Gold Price Forecast: XAU/USD hovers around the 200 DMA near $1840s

- Gold begins the week with losses of close to 0.50%.

- US Treasury yields and an upbeat sentiment weigh on the yellow metal.

- Gold Price Forecast (XAU/USD): Neutral biased, though a daily close below the 200-DMA might open the door for additional losses.

Gold spot (XAU/USD) is tumbling, weighed by rising US Treasury yields and an upbeat mood, as Federal Reserve officials begin their blackout period ahead of June’s monetary policy meeting. At $1842.02, the XAU/USD reflects the aforementioned, in a critical week regarding the US economic calendar, revealing inflation figures for May.

US Treasury yields and an upbeat sentiment weigh on the yellow metal

Sentiment remains positive courtesy of China’s easing of coronavirus restrictions and after an upbeat US employment report on Friday, as reflected by global equities registering gains. Also, China’s Caixin PMIs readings in Services and Composite, even though remaining in contractionary territory, were better than foreseen.

Hence, XAU/USD prices have been under pressure since the beginning of Monday’s trading session. Additional to US Treasury yields rallying, led by the 10-year benchmark note rate at 3.032%, almost ten bps up, the greenback remains positive in the day. The US Dollar Index climbs 0.27%, sitting at 102.448.

In the meantime, the last Fed speaker of the previous week, before the June meeting blackout, San Francisco’s Fed President Mary Daly, said that “I’m going to come into that September meeting, and if I don’t see compelling evidence (of lower inflation), then I could easily be a 50 bp in that meeting as well. There’s no reason we have to make that decision today, but my starting point will be do we need to do another 50 or not.”

She sounded more hawkish than foreseen, as some Fed policymakers expressed that the central bank might “pause” to assses economic conditions in September. For the new Fed Vice Chair Lael Brainard, that is not an option, as she pushed back on that last Thursday, saying that “it’s very hard to see the case for a pause.”

Therefore, the Federal Reserve is headed for back-to-back 50 bps rate hikes meetings in June and July. September is open, and we could see the first split in rate increases, some leaning towards 25 bps and the others remaining in the 50 bps pace unless the Fed’s Chair Jerome Powell convinces the committee.

The US economic docket would feature April’s Balance Trade, Initial Jobless Claims, the May Consumer Inflation report, and the UoM Consumer Confidence in the week ahead.

Gold Price Forecast (XAU/USD): Technical outlook

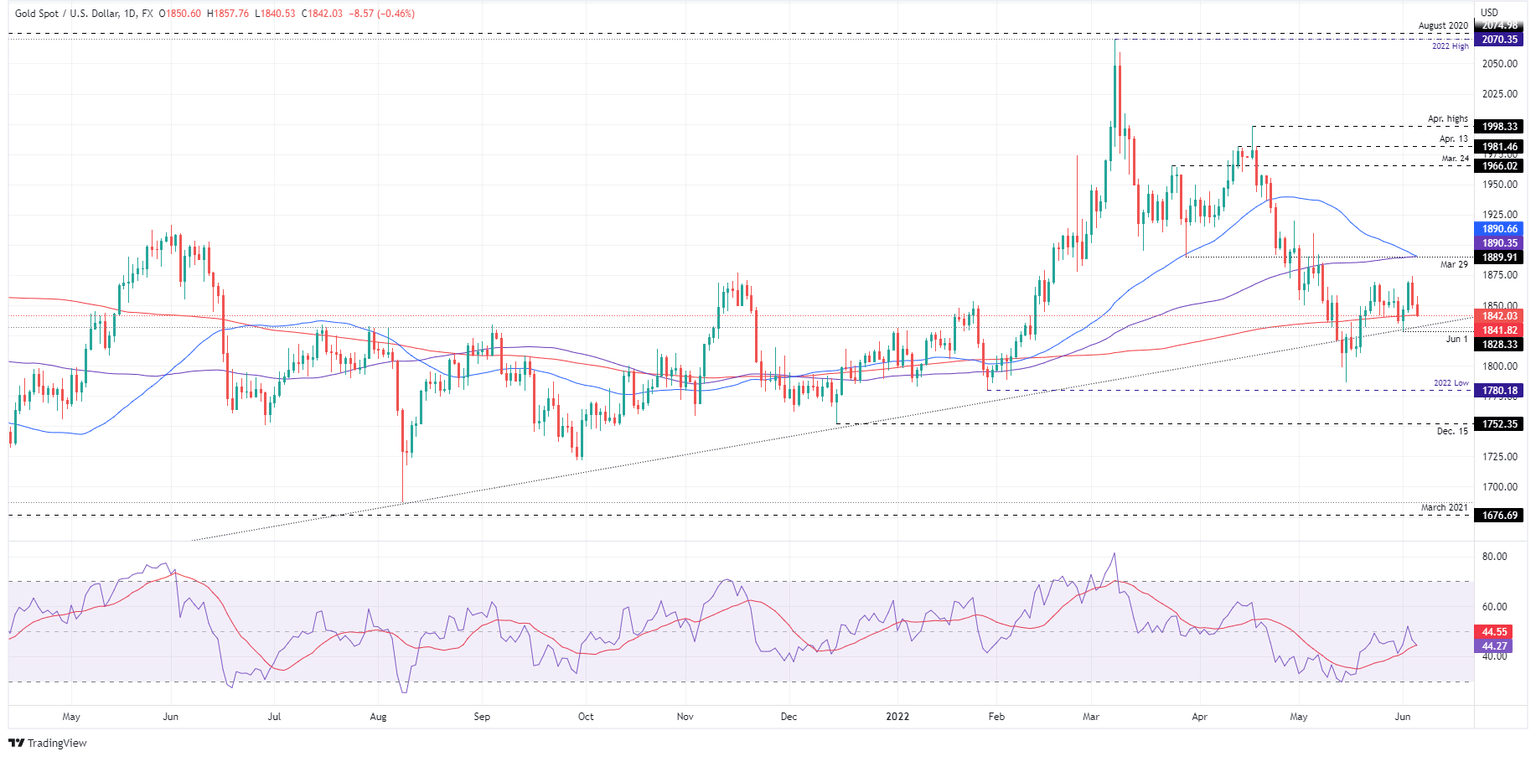

XAU/USD remains upward biased though it is threatening to break below the 200-day moving average (DMA) at $1841.82, which would open the door for further losses. Additionally, in bearish territory, the Relative Strength Index (RSI) is aiming lower but far from reaching oversold conditions.

That said, the XAU/USD path of least resistance in the near term is neutral. Upwards, the XAU/USD’s first resistance would be the 200-DMA at $1841.82. Break above would expose the June 6 high at $1857.76, followed by the June 3 swing high at $1874, shy of March’s lows-turned-resistance at $1889.91. On the flip side, the XAU/USD’s first support would be June 1 low at $1828.33. A breach of the latter would expose the $1800 mark, followed by the May 16 cycle low at $1786.50.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.