- Gold price rallies on the knee-jerk after Nonfarm Payrolls.

- Gold price bulls eye a break of $1,850 to take back control.

Gold price had been moving higher for a third consecutive day on Friday but the yellow metal was on track for a weekly fall as prospects of further interest rate hikes dented the precious metal's allure, while traders awaited a US Nonfarm Payrolls report.

The Nonfarm Payrolls report has arrived as follows:

US Nonfarm Payrolls

- US change in Nonfarm Payrolls Feb: 311K (exp 225K; prev 517K).

- REVISIONS - US Change in Nonfarm Payrolls Feb: 311K (exp 225K; prev 517K; prevR 504K).

- US Unemployment Rate Feb: 3.6% (exp 3.4%; prev 3.4%).

- US Average Hourly Earnings (MoM) Feb: 0.2% (exp 0.3%; prev 0.3%).

- Average Hourly Earnings (YoY) Feb: 4.6% (exp 4.7%; prev 4.4%).

On the knee-jerk, Gold price has rallied to a fresh corrective high near $1,845 as markets price out the odds of a 50 basis point rate hike from the Federal Reserve this month. The main disappointments come in the Unemployment Rate that might have been expected to remain unchanged at a historically low level of 3.4%; while average hourly earnings were a big disappointment also.

However, when combined with yesterday's JOLTS whereby the Federal Reserve's favorite gauge of labor demand strength, the vacancies-over-unemployed ratio ("V/U ratio"), these reports do not bode well for a Fed that is hoping for a meaningful slowing of the labor market.

The analysts at TD Securities explained that yesterday, ''the V/U ratio remained at a historical high of 1.9 vacancies per unemployed person. In terms of quits, the quits rate did decline to 2.5%, a two-year low, but the lay-offs rate remained quite low at 1.1% and in line with what we've seen in 2022. Overall, a robust report in line with continued labor market strength,'' the analysts argued.

Nevertheless, the Nonfarm Payrolls has missed the mark in some key areas although this could be regarded as a mean-revert in February after the gangbuster report that saw job creation surge to an unexpected 517k in January.

In the previous session, Jobless Claims surprised to the upside during the first week of March, jumping to above the 200k level for the first time in 8 weeks. The series printed 211k, up from 190k. This data took some sting out of the Federal Reserve chair Jerome Powell's hawkish tones when he testified to Congress and warned that a 50 basis point hike was not off the table. However, it is worth noting that the average for claims in 2018-19 was 220k, so the series still remains somewhat below the pre-Covid trend.

Fed funds futures had already been showing that investors had decreased the likelihood of a 50bp hike by the Fed in March to 56%, after being as high as 75% following Powell's speech this week.

Gold technical analysis

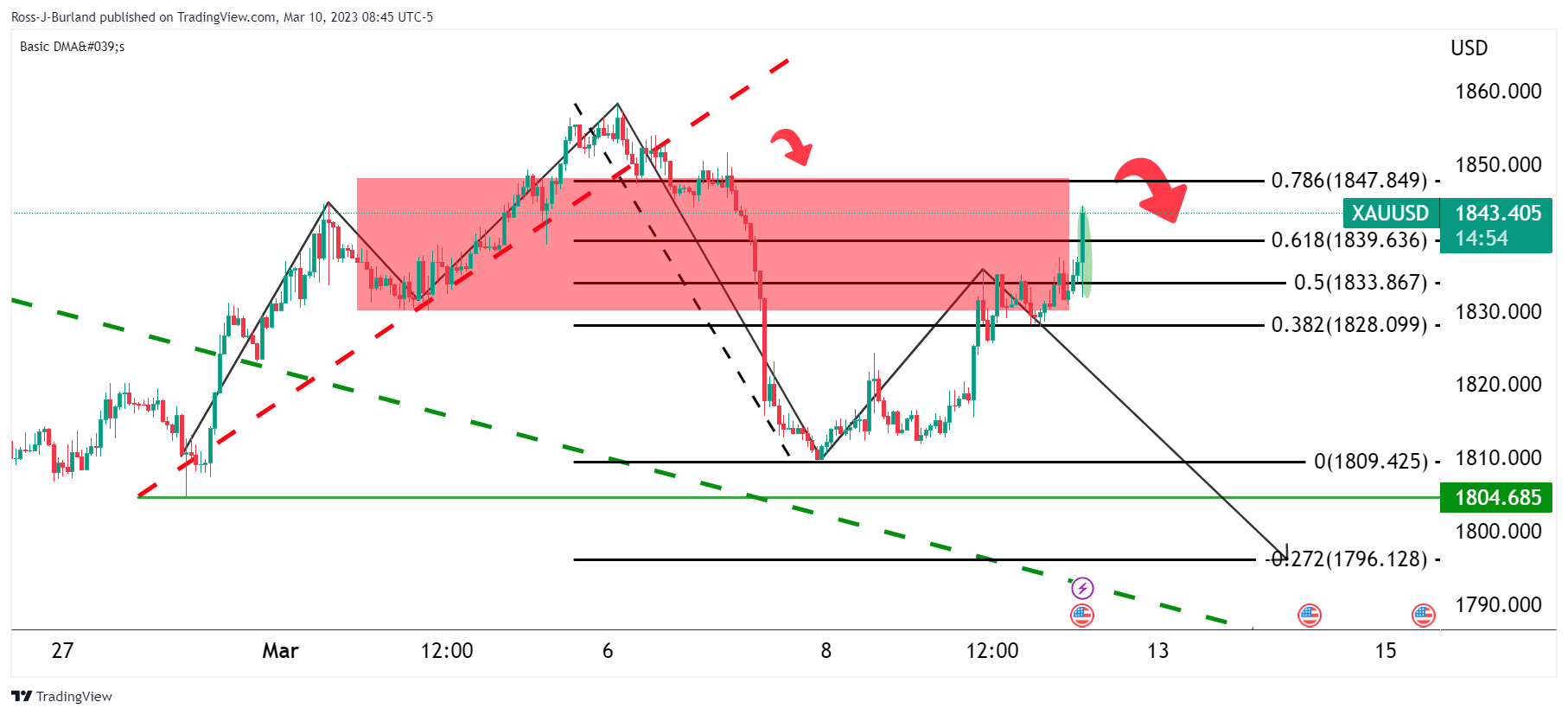

Leading into the event, Gold price crossed back above the $1,825 mark in the pursuit of the M-formation's neckline around the 50% mean reversion mark:

Gold price update

As illustrated, Gold price has rallied on knee-jerk. There is a support location down at $1,804 with resistance above $1,850. If the bears move in again, then there will be prospects of a move to test the Gold price 200 DMA in the coming days with the $1,1770s eyed in that regard. If the $1,850 give way to bulls then there are prospects of a move above the M-formation's double top with the $1900s exposed:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds above 1.0400 in quiet trading

EUR/USD trades in positive territory above 1.0400 in the American session on Friday. The absence of fundamental drivers and thin trading conditions on the holiday-shortened week make it difficult for the pair to gather directional momentum.

GBP/USD recovers above 1.2550 following earlier decline

GBP/USD regains its traction and trades above 1.2550 after declining toward 1.2500 earlier in the day. Nevertheless, the cautious market mood limits the pair's upside as trading volumes remain low following the Christmas break.

Gold declines below $2,620, erases weekly gains

Gold edges lower in the second half of the day and trades below $2,620, looking to end the week marginally lower. Although the cautious market mood helps XAU/USD hold its ground, growing expectations for a less-dovish Fed policy outlook caps the pair's upside.

Bitcoin misses Santa rally even as on-chain metrics show signs of price recovery

Bitcoin (BTC) price hovers around $97,000 on Friday, erasing most of the gains from earlier this week, as the largest cryptocurrency missed the so-called Santa Claus rally, the increase in prices prior to and immediately following Christmas Day.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.