- Gold retreats from two-week high, challenges three-day uptrend amid quiet session.

- Mixed concerns over inflation, Fed’s next move and geopolitics direct traders towards traditional safe-haven.

- US CPI becomes crucial amid a mismatch between inflation expectations and Fed rate-hike expectations.

- Gold Price Forecast: Bulls defying a critical Fibonacci resistance level

Update: Gold (XAU/USD) is taking advantage of an offer in the greenback as Asian shares advance on Wednesday on the coattails of a solid performance in stocks on Wall Street. US Treasury yields are holding near multi-year highs ahead of closely watched US inflation data this week. DXY, an index that measures the greenback vs a basket of currencies, is down some 0.13% at the time of writing while XAU/USD is adding 0.14% to yesterday's business.

However, there is some firm ground that the greenback is walking and the gold bugs could be challenged any more soon considering the Consumer Price Index should cement expectations the US Federal Reserve will raise interest rates next month. If there is a stronger than expected number, this could seal the deal for a larger 50 basis point rise.

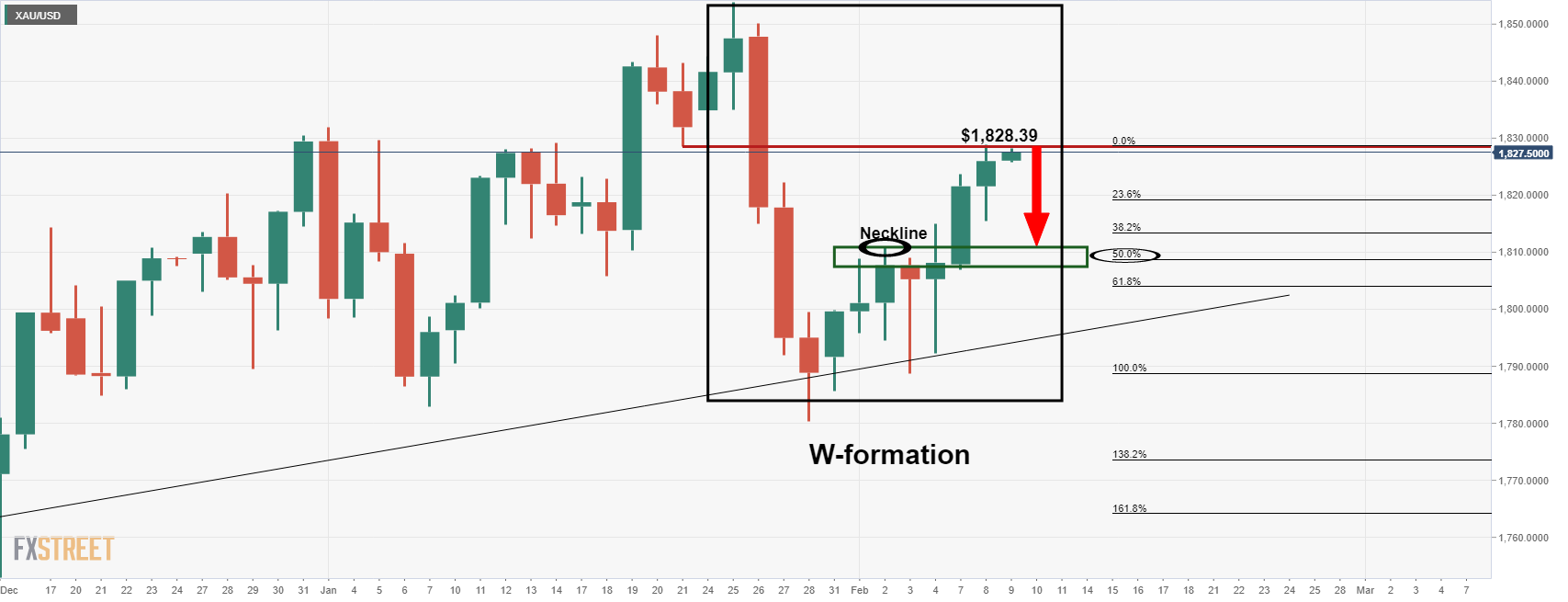

As per the prior analysis, and this week's, Gold, Chart of the Week: Bulls take on the 38.2% Fibo, now eye the 61.8% golden ratio, the price has finally moved on the 61.8% ratio as follows:

The bulls are up against an area of liquidity that could lead to supply entering the market which would typically cap the price. This leaves the focus on the downside which leaves the $1,811 vulnerable.

End of update

Gold (XAU/USD) buyers seem running out of steam after three consecutive days of the uptrend to the fortnight high, easing to $1,825 during Wednesday’s Asian session.

In doing so, the yellow metal portrays the market’s anxiety ahead of the key US Consumer Price Index (CPI) data amid multi-month high Treasury yields and sluggish US inflation expectations.

The benchmark US 10-year Treasury yields stay firmer around 1.956% following the previous day’s run-up to the highest levels since late 2019. On the contrary, US inflation expectations, as measured by the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, remain sluggish around a three-month low flashed during late January, recently around 2.42%.

That said, global traders remain anxious over the January inflation figures following the Fed’s upbeat performance. However, another player in the bull’s league, namely the European Central Bank (ECB), tried placating the reflation fears of late.

Also contributing to the gold’s upside momentum is the looming risk of a Russian invasion of Ukraine and the US-China trade tussles. On the same line are the latest comments from the Chinese Communist Party (CCP) that was quoted in the South China Morning Post (SCMP) as saying, “China should ‘support and guide’ the healthy development of capital, and prevent the ‘barbaric growth of capital.’”

It’s worth observing that the positive comments from Dr. Anthony Fauci, a leading US health expert, underpin the market’s optimism. However, reflation fears get the first hand charge and challenge covid-led optimism to favor gold prices. “The US is heading out of the “full-blown” pandemic phase of Covid-19, the US President’s Chief Medical Adviser said,” per the Financial Times (FT).

Amid these plays, Wall Street offered another positive day and the S&P 500 Futures also trade positive at the latest but the US Dollar Index (DXY) struggles to extend recovery moves.

Looking forward, risk catalysts and Fedspeak will direct short-term XAU/USD moves ahead of Thursday’s US inflation.

Technical analysis

Gold stays firmer inside the weekly bullish trend channel, recently easing from the top amid firmer RSI and MACD signals. Also favoring the upside bias is the metal’s successful trading beyond the 100 and 200 SMAs.

However, the previous support line from December 2021 precedes the stated channel’s upper line to challenge immediate advances of gold prices around $1,825-27.

Following that, a five-week-old horizontal area surrounding $1,829-32 will be a tough nut to crack for gold buyers, a break of which will open doors for a rally towards January’s peak surrounding $1,853.

Meanwhile, the 200-SMA and 100-SMA, respectively around $1,817 and $1,814, restrict short-term declines of the precious metal before directing gold sellers toward the channel’s support line, around $1,814 by the press time.

It’s worth noting, however, that gold’s downside past $1,814 will make it vulnerable to test the previous month’s low near $1,780 with the $1,800 threshold likely acting as an intermediate halt.

Gold: Four-hour chart

Trend: Further upside expected

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD trims losses and approaches 1.1380

The US Dollar now succumbs to the re-emergence of the selling pressure and allows EUR/USD to recoup part of the ground lost and approach to the 1.1380 zone on Thursday. Earlier on Thursday, the ECB matched estimates and lowered its rates by 25 bps.

GBP/USD extends the daily recovery, looks at 1.3300

The upside impulse in the British pound remains everything but abated and now propels GBP/USD to the upper end of the range, shifting its attention to recent yearly peaks near 1.3300 the figure.

Gold breaks below $3,300, daily troughs

Further improvement in the sentiment surrounding the risk-associated universe put Gold prices to the test on Thursday. Indeed, the troy ounce of the precious metal faces increasing downside pressure and breaches the key $3,300 mark to hit new daily lows.

Crypto market cap fell more than 18% in Q1, wiping out $633.5 billion after Trump’s inauguration top

CoinGecko’s Q1 Crypto Industry Report highlights that the total crypto market capitalization fell by 18.6% in the first quarter, wiping out $633.5 billion after topping on January 18, just a couple of days ahead of US President Donald Trump’s inauguration.

Future-proofing portfolios: A playbook for tariff and recession risks

It does seem like we will be talking tariffs for a while. And if tariffs stay — in some shape or form — even after negotiations, we’ll likely be talking about recession too. Higher input costs, persistent inflation, and tighter monetary policy are already weighing on global growth.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.