Gold Price Forecast: XAU/USD is attempting to move higher, but bears are are lurking

- XAU/USD is marching towards $1,960.00 as DXY has slipped amid uncertainty over the release of the US CPI.

- Fed’s Mester stated that inflation will remain at elevated levels even next year.

- Moscow’s positive comments on the Russia-Ukraine peace may underpin the risk-on impulse going forward.

Update: Gold (XAU/USD) has been trying to move higher in Asia at the start of the week, but the bears are committing while the greenback recovers from the opening bearish gap pertaining to the French elections and the euro's relief rally. However, as the bears move in, the gold price has stalled at a higher of $1,950 and is back under pressure moving into the red at the time of writing.

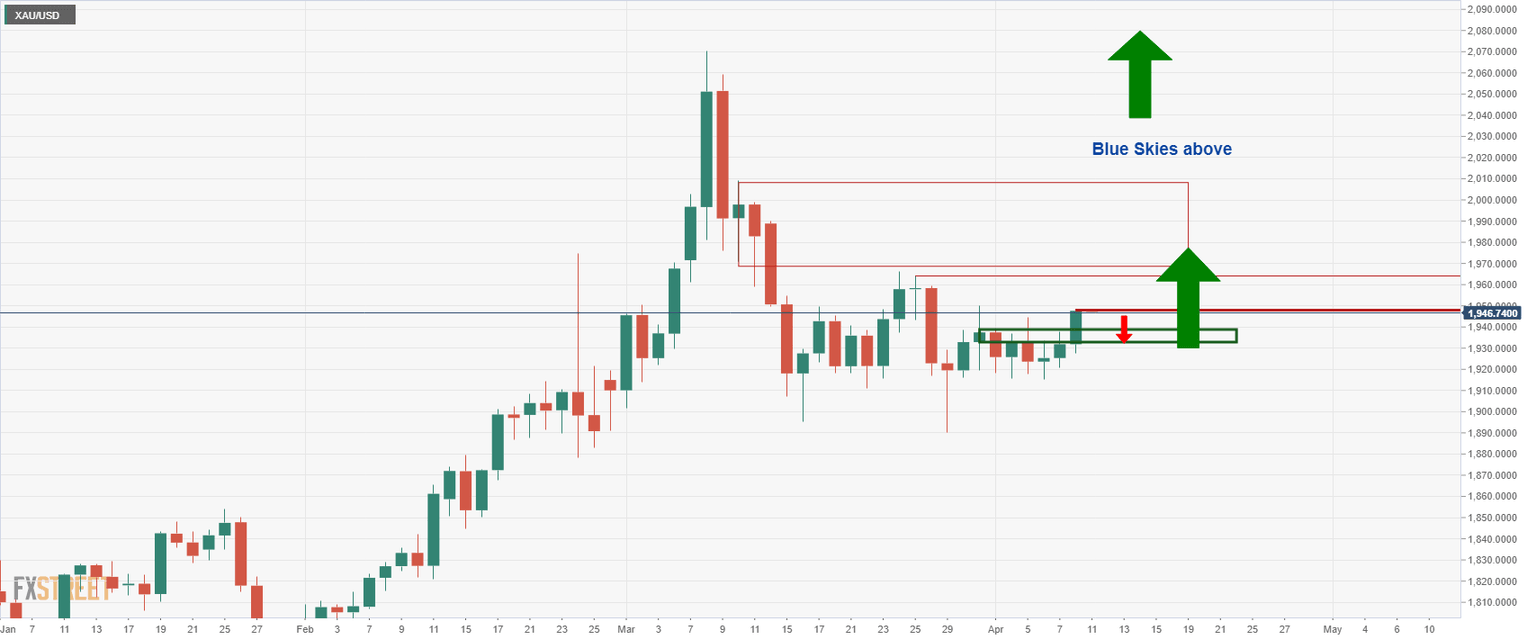

From a technical standpoint, the price needs to hold in the $1,930sit the bulls are going to have a shot in the near future at breaking higher and beyond daily resistance near $1,970.

End of update

Gold (XAU/USD) is firmly advancing towards $1,960.00 as the US dollar index (DXY) has failed to sustain above the psychological resistance of 100.00. The latter has witnessed a bearish gap open on Monday ahead of the rising uncertainty over the release of the US Consumer Price Index (CPI) on Tuesday.

A preliminary reading of the US CPI at 8.3% indicates that the Federal Reserve (Fed) will paddle the interest rate decision in May’s monetary policy to contain the inflation. Apart from that, the balance sheet reduction will also be driven faster to restrict liquidity in the economy. In an interview on CBS’s Face the Nation on Sunday, Cleveland Fed President Loretta Mester cited that Inflation will remain high this year and next even as the Fed moves steadily to lower the pace of price increases. This indicates that a tight policy environment is here to stay more than usual.

Meanwhile, the market sentiment is likely to turn positive amid de-escalation in the Russia-Ukraine war. Moscow’s spokesperson on Friday stated that "Russia's special operation in Ukraine could be completed in foreseeable future given aims are being achieved and work is being carried out by the military and peace negotiators," as per Reuters.

Gold Technical Analysis

On an hourly scale, XAU/USD is on the verge of exploding the consolidation, which is placed in a narrow range of $1,915.50-1,950.00. The 20- and 200-period Exponential Moving Averages (EMAs) at $1,940.00 and $1,931.45 respectively are scaling higher, which adds to the upside filters. The Relative Strength Index (RSI) (14) has shifted into a bullish range of 60.00-80.00, which indicates more upside ahead.

Gold hourly chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.

-637852270384179810.png&w=1536&q=95)