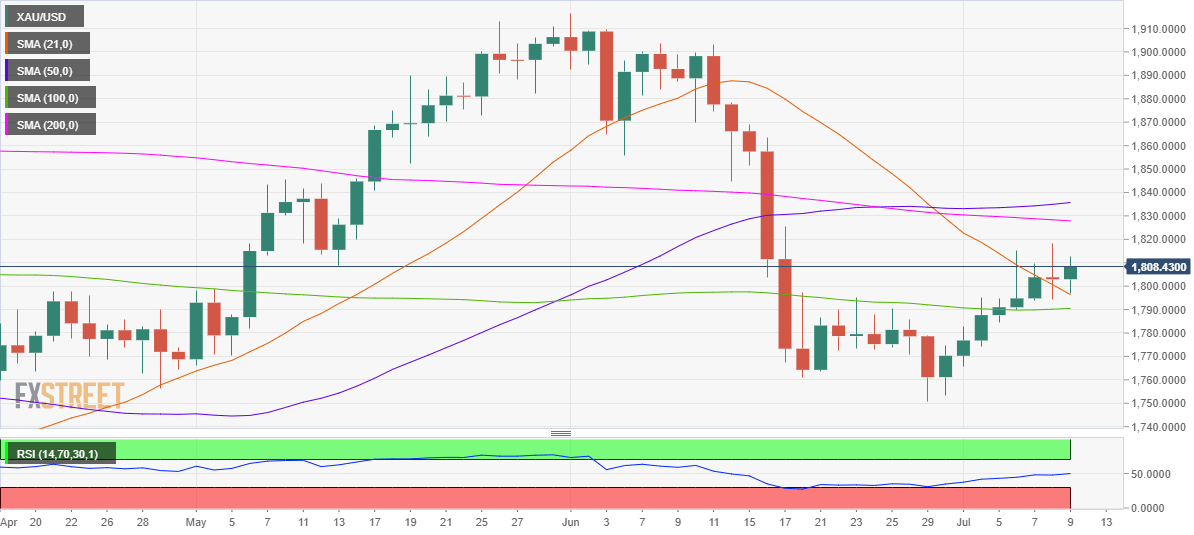

Gold Price Forecast: XAU/USD eyes 200-DMA amid acceptance above 21-DMA

- Gold price books third straight weekly gain, 200-DMA remains in sight.

- Daily closing above 21-DMA reignites bullish interest, as RSI recovers to 50.00.

- Gold Price Weekly Forecast: XAU/USD bulls bet on Golden Cross pattern, uptrend support, lower yields.

Thursday’s Doji candlestick doesn’t seem to have discouraged the bulls, as gold price staged an impressive bounce on Friday, although remained within the recent trading range.

Gold price rallied as high as $1812 before reversing into the weekly closing, settling the week at $1808.

Gold bulls managed to defend the critical short-term 21-Daily Moving Average (DMA) at $1796 and a daily closing yielded above the same, opens doors for the further upside next week.

The 14-day Relative Strength Index (RSI) has also steadily advanced to the central line, suggesting that the tide may have turned in favor of the bulls.

Therefore, gold buyers keep their sight on the horizontal 200-DMA, aligned at $1828.

Ahead of that, the past week’s high at $1818 could probe the bullish commitments.

Gold Price Chart: Daily

On the flip side, 21-DMA could limit any retracements from higher levels, below which the horizontal 100-DMA support at $1790 is likely to be tested.

A sustained break below the latter could revive the downtrend towards the two-month troughs of $1751.

Gold: Additional levels to watch

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.