- Gold price attempts a fresh run towards $1,950 after Wednesday’s downfall.

- Stagflation fears outweigh firmer Treasury yields to lift gold price northwards.

- Will gold retest $1,950 on Russia-Ukraine peace talks 2.0, Powell?

Gold price extends its range play around the $1,930 level for the third consecutive day, reversing a part of Wednesday’s sell-off. Soaring oil prices, a fallout of the Russia-Ukraine crisis, have refueled stagflation concerns worldwide, reviving gold’s demand as a safe haven. Meanwhile, the US dollar continues to hold fort amid ongoing strength in the Treasury yields due to the hawkish Fed Chair Jerome Powell’s testimony. The next direction in gold price hinges on the outcome of round two of the Russia-Ukraine ‘peace talks’ while the US economic data will continue to play second fiddle.

Read: Gold trades at major yearly resistance

Gold Price: Key levels to watch

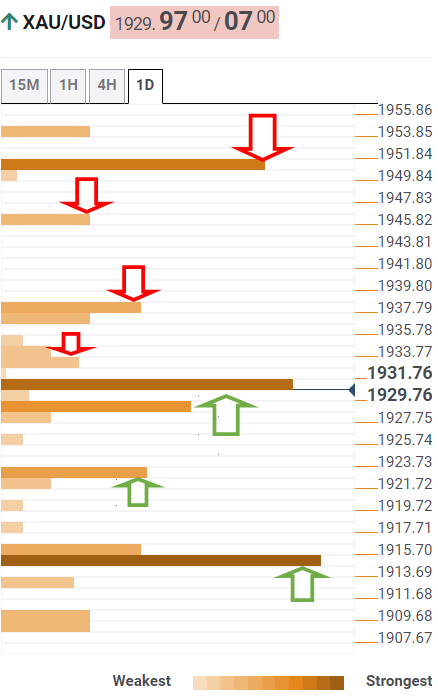

The Technical Confluences Detector shows that gold price is battling minor resistance around $1,933, where the SMA10 four-hour aligns.

Recapturing the latter will cheer buyers, propelling the price towards $1,937, which is the confluence of the Fibonacci 61.8% one-week and one-day.

Gold traders will create fresh buying opportunities above that level, triggering a fresh rally towards the pivot point one-day R1 at $1,945.

The $1,950 barrier remains the level to beat for gold bulls. At that point, the previous day’s high and pivot point one-week R1 coincide.

Alternatively, a decisive break below the $1,930-$1,929 support area is needed to resume the previous downside momentum.

That zone is the convergence of the Fibonacci 23.6% one-month, Fibonacci 38.2% one-day and SMA5 four-hour.

The next relevant support awaits at $1,922, the intersection of the intraday low, Fibonacci 23.6% one-day and Bollinger Band four-hour Middle.

Gold bears will need to crack the $1,915 cap to take on the additional downside. The Fibonacci 38.2% one-week, the previous day’s low and SMA5 one-day meet at that point.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD trims losses, flirts with 1.1400

EUR/USD gives away some of its earlier losses and reclaims the area beyond 1.1400 the figure on turnaround Tuesday. The better sentiment around the pair follows some loss of momentum in the US Dollar, which recedes from earlier tops.

GBP/USD picks up pace and surpasses 1.3400

GBP/USD now manages to regain balance and advances past the key 1.3400 barrier following the resurgence of some selling bias around the Greenback and a widespread recovery in the risk-associated universe.

Gold bounces off lows near $3,300

After bottoming out near the $3,300 region per troy ounce, Gold prices approach the $3,330 zone as the US Dollar gives away part of its daily advance and the risk-on mood gathers extra pace.

Bitcoin eyes $100,000 amid Arizona Reserve plans, corporate demand, ETF inflows

Bitcoin price is stabilizing around $95,000 at the time of writing on Tuesday, and a breakout suggests a rally toward $100,000. The institutional and corporate demand supports a bullish thesis, as US spot ETFs recorded an inflow of $591.29 million on Monday, continuing the trend since April 17.

May flashlight for the FOMC blackout period – Waiting for the fog to lift

We expect the FOMC will leave its target range for the federal funds rate unchanged at 4.25-4.50% at its upcoming meeting on May 6-7, a view widely shared by financial markets and economists. Market pricing currently implies only a 9% probability of the FOMC cutting the fed funds rate by 25 bps.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.