Gold Price Forecast: XAU/USD prints fresh hourly highs, $1,790 guards risk to $1,800

- Gold prices grind higher around weekly top, eyes to snap three-week downtrend.

- DXY pullback stops sellers even as market sentiment dwindles of late.

- Yields step back, stock futures print mild gains amid fresh challenges to risk appetite ahead of key US CPI.

- Gold Price Forecast: Consolidative phase continues, 1,758.80 still at sight

Update: Gold (XAU/USD) is printing fresh hourly highs in Asia as the US dollar and Treasury yields slide to new lows for the day.

Spot gold, XAU, rose 0.35% to $1,790.47 per ounce by 0300 GMT while the Benchmark 10-year and 30-year US Treasury yields continued to pull back from their one-week highs hit on Tuesday. The 10's are down some 1.3% to trade at a fresh low of the session at 1.458%.

The big event of the month will be the Federal Reserve meeting, but before then, on December 10, we have the crucial US Consumer Price Index for November, MoM. ''We expect inflation to slow significantly as fiscal stimulus fades and supply constraints ease, but we don't expect the data to be validating in the near term,'' analysts at TD Securities said. ''The CPI likely surged in Nov, with a drop in oil coming too late to avert another large gain in gasoline and core prices boosted by rapidly rising used vehicle prices and post-Delta strengthening in airfares and lodging.''

Meanwhile, traders will be looking to see whether inflation prints are expected to remain elevated in the early months of the year by the Fed. The markets are already pricing for Fed hikes that could still become more aggressive, but analysts at TD Securities said that they ''expect that it will ultimately prove to be far too hawkish.''

''In fact, with both an accelerated taper and more than three rate hikes already priced in for 2022, the balance of risks for gold positioning is shifting to the upside. The threshold for CTA short covering is razor-thin, which could ultimately catalyze higher gold prices.''

End of update

Gold (XAU/USD) picks up bids around $1,787 during early Wednesday, after refreshing the weekly high the previous day.

The yellow metal previously cheered the risk-on mood but the latest challenges to sentiment confront US Dollar Index (DXY) pullback to test the gold traders. That said, the yellow metal remains on the way to snap a three-week downtrend while keeping the previous week’s bounce off the monthly bottom.

DXY drops 0.08%, the first daily loss in six days while tracking the softer US bond coupons. The US 10-year Treasury yields decline two basis points (bps) to 1.47% at the latest while retreating from a weekly high. However, the S&P 500 Futures print mild gains and the stocks in Asia-Pacific are also trading mixed as traders jostle with contrasting news.

The receding fears of the South African coronavirus variant, dubbed as Omicron, joined policymakers’ readiness to safeguard respective economies of China and Japan to favor risk appetite previously. However, geopolitical tensions between the Washington and Kremlin, as well as the US-China tussles, joins fears of Chinese real-estate companies’ default to recently weighing on risk appetite.

That said, the US marks its dissent over the Russia-Ukraine tension by warning the Kremlin of sanctions, in addition to backing Ukraine with military power, if the two countries indulge in a war. “The Biden administration is in ‘intensive consultations’ with the new German government over its response if Russia invades Ukraine and believes Germany would be ready to take significant action if Russia launches an attack, a senior U.S. State Department official said on Tuesday,” said Reuters.

On a different page, China hints at consequences for the US, per local media, after Washington boycotts the 2022 Beijing Olympics. It’s worth noting that the reports of partial payment to Evergrande bondholders and looming payment for Kaisa raise fears in the Chinese markets, challenging global sentiment as well.

While challenges to risk appetite tests gold buyers, in contrast to the softer yields favoring prices, a lack of major data/events keeps the commodity traders looking for more macros for clear direction ahead of Friday’s US Consumer Price Index (CPI).

Technical analysis

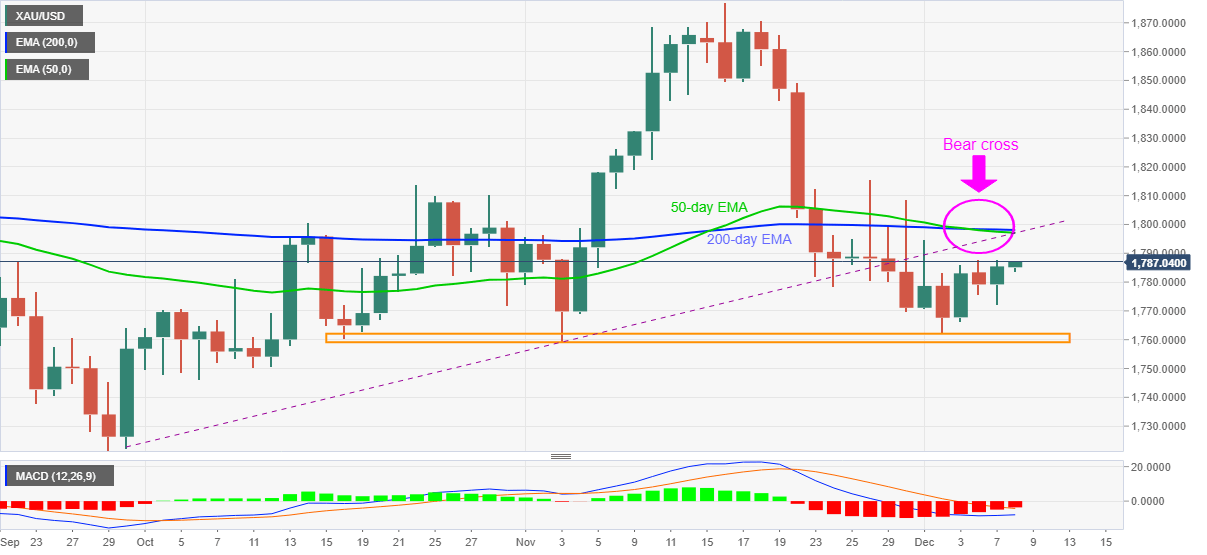

In contrast to the latest performance, technical patterns challenge gold buyers as it remains below the previous support line from September 30 amid bearish MACD signals.

Also favoring gold sellers is the bearish play of the moving average crossover, popularly known as the bear cross, portrayed by the 50-day EMA’s piercing off 200-day EMA.

That said, gold’s fresh declines may initially look to a seven-week-old horizontal area surrounding $1,762-60. Though, the $1,750 round figure and September’s low near $1,721 will question the metal’s further downside.

Alternatively, recovery moves will initially aim for the weekly top near $1,787 but the support-turned-resistance will challenge the gold buyers around $1,795.

Even if the bullion manages to cross the $1,795 hurdle, the stated EMA’s will act like a tough nut to crack for the gold bulls near the $1,800 threshold.

Gold: Daily chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.