Gold Price Forecast: XAU/USD stays below $1,985 hurdle ahead of pivotal Fed decision – Confluence Detector

- Gold Price fades bounce off one-week low amid market’s pre-Fed anxiety, China concerns.

- China-inspired optimism also dims as fears of Sino-US tussle reignite.

- Mixed data underpins dovish bias for US central bank but FOMC has always been a fighter.

- Fed Chair Powell’s speech can fuel Gold price on confirming policy pivot chatters.

Gold Price (XAU/USD) clings to mild losses as it fails to defend the previous day’s corrective bounce off the lowest level in a week amid a cautious mood on the Federal Reserve (Fed) monetary policy day announcement day. Apart from the pre-Fed caution, headlines suggesting fresh tensions between the US and China, mainly due to the looming trade and technology restrictions from Washington, also seem to exert downside pressure on the XAU/USD price.

It’s worth noting that the latest US data has been comparatively better and hence prods the Gold buyers even if expectations of China stimulus and concerns about witnessing a sooner end to the higher rates at top-tier central banks put a floor under the XAU/USD price. Elsewhere, lackluster US Treasury bond yields and receding optimism of the equity buyers also challenge the Gold Price upside of late.

Moving on, Gold traders should pay attention to the Federal Open Market Committee (FOMC) monetary policy meeting announcements for clear directions. More importantly, comments from Fed Chair Jerome Powell will be crucial to watch as the policymaker isn’t known to favor the dovish moves while the markets have already priced in 25 basis points (bps) of rate hike.

Also read: Gold Price Forecast: XAU/USD reclaims 100 DMA, further upside hinges on Fed Chair Powell

Gold Price: Key levels to watch

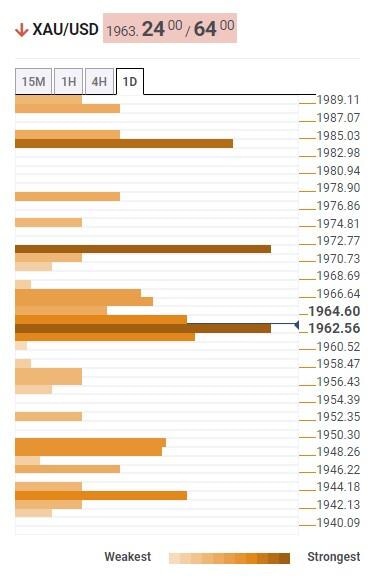

As per our Technical Confluence indicator, Gold Price prods the $1,962 support comprising the 100-DMA and a convergence of the Fibonacci 61.8% on one-week and 23.6% on one-day.

It’s worth noting that a clear break of the $1,962 support can quickly fetch the quote towards the $1,950 support encompassing the lower band of the Bollinger on the four-hour, Fibonacci 61.8% on one-month and Pivot Point one-day S1.

However, the Fibonacci 161.8% on one-day joins the convergence of the Pivot Point one-day S1 and one-week S3 to highlight $1,944 as the additional downside filter for the Gold Price after $1,950.

On the contrary, the $1,973 resistance confluence including Fibonacci 38.2% on one-week and Pivot Point one-month R1 will challenge the Gold buyers during the fresh run-up.

Following that, the previous monthly high and a joint of the Pivot Point one-day R3 and one-week R1 will challenge the XAU/USD bulls before directing them to the $2,000 psychological magnet.

Overall, the Gold Price remains on the bear’s radar unless staying below $1,985.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.