Gold Price Forecast: XAU/USD meanders around $1730s on risk-on and weak USD

- Gold Price registers minuscule gains of 0.03%, around $1738.

- Federal Reserve speaker begin to price a 50 bps increase to the Federal Funds rate.

- The US Dollar edges lower, weighed by falling US Treasury bond yields.

Gold Price is almost flat on Tuesday’s North American session, capitalizing on a soft US Dollar (USD) still off the daily highs as Federal Reserve (Fed) officials continued to express the US central bank needs to tighten monetary conditions. Also, sentiment remains fragile due to Covid-19 cases in China. At the time of writing, the XAU/USD is trading at $1737.49, unchanged.

XAU/USD capitalize on weak US Dollar amid falling US bond yields

Sentiment improved throughout the day. Federal Reserve policymakers grabbed investors’ attention as the US central bank prepared to slow down borrowing costs. Loretta Mester, Cleveland Fed President, said, “Maintaining price stability is a critical objective that will be accomplished using all available means.” On Monday, Mester commented that she Is open to moderate rate hikes, though she emphasized that a pause is off the table. She echoed some of San Francisco Fed President Mary Daly’s comments, which added that the Federal Funds rate (FFR) needs to peak at around 5%.

In the meantime, Covid-19 cases in China peaked at around 28K on Monday, the most significant increase since April 2022. Beijing increased restrictions, and arrivals had to take three PCR tests within the first three days. Some schools switched to online learning, while some districts in Beijing asked citizens to stay at home for at least five days.

Elsewhere, the US Dollar Index (DXY), which tracks the greenback value against six currencies, slashes 0.50% down to 107.200. US Treasury yields are also dropping, led by the 10-year benchmark note rate yielding 3.750%, eight bps down compared to Monday’s close, a headwind for the greenback.

All that said, Gold trader’s focus turns to further Fed speaking, with Esther George and James Bullard crossing news wires, ahead of the release of the Federal Reserve Open Market Committee (FOMC) last meeting minutes.

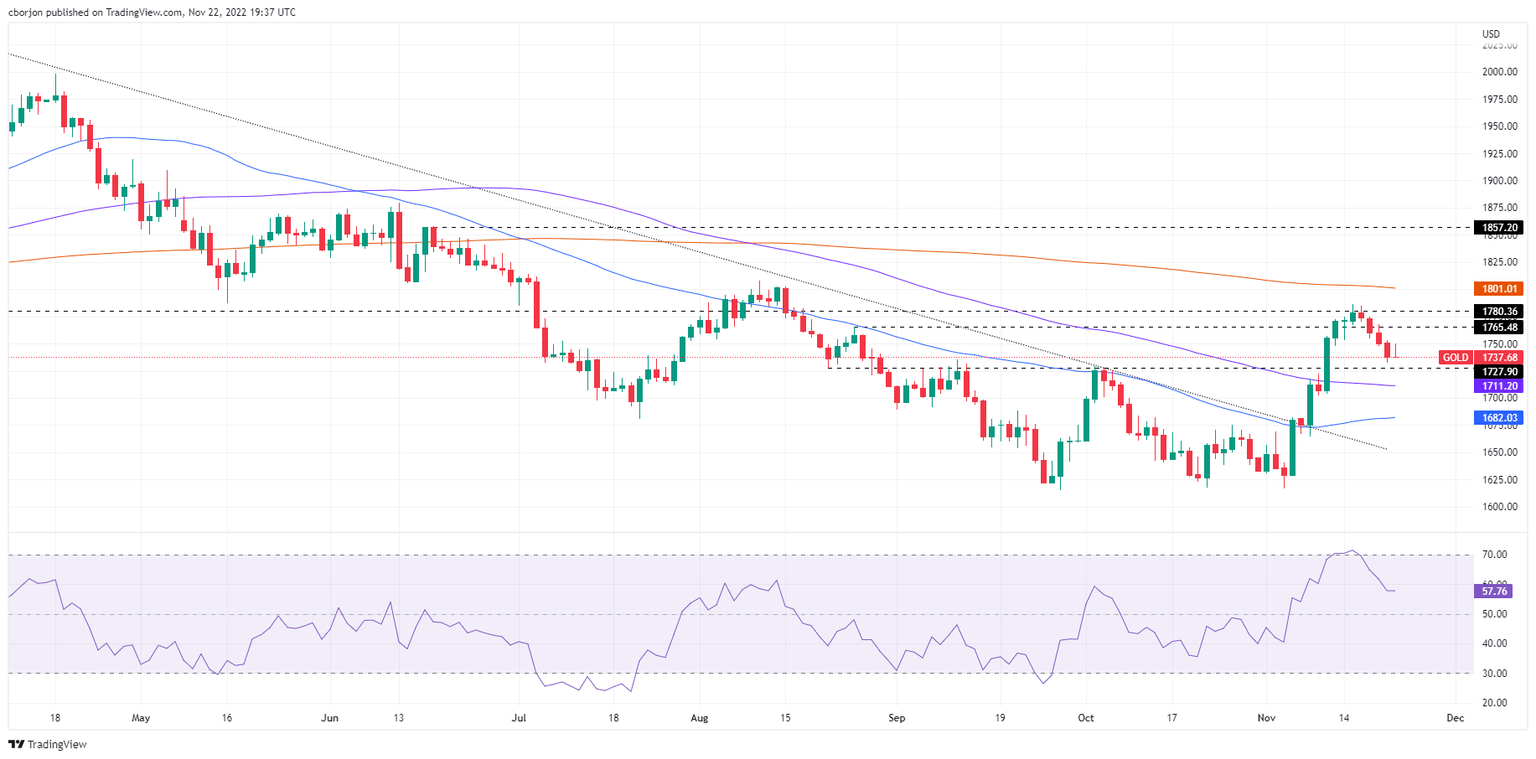

Gold (XAU/USD) Price Analysis: Technical outlook

The XAU/USD daily chart portrays the yellow metal as neutral-biased. Even though the Gold Price sits above the 50 and 100-day Exponential Moving Averages (EMAs), four days of consecutive losses and failure to crack the 200-day EMA at $1801 exacerbated a fall toward current prices. Therefore, XAU/USD might consolidate in the $1730-50 range.

Upwards, the XAU/USD key resistance levels are $1750, followed by the November high of $1786.53 and $1800. On the flip side, the XAU/USD first support would be the August 22 swing low of $1727, followed by the $1700 figure.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.