- Gold price cheers renewed USD selling on weaker Treasury yields and upbeat mood.

- Hawkish Fedspeak and strong US data jack up a 75 bps Sept Fed rate hike bets.

- Path of least resistance appears up for XAU/USD, with eyes on BOE, US jobs.

Gold price is trading on the front foot, awaiting a sustained move towards the $1,790-$1,792 supply zone. Strong US corporate earnings and economic data combined with the Chinese tech gains have lifted the overall market mood, despite ongoing China’s military threats against Taiwan. The greenback takes a back seat alongside the Treasury yields amid the market optimism, underpinning the USD-priced yellow metal. The further upside in XAU/USD hinges on the Fed rate hike expectations, with the chance for a 75 bps lift-off in September having increased to 42% after the recent hawkish comments from the Fed policymakers. Next of relevance for gold traders remain the US employment data, which could hint at a probable recession. The BOE monetary policy decision will be also closely followed for fresh trading direction in the non-interest-bearing bullion.

Also read: Gold Price Forecast: XAU/USD looks north towards 1,790, focus on BOE, yields

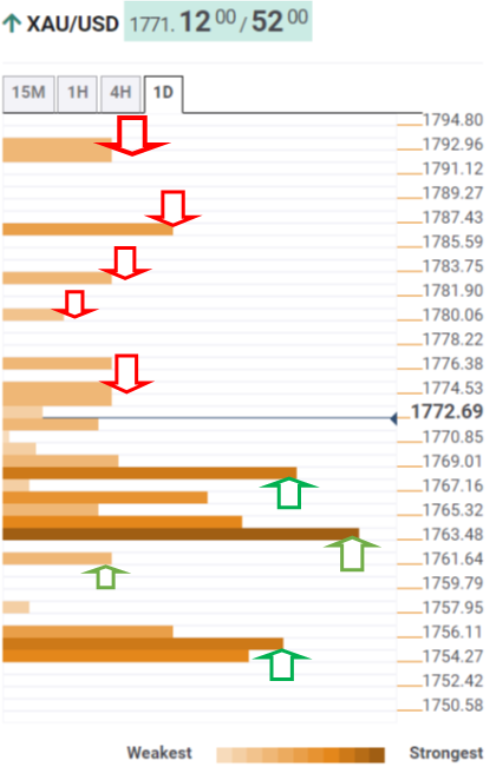

Gold Price: Key levels to watch

The Technical Confluence Detector shows that the gold price is heading into the pivot point one-day R1 resistance at $1,773, where the previous day’s high meets.

The next upside barrier is aligned at the Bollinger Band four-hour Upper at $1,780, above which the pivot point one-day R2 at $1,783 will be tested.

Bulls will then aim to take out $1,786, the pivot point one-week R1, on its way to $1,792. At that level, the SMA50 one-day and pivot point one-day R3 coincide.

On the downside, strong support is seen at the confluence of the previous week’s high and Fibonacci 23.6% one-day at $1,768.

Sellers are likely to challenge a dense cluster of support levels around $1,764, which is the intersection of the SMA5 one-day, Fibonacci 61.8% one-month and the previous low four-hour.

The next relevant support awaits at the Fibonacci 61.8% one-day at $1,761. The line in the sand for XAU bulls is $1,755, the convergence of the previous day’s low, Fibonacci 23.6% one-week and pivot point one-day S1.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD hovers above 1.0500 amid French political jitters

EUR/USD is trading modestly flat above 1.0500 in the early European morning on Wednesday. The pair gyrates in a familiar range amid a broadly stable US Dollar and French political uncertainty, as the government faces a no-confidence vote in a busy day ahead.

GBP/USD clings to gains below 1.2700 ahead of Bailey's speech

GBP/USD is consolidating gains below 1.2700 in early European trading on Wednesday. Traders refrain from placing fresh bets ahead of speeches from BoE Governor Bailey and Fed Chair Powell later in the day. US ADP Jobs and ISM Services PMI data are also awaited.

Gold price slides below $2,640, fresh daily low ahead of Fed Chair Powell's speech

Gold price attracts some sellers following an intraday uptick to the $2,650 supply zone and hits a fresh daily low during the first half of the European session on Wednesday. The precious metal, however, remains confined in a familiar range held over the past week or so as traders seem reluctant to place aggressive directional bets ahead of Fed Chair Jerome Powell's speech.

ADP report expected to show US private sector job growth cooled in November

The ADP Employment Change report is seen showing a deceleration of job creation in the US private sector in November. The ADP report could anticipate the more relevant Nonfarm Payrolls report on Friday.

The fall of Barnier’s government would be bad news for the French economy

This French political stand-off is just one more negative for the euro. With the eurozone economy facing the threat of tariffs in 2025 and the region lacking any prospect of cohesive fiscal support, the potential fall of the French government merely adds to views that the ECB will have to do the heavy lifting in 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.