Gold Price Forecast: XAU/USD rebound remains capped below $1,800 as sentiment stabilizes

- Gold consolidates its rebound below $1,800 amid stabilizing risk sentiment.

- Virus variant challenges market sentiment but US dollar weakness sounds fishy ahead of Fed’s Powell.

- Treasury yields dropped and drowned the DXY but US Health Officials are confident and save the greenback.

- Gold Weekly Forecast: XAU/USD looks to extend rebound amid renewed coronavirus fears

Update: With the renewed optimism that the effects of the new Omicron covid variant will likely be mild, the risk sentiment is stabilizing in Asia this Monday, which is limiting the recovery momentum in gold price. Further, the US dollar rebound alongside the Treasury yields’ keeps gold bulls in check. However, if the virus concerns escalate, then gold price is likely to extend its rebound above the $1,800 mark. Technically, with the latest upturn, gold price has recaptured the critical resistance around $1,792, where the 50, 100 and 200-Daily Moving Averages (DMA) coincide. A daily closing above the latter is needed to initiate a meaningful recovery from the previous week’s tumble in the bright metal.

Gold (XAU/USD) reverses late Friday’s pullback from $1,815 during Monday’s Asian session. In doing so, the metal keeps the previous day’s bounce off a two-month-old support line amid market fears emanating from the coronavirus strain, dubbed as ‘Omnicron’.

Grave symptoms like heavy mutations and the ability to resist vaccines enable Omicron to challenge the market’s previous optimism and calls for tighter monetary policies. The same weighed down the US Treasury yields and the US Dollar Index (DXY) the previous day but gold prices posted a volatile day with no gains amid mixed beliefs over the US dollar and the Fed’s next step.

The US National Institutes of Health (NIH) officials convey no cases of the stated virus variant in the world’s largest economy and remain hopeful that the virus vaccines, as well as the booster doses, can help overcome the fresh challenge. However, Atlanta Federal Reserve President Raphael Bostic rejected market talks that the virus strain will ease inflation fears by saying, “Covid is the source of inflation.”

Elsewhere, Canada and Australia are the latest ones to join the UK, Europe and South Africa to find cases of the COVID-19 variant whereas many counties have rejected flights from Africa and surrounding countries.

Read: Covid Special Report: How will worst coronavirus variant seen to date affect markets this week?

Even so, S&P 500 Futures print mild gains whereas the US 10-year Treasury yields jump 4.5 basis points (bps) to 1.53% at the latest.

Moving on, gold traders should keep their eyes on Fed Chairman Jerome Powell’s speech for fresh impulse, as well as comments from US President Joe Biden. Should Fed’s Powell cite grave concerns due to the recent virus variant breakout, the bullion prices are likely to rise more.

Technical analysis

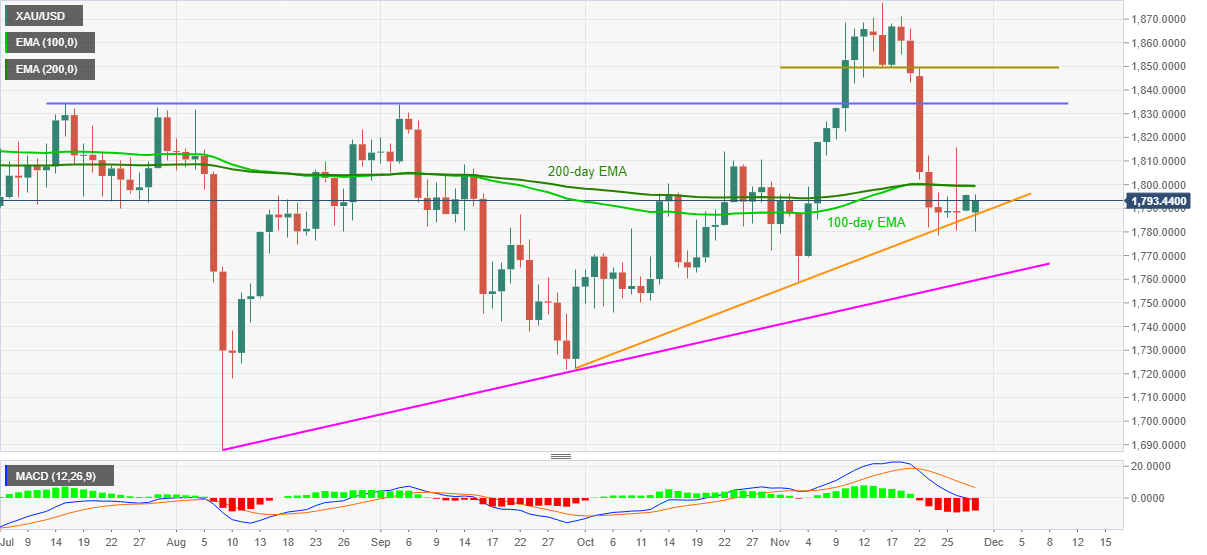

Gold struggles between a two-month-old support line and a convergence of the 100-day and 200-day EMAs. Hence, a clear break of the $1,785-1,800 area becomes necessary for the traders to get a fair view of the near-term trend.

However, the bearish MACD signals and a likely pick-up in the US dollar’s safe-haven demand challenge the gold buyers.

Other than the $1,800 threshold, the latest swing high near $1,815-16 may also challenge the metal’s upside momentum before challenging the $1,834 barrier comprising highs marked in July and September.

It’s worth noting that the horizontal line of $1,850 adds to the upside filters before directing the quote to the monthly high of $1,877.

Alternatively, a downside break of the $1,785 will quickly fetch gold prices to an ascending support line from August, near $1,760.

Should the gold bears keep the reins past $1,760, the bullion becomes vulnerable to test September’s low of $1,721, a break of which will direct the bears to aim for the yearly low of $1,687.

Gold: Daily chart

Trend: Sideways

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.