Gold Price Forecast: XAU/USD sits tight as traders mull inflation concerns

- Gold bulls keep reins inside weekly trading range at five-month high.

- DXY tracked yields to step back from multi-day low, allows bulls to tighten the grips.

- Mixed US data, Fedspeak favor price run-up amid inflation fears, US Jobless Claims, Fed policymakers’ speeches eyed.

- Gold Price Forecast: XAU/USD bulls eager to end consolidation phase, critical drop in yields eyed

Update: Gold (XAU/USD) is holding on in bullish territory and is attempting to continue high following the dip at the start of the week. The price is flat in Asia around $1,868.00 and has stuck to a tight range between $1,870.94 and $1,866.33 so far.

The rest of the week could be determined by central bank speaks and events that include today's Reserve Bank of New Zealand's release of the Q4 Survey of Expectations. This is more of a compelling event ahead of the forthcoming interest rate decision. While gold is not directly correlated to such an event not rate decision next week, the theme around inflation certainly is a driving force.

The yellow metal remains an ideal hedge against rising stagflationary winds. ''The tug-of-war between high inflation prints and market pricing for central bank hikes hasn't definitively concluded,'' analysts at ANX Bank argued. ''This leaves the yellow metal open to two-way risks, as it remains to be seen whether the technical breakout will be a sufficiently large catalyst to reverse the pervasively poor sentiment plaguing the precious metals complex.''

End of update

Gold (XAU/USD) ends Wednesday’s North American trading session with the highest daily gains in a week, edges around $1,867 as Asian traders braces for Thursday’s bell.

The yellow metal cheers the heavy pullback of the US Treasury yields that weighed on the US Dollar Index (DXY) amid a lack of major catalysts and ongoing inflation chatters. Also favoring the gold buyers is the mixed US housing numbers and policymakers’ indecision over the next moves of the Federal Reserve (Fed).

That said, US 10-year Treasury yields retreat from the highest levels since October 26 to post the heaviest daily fall in a week while ending Wednesday’s US trading session around 1.59%, down 4.3 basis points (bps). DXY tracks bond yields and marks a first negative daily closing in three after refreshing the 16-month top during early Wednesday.

A light calendar and mixed US housing numbers allowed the traders to consolidate recent moves but the ongoing inflation fears and talks of the monetary policy tightening underpin gold’s safe-haven demand as the greenback steps back. US Housing Starts mark a surprise fall in October and the previous readings were also revised down while the Building Permits rose past expectations and prior during the stated period.

Fedspeak keeps trying to push back the inflation fears and tame the rate hike talks. However, the policy hawks aren’t defeated and hence challenge gold buyers. Recently, Charles L. Evans, the chief executive officer of the Federal Reserve Bank of Chicago said, “It will take until the middle of next year to complete the Fed's wind-down of its bond-buying program, even as the central bank remains 'mindful' of inflation.”

It’s worth noting that US President Joe Biden signaled that they have a lot to follow up on despite having a “good meeting” with China’s Xi after the first round of virtual meeting. Alternatively, US Treasury Secretary Janet Yellen announced the extension of the debt ceiling to December 15, versus the previous expiry of December 3, to underpin the risk-on mood earlier the previous day.

Amid these plays, US stocks closed lower and oil had to bear the burden of the US push to the key global energy players to release their strategic reserves.

Moving on, US Weekly Jobless Claims and Fedspeak could entertain gold traders amid a light calendar going forward. However, inflation and rate hike remain the key catalysts to watch.

Technical analysis

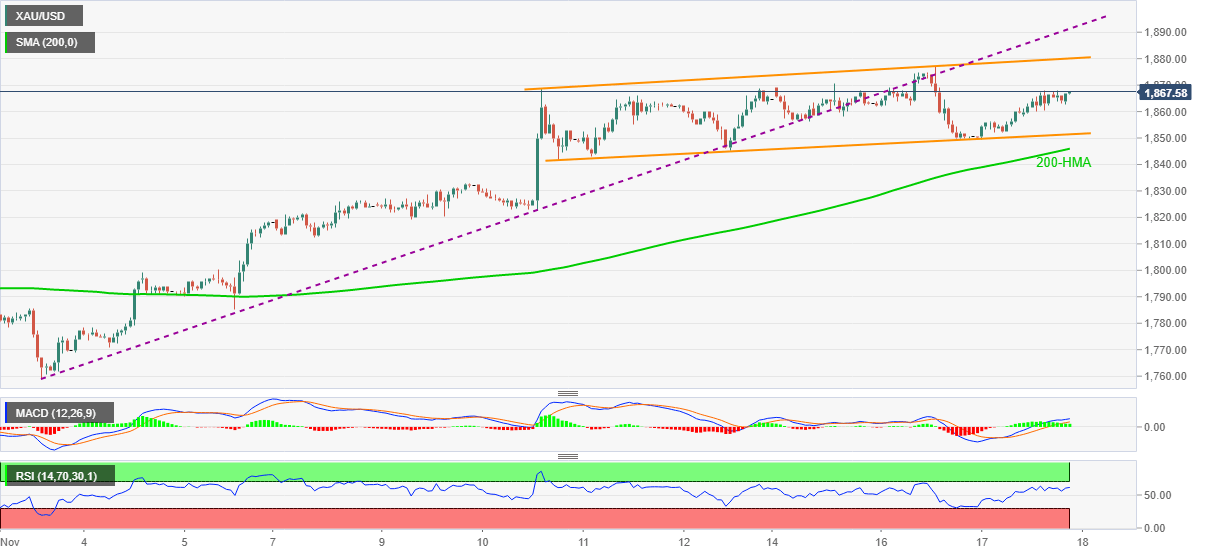

Gold remains on a front foot inside a weekly ascending trend channel. Also validating the bullish bias are the MACD signals, upward sloping but not overbought RSI line and sustained trading beyond 200-HMA.

However, sustained trading below a fortnight-long ascending trend line, around $1,887, restricts short-term advances of the metal. Adding to the upside filter is the upper line of the stated channel near $1,880 and the $1,900 threshold.

Meanwhile, a downside break of the channel’s support line, at $1,850, will defy the bullish formation but the gold sellers will need validation from the 200-HMA level of $1,843 to retake control.

Following that, gold prices become vulnerable to revisit $1,830 and $1,813-12 support levels before directing the bears to the $1,800 psychological magnet.

Gold: Hourly chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.