- Gold price extends the previous day’s losses on breaking $1,937-38 key support.

- US Dollar’s rebound ahead of Fed’s preferred inflation gauge also weighs XAU/USD.

- Hopes of US debt ceiling extension, fading recession woes underpin USD strength.

- Firmer US Core PCE Price Index becomes necessary for the Fed to defend hawkish policy moves and the Gold sellers.

Gold price (XAU/USD) sticks onto the US GDP-inflicted bearish bias as the metal traders await the Federal Reserve’s (Fed) preferred inflation gauge, namely the US Core Personal Consumption Expenditures (PCE) Price Index details for December. In addition to the pre-data anxiety, confirmation of the six-week-old rising wedge bearish chart pattern also keeps XAU/USD sellers hopeful.

The metal reversed from the nine-month high after the upbeat US Gross Domestic Product (GDP) data renewed expectations of a few more rate hikes from the Fed before the policy. The personal consumption and the GDP price index details, however, challenged the hawkish bias and put a floor under the metal. Even so, the early Friday news suggesting the US House Republicans’ nearness to overcoming the debt ceiling woes seemed to have renewed the XAU/USD downside.

It should be noted, however, that the odds of witnessing a softer US inflation and a dovish Fed rate hike are too high, which in turn suggests limited downside room for the Gold price.

Also read: Gold Price Forecast: XAU/USD confirms bearish wedge ahead of United States inflation data

Gold Price: Key levels to watch

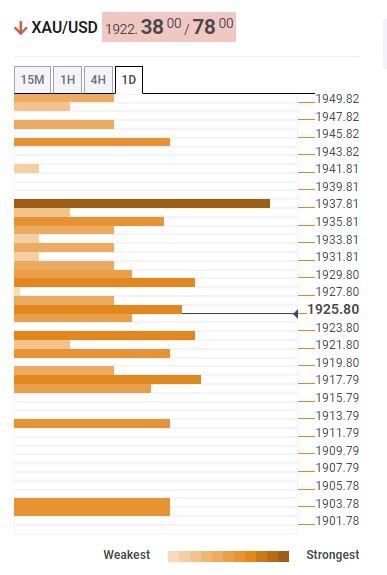

The Technical Confluence Detector shows that the Gold price stays depressed below the $1,937-38 resistance confluence, comprising the previous weekly high and Fibonacci 61.8% on daily chart.

As a result, the Fibonacci 38.2% on weekly and Pivot Point one-month R3, respectively around $1,920 and $1,917, appear imminent levels to grab for the XAU/USD sellers.

However, a slew of technical indicators encompassing the Pivot Point one-week S1 and S2, as well as SMA 100 on four-hour play, seem to highlight the $1,900 as a tough nut to crack for the Gold bears.

Alternatively, an upside clearance of the $1,938 resistance confluence will need validation from the $1,945 hurdle, including the Pivot Point one-week R1, to convince buyers.

Following that, a run-up towards late March 2022, close to $1,966, appears an easy play for the Gold buyers.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD eyes multi-month low on US-China trade war concerns

AUD/USD remains under heavy selling pressure for the second straight day and dives back closer to a multi-month low during the Asian session on Tuesday. Trump's threatened tariffs on China undermine the China-proxy Aussie amid a softer risk tone.

USD/JPY extends its consolidative price move around 154.00

USD/JPY remains confined in a familiar range as traders seem reluctant amid mixed fundamental cues. The uncertainty over the timing and pace of interest rate hikes by the BoJ, the recent surge in the US bond yields and the risk-on mood undermine the JPY.

Gold rebounds from one-week low; finds support ahead of $2,600

Gold price dropped to a one-week low during the Asian session on Tuesday, albeit finds some support in the vicinity of the $2,600 mark. The prevalent risk-on environment, along with bets for slower Fed rate cuts and elevated US bond yields, drives flows away from the safe-haven XAU/USD and supports prospects for further losses.

Ripple's XRP eyes $1.96 after WisdomTree files for XRP ETF in the US

Ripple's XRP surged over 7% on Monday and aims to stage a rally toward its April 2021 high after WisdomTree registered for an XRP ETF in the US state of Delaware on Monday.

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.