Gold Price Forecast: XAU/USD forges bullish path above $1,960, Fed, banking turmoil eyed – Confluence Detector

- Gold price struggles to reverse the previous day’s pullback from YTD top.

- Mixed headlines about banking crisis, cautious mood ahead of key central bank events probe XAU/USD traders.

- Rebound in yields, hawkish Fed bets probe Gold buyers ahead of FOMC.

- XAU/USD bears need validation from $1,960 support confluence, Fed’s hawkish bias.

Gold price (XAU/USD) regains upside momentum, following the pullback from a Year-To-Date (YTD) high, amid cautious optimism surrounding the banking sector. Adding strength to the recovery moves could be the market’s inaction amid the Japanese holiday, as well as the failures on the part of the US Treasury bond yields to extend the recent corrective bounce off a six-month low.

Headlines suggesting the US policymakers’ search for ways to insure all banking deposits join the UBS-Credit Suisse deal and major central banks’ rush to keep the markets liquid with the US Dollar flow seem to favor the Gold buyers.

It’s worth noting, however, that the latest read of the CME’s FedWatch tool mentions the probability of witnessing a 0.25% Fed rate hike on Wednesday as near to 75%, up from the last week’s 65%, which in turn allows the US Treasury bond yields to rebound. That said, Treasury bond yields remain inactive as Japan’s holidays limited bond trading in Asia. It’s worth noting that the US 10-year and two-year Treasury bond yields bounced off the lowest levels since September 2022 the previous day.

Moving on, Fed’s reaction to the banking crisis will be crucial for Gold traders to watch as the 0.25% rate hike is already given. Should the dot-plot tease policy pivot, the US Dollar can have a further downside to trace, which in turn can propel the XAU/USD price.

Also read: Gold Price Forecast: XAU/USD grinds beyond $1,940 support, banking crisis, Federal Reserve in focus

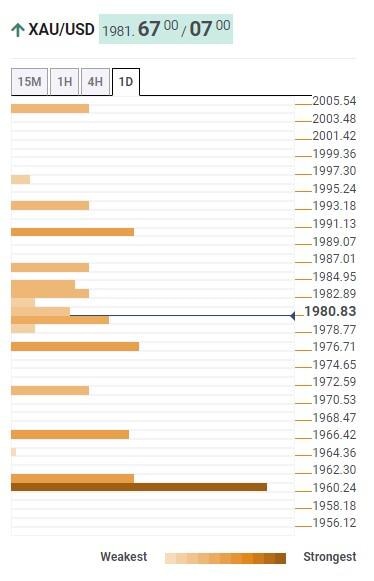

Gold Price: Key levels to watch

As per Technical Confluence Detector, Gold price trades successfully beyond the $1,960 support confluence, despite the latest inaction, which in turn keeps the XAU/USD buyers hopeful. That said, the stated key support comprises Fibonacci 23.6% on one-week, previous monthly high and Pivot Point one-day S1.

That said, Fibonacci 23.6% on one-day and 50-HMA levels restrict immediate downside of the Gold price near $1,976 and $1,965-66 in that order. It's worth mentioning that the $1,940 acts as the key downside support, apart from the $1,960, which could challenge the XAU/USD bears.

Meanwhile, the previous weekly high surrounding $1,990 can act as an immediate resistance before highlighting the $2,000 threshold.

In a case where the Gold price remains firmer past $2,000, Pivot Point one-day R1 can act as a validation point for the further run-up near $2,005 before fueling the XAU/USD towards 2022’s peak of $2,070.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.