Gold Price Forecast: XAU/USD keeps bounce off 200-DMA on softer yields, US ADP, Fed Minutes eyed

- Gold prices struggle for clear direction after bouncing off key support the previous day.

- Market sentiment dwindles as Omicron fears ebb, indecision over Fed’s next moves.

- Yields retreat from multi-day top, DXY softens ahead of early signals for Friday’s NFP, FOMC Minutes.

- Bang and Plunge: 2022 replays 2021 for gold

Gold (XAU/USD) prices grind higher past $1,815 heading into Wednesday’s European session. In doing so, the yellow metal struggles to extend the previous day’s recovery moves from the 200-DMA as markets await the key catalysts from the US.

The upbeat scientific studies and comments from the World Health Organization (WHO) Incident Manager Abdi Mahamud tamed fears concerning the South African covid variant, namely Omicron. However, the faster spread of the virus variant and news of another strain being found in France, having more pace in spreading than Omicron, challenge the market’s optimism of overcoming the pandemic.

On a different page, mixed US data and a pause in the US Treasury yields, as well as receding inflation expectations, tease the gold buyers.

The ISM Manufacturing PMI dropped to the lowest in 11 months in December, 58.7 versus 60.0 forecast and 61.1 prior whereas November’s JOLTS Jobs Openings came in lower than the upwardly revised previous reading of 11.091M to 10.562M. Further, US inflation expectations, as per 10-Year Breakeven Inflation Rate numbers from the Federal Reserve Bank of St. Louis (FRED) eased from a six-week high.

It’s worth noting that Minneapolis Fed President and 2022 voting FOMC member Neil Kashkari signaled the need for two rate hikes but couldn’t match the money market bets for three such actions in 2022, which in turn probed gold buyers the previous day.

Amid these plays, S&P 500 Futures drop 0.40% whereas the US 10-year Treasury yields drop 1.5 basis points (bps) to 1.65% while portraying a pullback from a six-week high.

Hence, the market sentiment is mostly mixed, slightly bearish, but the gold traders await the US ADP Employment Change for December, expected 400K versus 534K prior, as well as Federal Open Market Committee (FOMC) Meeting Minutes. Should the Fed policymakers agree over a faster pace of rate hikes in 2022, gold buyers have a reason to worry.

Read: US ADP December Preview: Suddenly its inflation, not jobs

Technical analysis

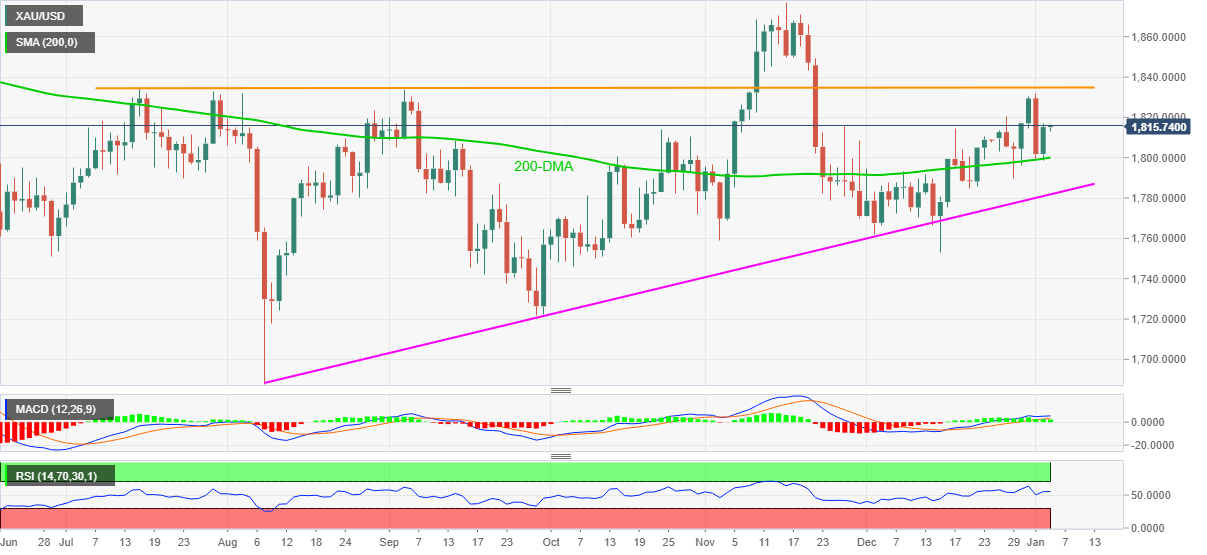

Gold stays above 200-DMA with firmer MACD and RSI adding to the bullish bias targeting another battle with the $1,834 hurdle comprising tops marked during July and September.

In a case where the gold buyers manage to cross the $1,834 hurdle, the run-up towards $1,850 and November’s swing high near $1,877 can’t be ruled out.

Meanwhile, a daily closing below 200-DMA surrounding $1,800 is a call to the gold sellers as an upward sloping trend line from August, near $1,780, becomes crucial support to watch afterward.

Though, a sustained break of $1,780 will make gold vulnerable to challenge December’s low of $1,753.

To sum up, gold buyers are gradually tightening their grips ahead of this week’s key data/events.

Gold: Daily chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.