- Gold Price renews two-week high as bulls cheer sooner end of hawkish monetary policies.

- Downbeat activity data recalls challenges for “higher for longer” rates, fueling XAU/USD amid upbeat sentiment.

- China-linked optimism adds strength to the Gold Price rebound despite cautious mood ahead of key central bankers’ speeches.

- Jackson Hole Symposium gains additional importance as hawks are challenged by recent PMI.

Gold Price (XAU/USD) rises to the highest levels in two weeks, up for the fifth consecutive day, as bulls cheer receding fears of higher rates ahead of top-tier US data and central bankers’ speech at the annual Jackson Hole Symposium event.

The recent downbeat Purchasing Managers Index (PMI) data for August from the developed economies, including the US, restored the market’s previous concerns about the central bank policy pivot and weighed on the Greenback, which in turn fuelled the Gold Price.

Additionally, expectations that the diplomatic ties between China and the US will improve also allowed the XAU/USD to remain firmer due to Beijing’s status as one of the world’s top Gold customers.

Elsewhere, the US Dollar’s sluggish move and the market’s optimism, backed by the technology stocks, as well as a pullback in the US Treasury bond yields from the multi-year high add strength to the Gold price run-up.

However, a slew of US data remains to be published and can test the XAU/USD bulls. Above all, Fed Chairman Jerome Powell’s defense of the hawkish monetary policy will be crucial to watch for clear directions as the latest US data suggest the nearness to the end of the rate hike cycle, which if confirmed could weigh on the US Dollar and favor the Gold buyers.

Also read: Gold Price Forecast: XAU/USD looks to challenge key $1,932 resistance ahead of Jackson Hole

Gold Price: Key levels to watch

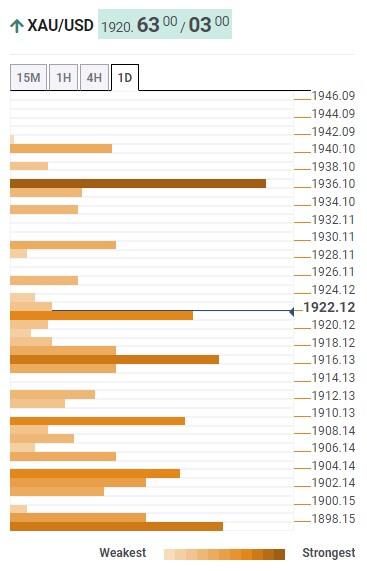

Our Technical Confluence indicator shows that the Gold Price stays well beyond the short-term key resistances, now support, while approaching the key $1,938 resistance confluence comprising Fibonacci 61.8% on one-month and 161.8% on one-week.

Before that, Pivot point one-week R2, near $1,930, may test the XAU/USD buyers.

It’s worth noting that Pivot Point one-week R3 acts as an extra upside filter around $1,942.

That said, the previous weekly high joins the middle band of the Bollinger on the hours chart and Pivot Point one-month S1 to highlight $1,916 as an immediate support.

Following that, the 200-DMA and Pivot Point one-week R1 appears a tough nut to crack for the Gold sellers around $1,910.

Above all, the XAU/USD buyers remain on the table unless witnessing a sustained downside break of the $1,898 support confluence comprising the 5-DMA and Fibonacci 38.2% on one-week.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD extends recovery beyond 1.0400 amid Wall Street's turnaround

EUR/USD extends its recovery beyond 1.0400, helped by the better performance of Wall Street and softer-than-anticipated United States PCE inflation. Profit-taking ahead of the winter holidays also takes its toll.

GBP/USD nears 1.2600 on renewed USD weakness

GBP/USD extends its rebound from multi-month lows and approaches 1.2600. The US Dollar stays on the back foot after softer-than-expected PCE inflation data, helping the pair edge higher. Nevertheless, GBP/USD remains on track to end the week in negative territory.

Gold rises above $2,620 as US yields edge lower

Gold extends its daily rebound and trades above $2,620 on Friday. The benchmark 10-year US Treasury bond yield declines toward 4.5% following the PCE inflation data for November, helping XAU/USD stretch higher in the American session.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.