Gold Price Forecast: XAU/USD pokes $1,750 inside falling wedge, Fedspeak, recession eyed

- Gold price stays pressured inside a bullish chart pattern after declining for four consecutive days.

- Mostly hawkish Fedspeak, fears surrounding China recession exert downside pressure.

- Firmer US data also helped XAU/USD bears to keep reins.

- A light calendar keeps risk catalysts in the driver’s seat and could help extend downside bias.

Gold price (XAU/USD) licks its wounds around a fortnight low near $1,760, flashed the previous day, as traders seek fresh clues inside a bullish chart pattern during Friday’s initial Asian session. That said, the precious metal dropped during the last four consecutive days amid the broad US dollar strength, mainly favored by the hawkish Fedspeak and the firmer US data, not to forget recession woes in China and Europe.

US Dollar Index (DXY) rose to the highest levels in one month during the previous day on price-positive numbers from Philadelphia Fed Manufacturing Survey and the weekly Initial Jobless Claims. That said, the activity gauge rallied to 6.2 for August versus -5 expected and -12.3 prior while the weekly jobless claims dropped to 250K, below 265K market consensus and 252K revised prior.

Elsewhere, San Francisco Fed President Mary Daly mentioned that they (Fed) will continue to raise the rates to "right-size it." The policymaker added that either 50 basis points or a 75 basis points hike would be appropriate, while signaling the move for the September rate decision. However, Minneapolis Federal Reserve Neel Kashkari mentioned that, per Reuters, he does not believe the county is currently in a recession. Further, the all-time hawk St. Louis Fed President James Bullard said he is leaning towards another 75 bps rate hike in September.

It should be noted that Goldman Sachs and Nomura both cut the dragon nation’s growth forecasts after witnessing the latest jump in the covid numbers. Also negatively impacting the Chinese economy are the doubts over the People’s Bank of China’s (PBOC) capacity to tame recession woes. Additionally, comments from the US Trade Representative’s office stating, “Early this autumn, the US and Taiwan will begin formal negotiations on a trade initiative,” seem to renew the fears of the US-China tussle and also roil the mood. Considering Beijing’s status as among the world’s top gold consumers, negatives for the nation weigh on the XAU/USD prices.

On a different page, "The economic outlook for Germany, Europe's largest economy, is gloomy due to energy price rises and supply chain disruptions," the German Finance Ministry said in its August monthly report, per Reuters.

Amid these plays, Wall Street closed mixed while the US 10-year Treasury yields retreated from their monthly high.

Looking forward, a lack of major data/events could help gold sellers to keep reins.

Technical analysis

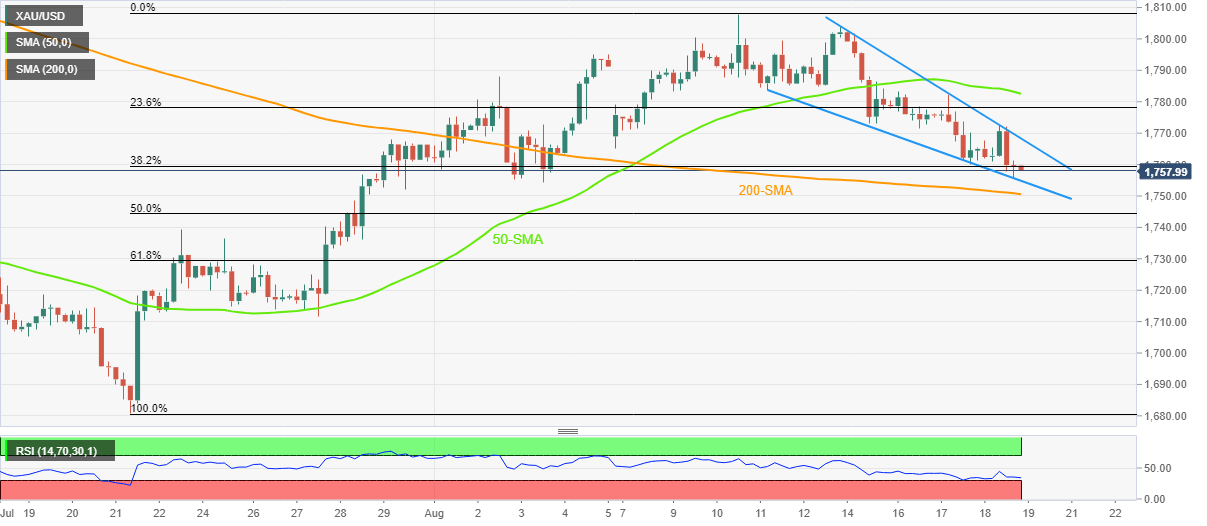

Gold price holds lower ground near the support line of a one-week-old falling wedge bullish chart pattern.

Given the nearly oversold RSI conditions and the metal’s refrain to defy the wedge, by breaking below the support line figure of $1,754, XAU/USD price may remain doubtful for further declines.

Even if the quote drops below $1,754, the 200-SMA level of $1,750 could act as an extra challenge for the metal bears.

Meanwhile, upside clearance of the $1,769 will confirm the bullish chart pattern, which in turn (theoretically) suggests a run-up towards $1,820. However, the 50-SMA and the monthly high, respectively around $1,782 and $1,808, could challenge the gold buyers in between.

Gold: Four-hour chart

Trend: Limited downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.