Gold Price Forecast: XAU/USD prints bullish consolidation near $1,950 amid Fed blackout

- Gold Price struggles to extend two-week uptrend, edges lower after refreshing one-month high.

- Softer United States inflation numbers flag concerns about Federal Reserve’s policy pivot and propel XAU/USD via downbeat US Dollar.

- Mixed China updates, Friday’s upbeat US data prod Gold buyers during Fed policymakers’ silence ahead of late July FOMC.

- China Q2 GDP, US Retail Sales eyed for clear directions.

Gold Price (XAU/USD) prints mild losses around $1,953 as it extends Friday’s retreat from the short-term key resistance line amid the early hours of Monday’s Asian session. In doing so, the XAU/USD consolidates the biggest weekly gain since early April amid the Federal Reserve (Fed) blackout ahead of late July’s monetary policy meeting. Also allowing the Gold buyers to take a breather are the weekend headlines surrounding China, the latest data from the United States and cautious mood ahead of top-tier statistics from Beijing.

Gold Price pares recent gains as Fed blackout joins mixed signals

Gold Price rallied heavily the last week after the US inflation clues flagged concerns about the Federal Reserve’s (Fed) end of the rate hike cycle and drowned the US Dollar. However, Friday’s upbeat US data and the recently mixed headlines about the US-China ties join anxiety ahead of China’s second quarter (Q2) 2023 Gross Domestic Product (GDP) data to prod the XAU/USD bulls.

On Friday, the preliminary reading of the University of Michigan's (UoM) Consumer Confidence Index rose to 72.6 from 64.4 in June, versus the market’s expectations of 65.5. Further details suggested that the one-year and 5-year consumer inflation expectations per the UoM survey edged higher to 3.4% and 3.1% in that order versus 3.3% and 3% respective priors.

Previously, the US Consumer Price Index (CPI) and Producer Price Index (PPI) for June dropped to 3.0% and 0.1% on a yearly basis from 4.0% and 0.9% YoY in that order, which in turn drowned the US Dollar amid fears of nearness to the Fed’s policy pivot.

Even so, “Fed likely to need two more 25 basis point rate hikes this year,” said Federal Reserve Governor Christopher Waller late Thursday. The policymaker also ruled out concerns about the Fed rate peak while stating the need for two more downbeat inflation numbers in the prepared remarks for delivery before a gathering held by The Money Marketeers of New York University shared by Reuters.

Elsewhere, "I am eager to build on the groundwork that we laid in Beijing to mobilize further action," said US Treasury Secretary Janet Yellen’s comments from a meeting of Group of 20 (G20) finance ministers and central bankers in India reported Reuters. Her comments raised hopes of improving relations between the US and China. However, the policymaker also cited a lack of proper address to China’s unfair trade practices and challenged optimists. It’s worth noting that the fears about China’s slowdown in economic recovery and the US-China tension also test the Gold buyers as Beijing is one of the biggest XAU/USD customers.

It’s worth observing that the receding fears of the hawkish Fed moves allowed the equities to welcome bulls while the US Treasury bond yields dropped heavily, which in turn drowned the US Dollar Index (DXY) and fuelled the Gold Price. That said, the DXY marked the biggest weekly fall since November in the last.

Hence, the concerns about the Fed’s nearness to policy pivot put a floor under the Gold Price even if the blackout period ahead of late July’s Federal Open Market Committee (FOMC) monetary policy meeting can allow the XAU/USD to pare recent gains.

Additionally important to watch will be China’s Q2 GDP will join the Industrial Production and Retail Sales for June. Furthermore, US Retail Sales for June and headlines surrounding the US-China ties, as well as the global growth, will be crucial for near-term Gold Price directions.

Gold Price Technical Analysis

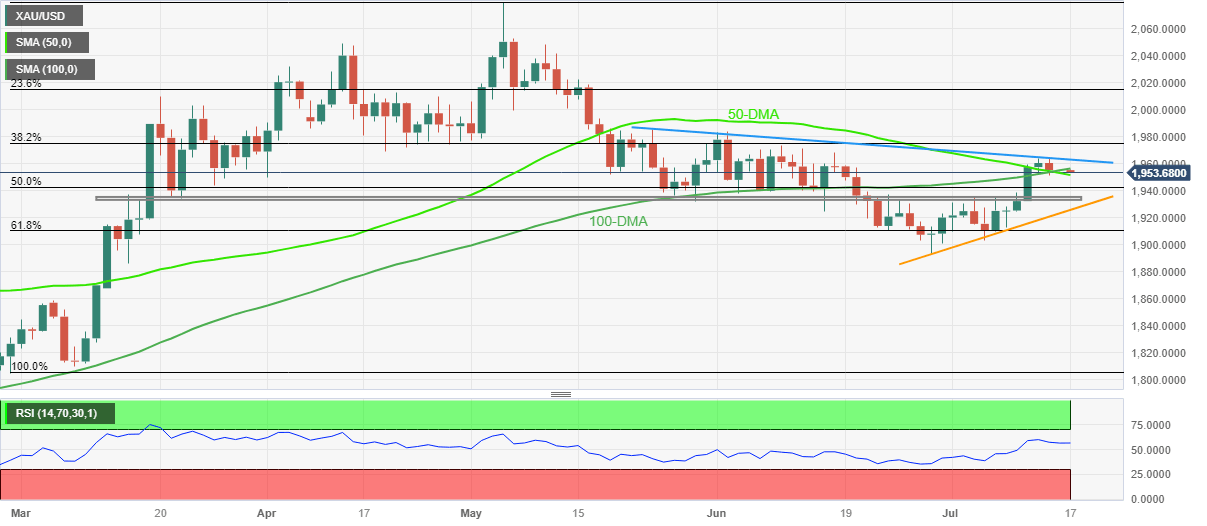

Gold Price extends Friday’s retreat from a seven-week-old descending resistance line, around $1,965 by the press time, by tracking a pullback in the Relative Strength Index (RSI) line, placed at 14. In doing so, the XAU/USD also slips beneath the 100-SMA, close to $1,956 at the latest.

However, the 50-SMA around $1,950 by the press time, appears a tough nut to crack for the XAU/USD bears before taking control.

Even if the Gold bears manage to smash the $1,950 SMA confluence, a four-month-old horizontal support zone, near $1,935-33, quickly followed by a 12-day-old rising support line, close to $1,925 at the latest, could challenge the sellers before giving them control.

On the contrary, a daily closing beyond the 100-SMA level of near $1,956 can propel the quote towards the previously stated resistance line of near $1,965, a break of which will extend the Gold Price run-up towards the last monthly high surrounding $1,985.

Following that, the $2,000 psychological magnet will act as the last defense of the XAU/USD sellers.

Overall, the Gold Price is likely to witness a pullback but the establishment of the bearish trend is far from sight.

Gold Price: Daily chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.