Gold Price Forecast: XAU/USD hits weekly high despite rising US bond yields

- Gold price (XAU/USD) hits a new weekly high of $1987.25, gaining more than 0.56%

- US economic data shows business activity is gaining traction, with New Home Sales soaring more than 12% in September.

- The US 10-year Treasury bond yield gains 13 basis points at 4.95%.

- Gold traders eye upcoming US economic data, including Q3 GDP, Durable Good Orders, and unemployment claims.

Gold price (XAU/USD) snaps two days of losses and hits a new weekly high of $1987.25, despite rising US Treasury bond yields, which are usually a headwind for the yellow metal. At the time of writing, the non-yielding metal extends its gains of more than 0.56%, changing hands at $1981.67 a troy ounce.

Gold prices defy headwinds from rising US Treasury bond yields and a strong US Dollar, reaching a new weekly high

Even though US Treasury bond yields remain higher, XAU/USD has gained traction pm Wednesday. The latest round of economic data in the United States (US) shows that business activity is gaining traction, as revealed by S&P Global PMIs on Tuesday. That and New Home Sales smashing August’s figures, with sales soaring more than 12%, were the two fundamental reasons behind the rise in the Greenback.

As the Wall Street close looms, the US 10-year Treasury bond yield gains 13 basis points and sits at 4.95%, while the US Dollar Index (DXY) climbs 0.29%, at 106.55. However, Gold prices seem immune to recent US Dollar strength, as the XAU/USD reached a weekly high above $1985.

In addition to that, geopolitical risks remained, after the Israeli Prime Minister Benjamin Netanyahu stated that preparations for a ground invasion were underway. However, he did not provide specific details regarding the operation. Netanyahu advised civilians in Gaza to move to the south and mentioned that the timing of the invasion would be determined by consensus.

Given the fundamental backdrop, Gold could remain upward biased, but October’s 26 data could rock the boat. The US agenda would feature Gross Domestic Product (GDP) for Q3, alongside Durable Good Orders and unemployment claims. If the data is dollar-supportive and could trigger a repricing for further interest rate hikes by the Federal Reserve (Fed), then Gold prices could dip. Otherwise, expect further XAU/USD upside.

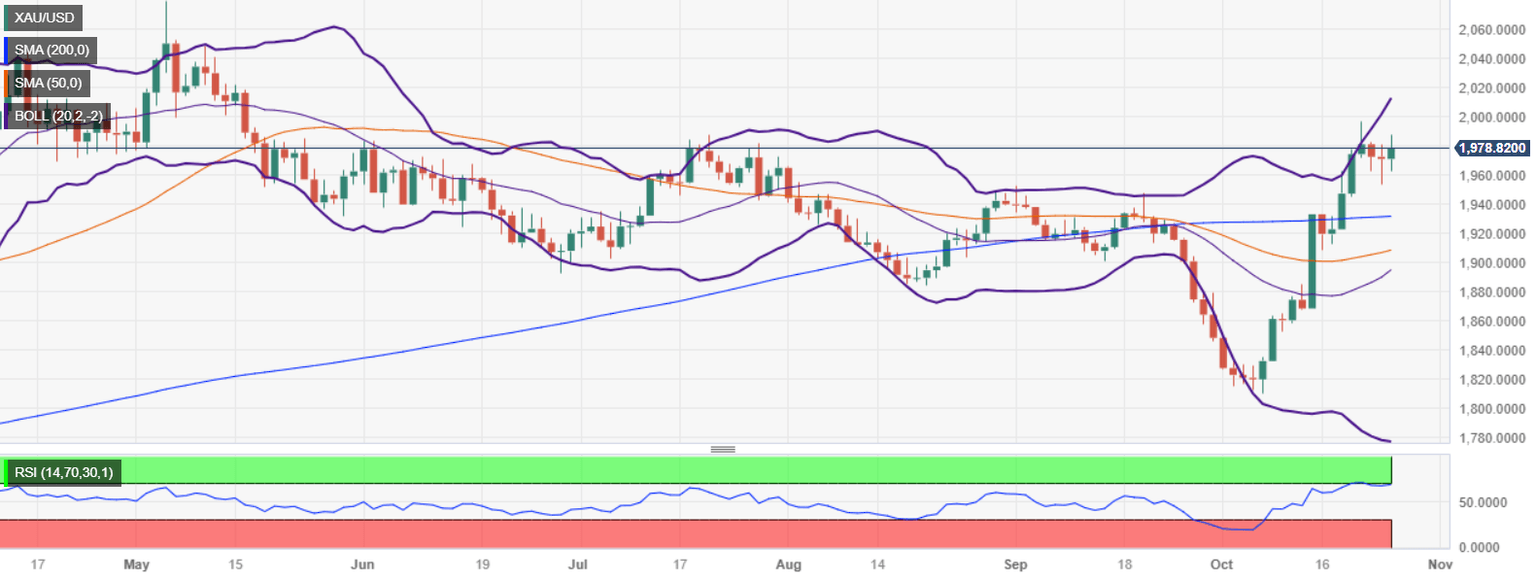

XAU/USD Price Analysis: Technical outlook

Gold is upward biased after reclaiming the 200-day moving average (DMA) at $1931.973, though it could remain sideways, following a more than 8% rally from October lows towards $1997. If XAU/USD manages to reclaim $1990, that could open the door to challenging $2000. On the flip side, if Gold prices drop below the current week’s low of $1953.69, the next support will emerge at the 200-DMA, followed by the 100-DMA at $1923.07.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.