Gold Price Forecast: XAU/USD and DXY consolidate ahead of Jackson Hole

- Gold bears take a breather after two-day downtrend.

- Firmer Treasury yields, strong equities trouble gold traders despite USD weakness keeping buyers hopeful.

- Sideways moves are expected as key risk data/events scheduled for release.

- Gold Weekly Forecast: XAU/USD to stay in consolidation ahead of Jackson Hole

Tokyo update, 26/08: Gold (XAU/USD) is stationed near $1,790 as the Tokyo morning continues with traders armed with dry powder awaiting the next market catalyst.

The US dollar and markets, in general, are sidelined ahead of a keynote speech to come from the Federal Reserve's chairman, Jerome Powell on Friday.

Investors are looking for more clues from the central bank as to timings of tapering their bond purchasing programme and for an update of their economic outlook, specifically with regards to the delta variant in the US and globally.

The outcome of the event is expected to set the stage for the remaining quarter of the year, although should the Jackson Hole be less conclusive, it will leave the focus on the Fed's September meeting and pivotal data events, such as next month's US Nonfarm Payrolls.

At the time of writing, the US dollar index that measures the currency against a basket of major rivals is perched above a critical 92.80 level.

More on how critical this level is, here: US dollar at make or break point, the countdown to taper

For the day ahead, US data will be the focus.

The second quarter Gross Domestic Product is expected by the analysts at Westpac ''to only be revised at the margin (if at all) in its second estimate.''

''Initial claims should also edge lower, though delta is a clear risk to that view. Finally, the August Kansas City Fed index will provide yet another regional view of manufacturing in the US,'' the analysts said.

End of update.

Gold (XAU/USD) seesaws around $1,791 during a sluggish Asian session on Thursday. The precious metal dropped during the last two days as firmer US Treasury yields and strong equity returns lured traders off gold. However, cautious mood ahead of the key Jackson Hole Symposium restricts immediate moves of the commodity prices.

US bonds bears and the equity bulls recently cheered increasing hopes that the global central banks’ easy money policies will prevail for a longer time, as well as optimism towards overcoming the coronavirus. Also underpinning the risk-on mood could be the US policymakers’ passage of the $3.5 trillion budget plan on Tuesday.

Downbeat US Durable Goods Orders for July and US Health Official Anthony Fauci’s expectations of getting the COVID-19 conditions under control by early 2022, backed by strong jabbing, favored the firmer risk appetite. Also on the positive side was news that representatives of Wall Street and China will meet to soften the terms of equity trading. Furthermore, chatters over faster jabbing in the Asia–Pacific and news of more covid vaccine approvals in the pipeline to the US Food and Drug Administration (FDA) brighten the market’s mood as well.

It’s worth noting that the escalating Delta covid variant woes and geopolitical tension surrounding Afghanistan challenge the market sentiment. Additionally, traders also turn cautious ahead of the US Personal Consumption Expenditure (PCE) data and second reading of the US Q2 GDP, not to forget Fed Chair Jerome Powell’s speech, up for publishing on Friday.

Amid these plays, US equities remained firm for the fifth consecutive day by the end of Wednesday whereas the US Dollar Index (DXY) dropped 0.7% to the one-week low, down for the fourth day in a row.

Looking forward US data may entertain gold traders but the cautious sentiment could restrict the moves ahead of Powell’s Jackson Hole speech.

Technical analysis

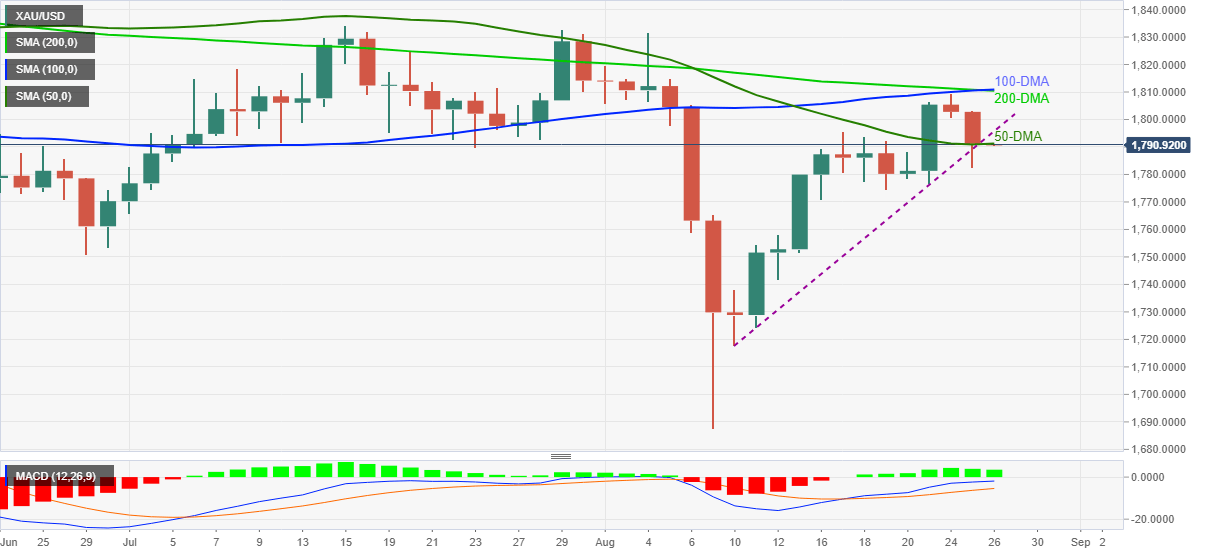

Gold struggles to justify a downside break of a 12-day-old support line amid bullish MACD signals. Even so, the metal’s sustained trading below the crucial Simple Moving Averages (DMAs) keeps sellers hopeful.

Hence, bears will wait for clear trading below $1,790 and will be convinced for further ruling on the break of August 19 low surrounding $1,775.

Following that, June’s bottom close to $1,750, August 10 low near $1,717 and the $1,700 round figure may add to the downside filters ahead of the latest trough of $1,687.

Alternatively, an upside cross to the previous support line, around $1,795, will aim for the $1,800 threshold.

However, gold buyers will remain challenged until crossing a convergence of 100-DMA and 200-DMA near $1,810–11.

Gold: Daily chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.