Gold Price Forecast: XAU/USD portrays Christmas mood above $1,800

- Gold prices remain inactive following an upward grind near the weekly top.

- Risk-on mood, softer USD favored gold buyers despite firmer yields.

- Omicron, US stimulus and China are the key catalysts to watch for short-term direction.

- Gold 2022 Outlook: Correlation with US T-bond yields to drive yellow metal

Gold (XAU/USD) prices hang in balance around $1,809, after refreshing the week’s high to $1,810 the previous day. In doing so, the yellow metal shows the typical market inactivity during Christmas Eve.

That said, the bulls recently cheered optimism concerning the fewer odds of hospitalization due to the South African covid variant, dubbed as Omicron. Also positive for gold was the US Food and Drug Administration’s (FDA) approval of Merck's Covid-19 pill, a day after approving Pfizer’s pill to battle the Omicron. Earlier in the week, US Military also conveyed news of developing a single cure for covid and all variants.

It should be noted, however, that the French cancellation of orders for Merck’s pill, citing notably lesser effect than promoted, joins a steady rise in Omicron cases to challenge the market optimism and gold prices.

On the same line were the firmer US data that underpinned the US Treasury yields to refresh monthly high near 1.50%. Among the key economics, upticks in the Fed’s preferred gauge of inflation, namely the Core PCE Price Index, not to forget Durable Goods Orders and Michigan Consumer Sentiment Index, favored the bond bears of late.

Additionally, indecision over US President Joe Biden’s Build Back Better (BBB) plan and China’s dislike for the American passage of a bill that highlights Uyghur minority issues also challenge the risk-on mood and test the gold buyers.

Distantly, the latest words from a Fed policymaker, namely Christopher Waller, were hawkish and signaled rate hikes in early 2022, which in turn challenge the metal’s further upside.

Above all, holiday-thinned market volume and off in multiple Western bourses could challenge momentum traders.

Technical analysis

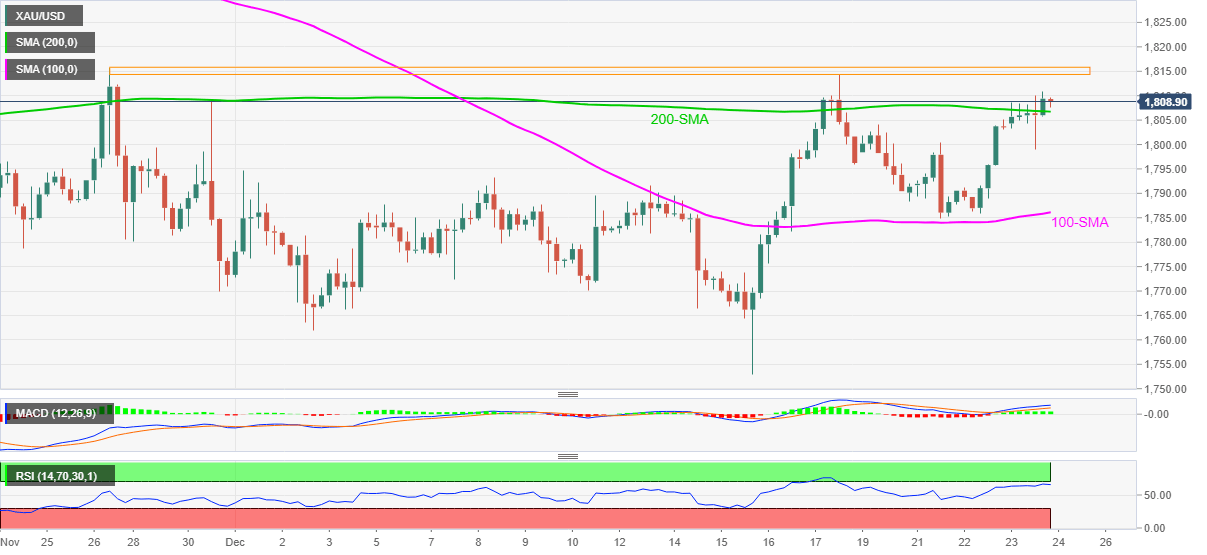

Gold prices seesaw around 200-SMA as sluggish MACD and nearly overbought RSI line suggest pullback but an absence of market moves keep the recovery moves intact.

That said, the $1,800 round figure holds the key for the metal’s fresh declines targeting the 100-SMA level near $1,785.

It should be noted, however, that multiple supports near $1,770 and the early December low of $1,762 may test bears before directing them to the monthly low close to $1,753.

Alternatively, tops marked during late November and the monthly high, close to $1,814-16, challenges short-term gold buyers before directing them to the highs marked in July and September around $1,834.

Gold: Four-hour chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.