, not to forget the Sino–American tension updates, are also important for fresh impulse.

Also read: Gold Price Forecast: XAU/USD approaches $1,900 as odds for a Fed hike increase

Gold Price Technical Analysis

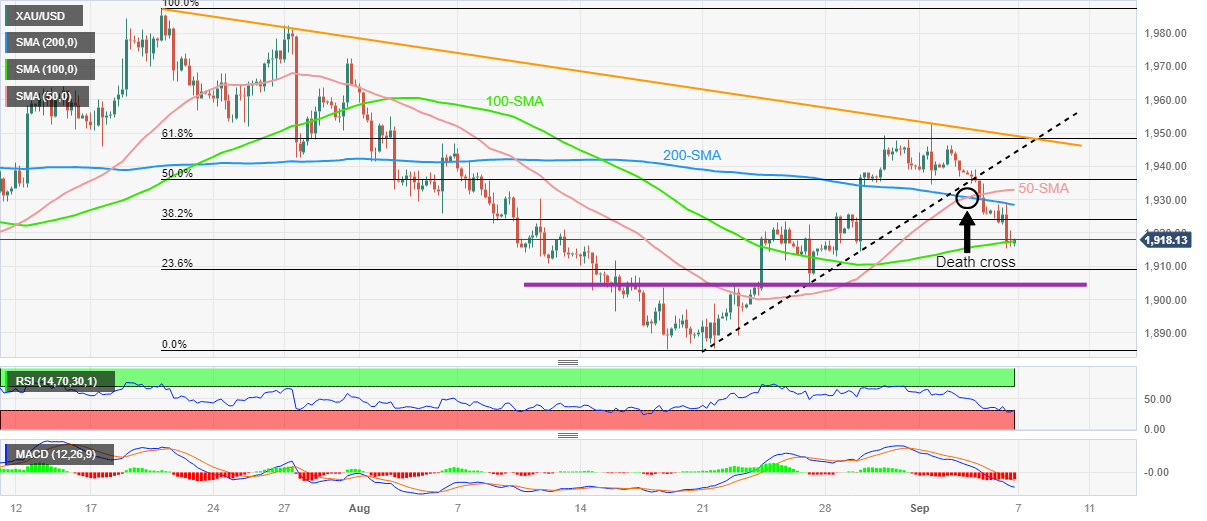

Gold Price justifies the week-start “Death Cross” bearish moving average crossover while declining in the last five consecutive days, backed by the bearish signals from the Moving Average Convergence and Divergence (MACD) indicator. That said, the 50-bar Simple Moving Average’s (SMA) piercing of the 200-SMA portrays the “Death Cross” bearish crossover suggesting further declines in the underlying asset.

It’s worth noting, however, that the Relative Strength Index (RSI) line, placed at 14, is in the oversold territory, which in turn highlights the 100-SMA support of around $1,917 as a short-term key challenge for the XAU/USD sellers.

In a case where the Gold bears ignore the RSI conditions and break the stated SMA support, a horizontal area comprising multiple levels marked in the last three weeks, around $1,904, quickly followed by the $1,900 round figure to restrict the commodity’s further downside.

If at all the XAU/USD remains bearish past $1,900, the previous monthly low of around $1,885 will act as the final defense of the buyers.

On the contrary, the 200-SMA and 50-SMA guard immediate recovery of the Gold price near $1,929 and $1,933 respectively.

Following that, the previous support line from August 21, close to $1,945, will test the XAU/USD buyers before directing them to the 61.8% Fibonacci retracement of July-August downside, close to $1,949.

It should be observed that a seven-week-long falling resistance line surrounding $1,950 might act as an extra filter for the Gold buyers.

Overall, the Gold price remains bearish but the downside room appears limited.

Gold Price: Four-hour chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.