Gold Price Forecast: XAU/USD drifts below $1,800 on growth concerns ahead of FOMC Minutes

- Gold price consolidates the biggest daily fall in a month amid market’s inaction.

- Economic slowdown fears surrounding the US, Europe and China challenge buyers.

- Sluggish yields, lack of market activity ahead of the key Fed Minutes restrict XAU/USD moves.

Gold price (XAU/USD) pares the recent losses at around $1,780 as a sluggish session allows sellers to consolidate downside moves during Tuesday morning in Europe. Even so, market’s fears relating to the economic conditions in the US, Europe and China seem to keep the commodity buyers hopeful.

Softer prints of the US and China data, as well as downbeat Treasury yields, also portray the economic fears, not to forget the Sino-American tussles. On the same line was the German economic crisis. Europe works on a nuclear deal with Iran to battle the energy crisis at home. However, Tehran’s response appears not so positive as Tehran's "additional views and considerations" to the EU text would be conveyed later, per Reuters. It’s worth noting that German Economy Minister Robert Habeck said on Monday, as reported by Reuters, “Germany's Russia-dependent energy model has failed and isn't coming back."

On the same line could be the geopolitical tussles relating to China. Xinhua reported that China imposes sanctions on a number of Taiwan separatists. Previously, the visit of multiple US lawmakers to Taiwan irritated Beijing, which in turn led to fierce military drills near the Taiwan border and an escalation of the geopolitical risks.

Elsewhere, US NY Empire State Manufacturing Index for August dropped to -31.3 from 11.1 in July and 8.5 in market forecasts. Further, the US August NAHB homebuilder confidence index also fell to 49 versus 55, its lowest level since the initial months of 2020. On the other hand, China released downbeat Retail Sales and Industrial Production data for July while also conveying a rate cut from the People’s Bank of China (PBOC). However, market chatters that China’s efforts aren’t enough to restore the market’s sentiment appear to exert additional downside pressure on the XAU/USD prices.

Against this backdrop, the US 10-year Treasury yields snap a two-day downtrend around 2.78% but stays sluggish of late. Further, the S&P 500 Futures decline 0.10% intraday at the latest.

Looking forward, today’s German ZEW Economic Sentiment data for August will precede the US Building Permits, Housing Starts and Industrial Production numbers for July for fresh impulse. Above all, Fed Minutes will be crucial amid indecision over the US central bank’s next move.

Technical analysis

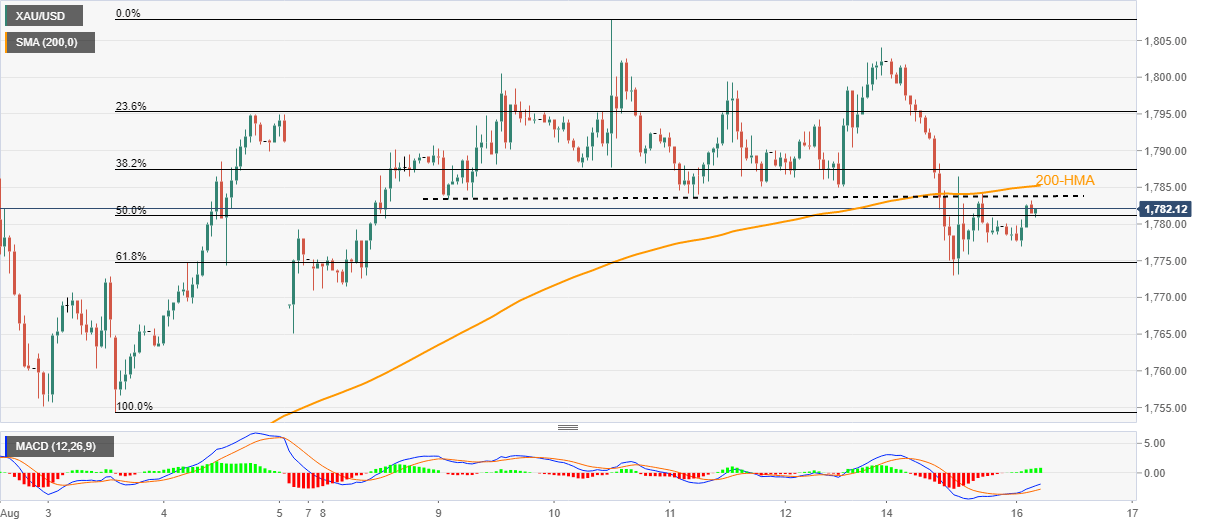

Gold price portrays a corrective pullback from the 61.8% Fibonacci retracement (Fibo.) of August 03-10 upside amid recently firmer MACD.

However, the recovery moves need validation from the previous support line from August 09 and the 200-HMA, respectively around $1,783 and $1,785, to recall XAU/USD bulls.

Even so, the $1,800 threshold and the monthly peak surrounding $1,808 could challenge the metal’s further upside.

Alternatively, a downside break of the 61.8% Fibo. level of $1,775 cold quickly fetches the quote towards the monthly low near $1,754.

It’s worth noting, however, that there are multiple supports to challenge gold bears around $1,740 and the $1,700 round figure to watch past $1,754.

Gold: Hourly chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.