- Gold starts out on the back foot due to a strong US dollar and the Fed.

- Risk-off flows should continue, however, supporting the safe-havens.

- XAU/USD to remain bearish amid rising US yields.

Update: The gold price in Asia, XAU/USD, remains subdued as the opening session progresses while the US dollar stays in the hands of the bulls while above 98.50, as per the DXY index. Gold trades at $1,925 and flat on the day so far after starting out lower at $1,921.48.

The dollar made a firm start to the week following last Friday's mixed Nonfarm Payrolls data and as Treasury yields rose with expectations of a hawkish Federal reserve and subsequent US interest rate hikes. Additionally, there has been talk of bans on Russian gas that have kept the euro within sight of its 2022 lows.

According to Reuters, ''Germany's defence minister said on Sunday that the European Union must discuss banning imports of Russian gas, which could drag further on growth and the currency after Ukrainian and European officials accused Russian forces of atrocities.''

End of update

At $1,924.27 the low in the open, the gold price is starting out on the back foot on Monday in the Asian open. The yellow metal ended Friday down some 0.62% at $1,925 after travelling from a high of $1,939.62 to a low of $1,918.10.

Investors are having to weigh up the risks of a protracted war in Ukraine and as the peace talks drag on to no avail as well as a US recession against a hawkish backdrop at the Federal Reserve. Analysts at TD Securities explained that gold remains in the crosshairs as the Fed pricing provides a constant dark cloud over the precious metal market.''

''While safe-haven appetite and massive ETF inflows provide a strong offset, keeping prices above CTA liquidation thresholds near $1830/oz, the drag of a hawkish Fed backdrop is increasingly weighing on the upside momentum of the yellow metal.''

On Friday, the US Nonfarm Payrolls were solid for March. 431,000 jobs were added last month, below the estimates of 490,000, although data for February job increases were revised higher. However, the Unemployment rate fell to 3.6%, the lowest since February 2020. This has supported the US dollar. As measured by the DXY index, the greenback was higher for the second straight day after two straight down days and is trading back near 98.50. This month’s cycle high near 99.418 should eventually be tested. The US dollar is bid in the open on Monday, now trading in the 98.60s.

Additionally, Reuters reported that the futures contracts tied to the Fed's policy rate fell after the jobs report, pointing to expectations that the Fed will hike by a half-a-percentage point at each of its next three meetings to deal a more decisive blow to price pressures. ''That would follow a quarter-point hike on March 16, when the Fed embarked on a new tightening cycle.''

Nonetheless, despite the strength in the greenback, analysts at TD Securities argued that ''so long as material progress on ceasefire talks and de-escalation remains elusive, haven flows are likely to keep the yellow metal supported.'

As per the speculation of a US recession, the analysts said, at the same time, ''the 2y-10y curve flirting with inversion has further fueled talk of the recession on the horizon, offering another positive dynamic for the gold market. With that said, while geopolitical tensions and yield curve recession signals re-ignite investor interest in gold, downside risks are more prevalent amid a hawkish Fed backdrop and as negotiators continue to work towards a ceasefire.''

Gold, technical analysis

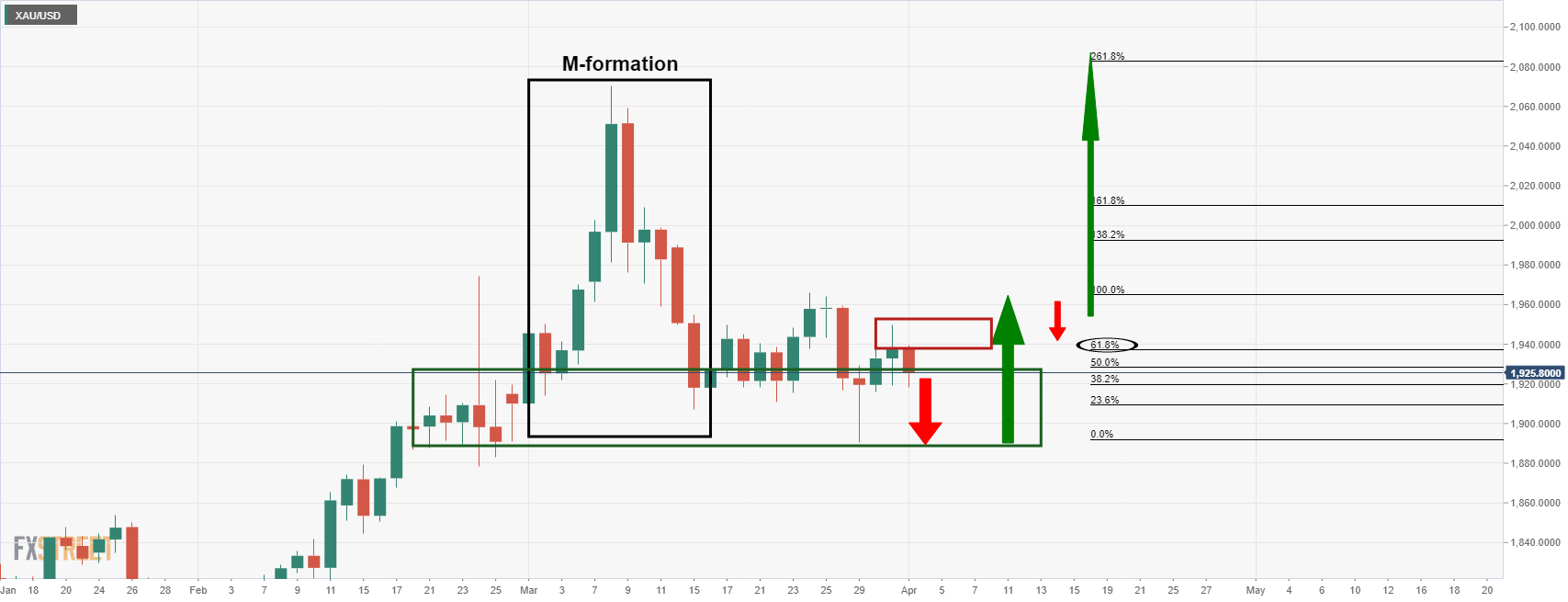

As per the pre-open analysis, Chart of the Week, Gold: XAU/USD is pressured for the open ...

... the M-formation is a bullish reversion pattern and the price would be expected to be attracted to the neckline between $1,980 and $2,000. However, the sideways consolidation has played out to the point that there appears to be a bias to the downside for the near term where gold is being resisted by a 61.8% Fibo currently.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD stays below 1.0400 ahead of US inflation data

EUR/USD struggles to stage a decisive rebound on Friday and continues to trade below 1.0400. The risk-averse market atmosphere helps the US Dollar hold its ground and limits the pair's upside. Investors await November PCE inflation data from the US.

GBP/USD touches fresh multi-month low below 1.2500

GBP/USD recovers to the 1.2500 area after touching its lowest level since May near 1.2470. The pair stays on the back foot after the Fed and the BoE policy announcements this week pointed to a potentially diverging policy outlook.

Gold price holds above $2,600, supported by souring market mood

Gold clings to modest daily gains above $2,600 on Friday amid the prevalent risk-off mood. Against the backdrop of persistent geopolitical risks and trade war fears, the threat of a US government shutdown drives some haven flows towards the bullion.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.