Gold price forecast: XAU/USD extends correction to near $1,720 as DXY rebounds, Fed policy eyed

- Gold price has extended its corrective move to near $1,720.00 ahead of Fed policy.

- The resurgence of recession fears will keep the DXY on the back foot broadly.

- A symmetrical triangle formation is indicating a consolidation ahead.

Gold price (XAU/USD) has shifted into a corrective phase after facing barricades at around $1,728.00 in the Asian session. The precious metal has surrendered the majority of its gains and is likely to remain lackluster as investors are getting anxious ahead of the monetary policy announcement by the Federal Reserve (Fed). The bright metal may display more losses if it drops below Monday’s low at $1,714.80.

A rate hike by the Fed with 75 basis points (bps) looks imminent as price pressures have climbed to 9.1% and are hurting the paychecks of the households badly. This time, the gold prices won’t find significant offers after the rate hike announcement as market participants were betting over a rate hike by 100 bps but the downbeat US economic data trimmed Fed’s ambitious mood.

Initial jobless benefits have reached to seven-month high at 250k and the S&P PMI remained downbeat last week. Now, lower consensus for US Durable Goods Orders is indicating that higher interest rates have started displaying their consequences. This may keep the US dollar index (DXY) on the backfoot on a broader basis. While, on an intraday basis, a firmer rebound in the DXY has dragged the gold prices.

Gold technical analysis

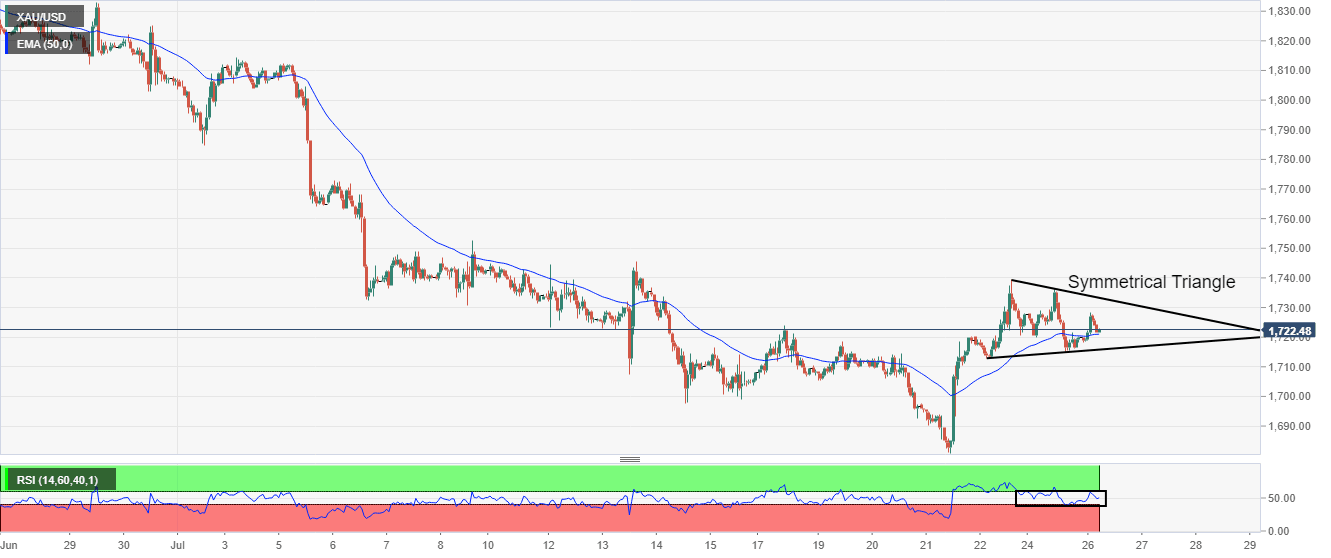

On an hourly scale, the gold price is auctioning in a symmetrical triangle pattern. The upward and downward-sloping trendline of the volatility contraction pattern is placed from July 22 low and high at $1,712.94 and $1,739.37 respectively. The above-mentioned chart pattern indicates a volatility squeeze, which will be followed by an expansion in volumes and candlesticks’ range.

The gold prices are overlapping with the 50-period Exponential Moving Average (EMA) at $1,721.40, which signals a consolidation ahead.

Also, the Relative Strength Index (RSI) (14) has shifted into a 40.00-60.00 range, which signals that the asset is awaiting potential a trigger for a decisive move.

Gold hourly chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.