- Gold Price remains firmer around two-week high as bulls cheer softer US Dollar, cautious optimism.

- US Dollar traces downbeat yields amid uncertainty about Fed’s next moves and anxiety ahead of Consumer Confidence data.

- Hopes of more stimulus from China add strength to XAU/USD run-up after snapping the four-week losing streak.

- Gold Price approaches key upside hurdle as top-tier US statistics loom.

Gold Price (XAU/USD) defends the previous weekly recovery, the first in five, as it rises for the second consecutive day amid the broad US Dollar weakness. Also adding strength to the XAU/USD rebound is the cautious optimism in the market, as well as the downbeat Treasury bond yields.

It’s worth noting that the US Dollar Index (DXY) cheers the Fed policymakers’ data dependency and recent mixed US data, as well as a sustained pullback in the US Treasury bond yields from the multi-year high marked last week.

Elsewhere, hopes of more stimulus from China via fiscal, as well as monetary policy, keep the Gold buyers hopeful.

However, the cautious mood ahead of the US inflation and employment clues, as well as China activity data, prod the XAU/USD bulls around the key $1,940 resistance confluence.

To sum up, the Gold Price has the majority of catalysts needed for the further upside but $1,940 and broad US Dollar weakness, as well as the downbeat yields, will decide the further advances of the XAU/USD.

Also read: Gold Price Forecast: Tide turns in favor of XAU/USD buyers, US jobs data awaited

Gold Price: Key levels to watch

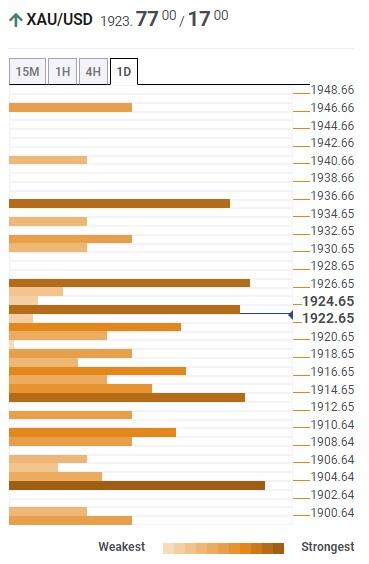

As per our Technical Confluence indicator, the Gold Price floats within a $40 region multiple resistance area ahead of this week’s top-tier US inflation and employment clues.

That said, a convergence of the Pivot Point one-day R1 and the previous daily high guards the immediate recovery of the Gold Price near $1,928.

Following that, the 200-SMA on the four-hour (4H) chart and Fibonacci 61.8% on one-month, around $1,937, restricts further upside of the Gold Price.

In a case where the XAU/USD buyers keep the reins past $1,937, the Pivot Point one-week R2 around $1,945 will act as the last defense of the Gold sellers.

On the flip side, a convergence of the 5-DMA, previous daily low, Fibonacci 23.6% on one-week and Pivot Point one-day S1 together restrict the immediate Gold Price downside near $1,910.

Should the XAU/USD bears manage to conquer the $1,910 key support, the 10-DMA, previous monthly low and Fibonacci 161.8% on weekly chart, close to $1,900 at the latest, will act as the last check for the sellers.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD turns lower toward 1.1300 as US Dollar demand picks up

EUR/USD has come under renewed selling pressure and heads back toward 1.1300 n Monday’s European session. The upbeat market mood and a fresh US Dollar uptick undermines the pair amid a quiet start to a critical week ahead.

GBP/USD drops back below 1.3300 on US Dollar strength

GBP/USD returns to the red below 1.3300 in the European trading hours on Monday. Sustained US Dollar strength and easing trade tensions weigh negatively on the pair. Meanwhile, the technical outlook on the daily chart suggests a weakening bullish trend.

Gold price remains depressed below $3,300 amid signs of easing US-China trade tensions

Gold price maintains its offered tone through the Asian session on Monday and currently trades below the $3,300 round-figure mark, down 0.75% for the day. Despite mixed signals from the US and China, investors remain hopeful over the potential de-escalation of tensions between the world's two largest economies.

Bitcoin and Ethereum stabilize while Ripple shows strength

Bitcoin and Ethereum prices are stabilizing at around $93,500 and $1,770 at the time of writing on Monday, following a rally of over 10% and 12% the previous week. Ripple price also rallied 8.3% and closed above its key resistance level last week, indicating an uptrend ahead.

Week ahead: US GDP, inflation and jobs in focus amid tariff mess – BoJ meets

Barrage of US data to shed light on US economy as tariff war heats up. GDP, PCE inflation and nonfarm payrolls reports to headline the week. Bank of Japan to hold rates but may downgrade growth outlook. Eurozone and Australian CPI also on the agenda, Canadians go to the polls.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.