- Gold price is retreating from three-week highs, as the US dollar finds demand.

- The metal awaits critical US economic data for clarity on the Fed’s policy.

- $1,730-$1,735 supply zone appears a tough nut to crack for XAU/USD bulls.

Gold price is pulling back from three-week highs of $1,730, as the US dollar is finding fresh demand so far this Wednesday. The bright metal is snapping its two-day rally, as markets are turning cautious heading into the critical US economic data in the second half of this week. After weak US ISM Manufacturing and Job Openings data, investors started betting that the Fed will slow down its tightening pace, as the economy appears to be cooling. The dollar sell-off alongside the Treasury yields on Tuesday, therefore, helped the USD-priced bullion extend its recovery momentum above the $1700 threshold. Gold’s fate now hinges on the upcoming US employment data, which will provide more clarity on the size of the November Fed rate hike. According to the CME Group’s FedWatch Tool, markets are pricing a 62% chance of a 75 bps lift-off by the Fed next month, up from roughly 50% seen a day ago.

Also read: Chart of the day: Gold

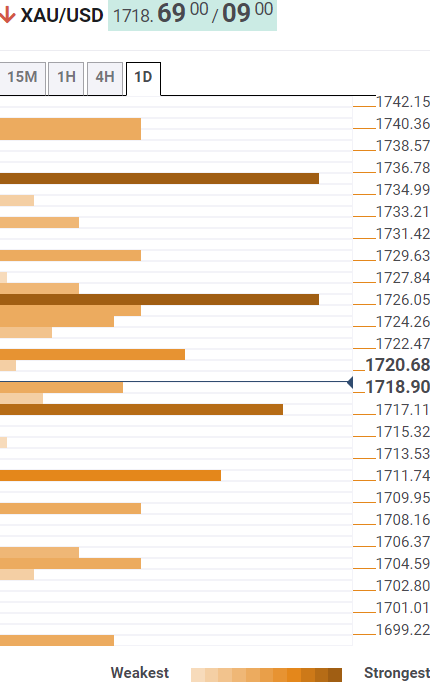

Gold Price: Key levels to watch

The Technical Confluence Detector shows that the gold price is closing in on the Fibonacci 38.2% one-day support at $1,717, below which a fresh drop towards the pivot point one-week R2 at $1,711 will be in the offing.

The next stop for sellers is seen at the Fibonacci 61.8% one-day at $1,709 while the confluence of the SMA10 four-hour and pivot point one-day S1 at $1,705 will offer a strong cushion to buyers.

On the flip side, the immediate resistance is aligned at $1,721, the Fibonacci 23.6% one-day, above which the next powerful barrier around $1,726 will get retested. That level is the confluence of the pivot point one-month R1 and SMA50 one-day.

The previous day’s high of $1,730 will be on the buyers’ radars if the upswing gathers steam. The previous month’s high of $1,735 will be irresistible for gold optimists.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds above 1.0450 German sentiment data

EUR/USD stays in positive territory above 1.0450 after retracing a portion of its bullish opening gap. The data from Germany showed that the IFO - Current Assessment Index declined to 84.3 in November from 85.7, while the Expectations Index edged lower to 87.2 from 87.3.

GBP/USD pulls back toward 1.2550 as US Dollar sell-off pauses

GBP/USD is falling back toward 1.2550 in the European session on Monday after opening with a bullish gap at the start of a new week. A pause in the US Dollar decline alongside the US Treasury bond yields weighs down on the pair. Speeches from BoE policymakers are eyed.

Gold price manages to hold above $2,650 amid sliding US bond yields

Gold price maintains its heavily offered tone through the early European session on Monday, albeit manages to hold above the $2,650 level and defend the 100-period Simple Moving Average (SMA) on the 4-hour chart. Scott Bessent's nomination as US Treasury Secretary clears a major point of uncertainty for markets.

Bitcoin consolidates after a new all-time high of $99,500

Bitcoin remains strong above $97,700 after reaching a record high of $99,588. At the same time, Ethereum edges closer to breaking its weekly resistance, signaling potential gains. Ripple holds steady at a critical support level, hinting at continued upward momentum.

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.