- Gold extends Wednesday’s rebound with a slower pace.

- DXY ignores firmer Treasury yields, tapering concerns as US CPI confirms “transitory” outlook.

- Vaccine/virus updates, US PPI eyed for fresh impulse, bulls stay hopeful.

- Gold Weekly Forecast: Eyes $1,750 on NFP-inspired USD strength

Update: Gold added to the previous day's strong move up – marking the biggest one-day percentage gain since May 6 – and edged higher for the second consecutive session on Thursday. The XAU/USD held on to its modest gains through the early European session and was last seen hovering near three-day tops, just above the $1,755 level. Signs of moderating inflationary pressure in the US eased fears about an early withdrawal of the stimulus by the Fed. This was reinforced by some follow-through pullback in the US Treasury bond yields, which extended some support to the non-yielding yellow metal.

That said, the Fed officials have started to guide the market towards early tapering and higher interest rates as soon as 2022. This was seen as a key factor that helped limit the US dollar profit-taking slide and might act as a tailwind for the precious metal. A stronger USD tends to undermine demand for dollar-denominated commodities, including gold, warranting some caution for aggressive bullish traders. Nevertheless, the intraday uptick assisted the XAU/USD to move further away from the early week flash crash to the $1,688 region, back closer to YTD lows touched in March.

Market participants now look forward to the US economic docket, featuring the releases of the Producer Price Index and the usual Initial Weekly Jobless Claims for a fresh impetus. This, along with US bond yields and the broader market risk sentiment, might further contribute to producing some meaningful trading opportunities around gold.

Previou update: Gold (XAU/USD) struggles to extend the previous day’s recovery moves, the biggest run-up since early May, taking rounds to $1,750 ahead of Thursday’s European session. Gold prices seesaw in a choppy range as bulls seek fresh clues to copy the previous day’s heavy rise.

Also challenging the metal’s rise could be the latest chatters surrounding Fed tapering and rate hikes. Recently, Federal Reserve Bank of San Francisco President Mary C. Daly said, per the Financial Times, “Tapering of asset purchases could start as soon as this year.”

Kansas City Fed President Esther George teased early tapering the previous day while also citing a long way for the monetary policy adjustments. On the same line were Dallas Fed President Robert Kaplan and Richmond Fed President Thomas Barkin.

Additionally, a battle between the covid woes and the vaccine drive also confuses gold traders. While the virus infections are recently on the rise, the NBC news said that the US Food & Drug Administration (FDA) braces for the third vaccine dose for immunocompromised people.

It should be noted that the US Dollar Index (DXY) remains on the back foot after easing from the highest since April on Wednesday, down 0.02% intraday near 92.88. The greenback’s sluggish moves could be linked to the subdued S&P 500 Futures but not the US 10-year Treasury yields that stay firmer to regain 1.35% level by the press time.

Looking forward, gold traders will look for more optimism and further USD weakness to keep the recovery moves on the table. Also important will be the US Producer Price Index (PPI) data for July, market consensus backs no change in 5.6% YoY figures, as well as the weekly readings of the US Jobless Claims, likely to ease from 385K to 375K.

Technical analysis

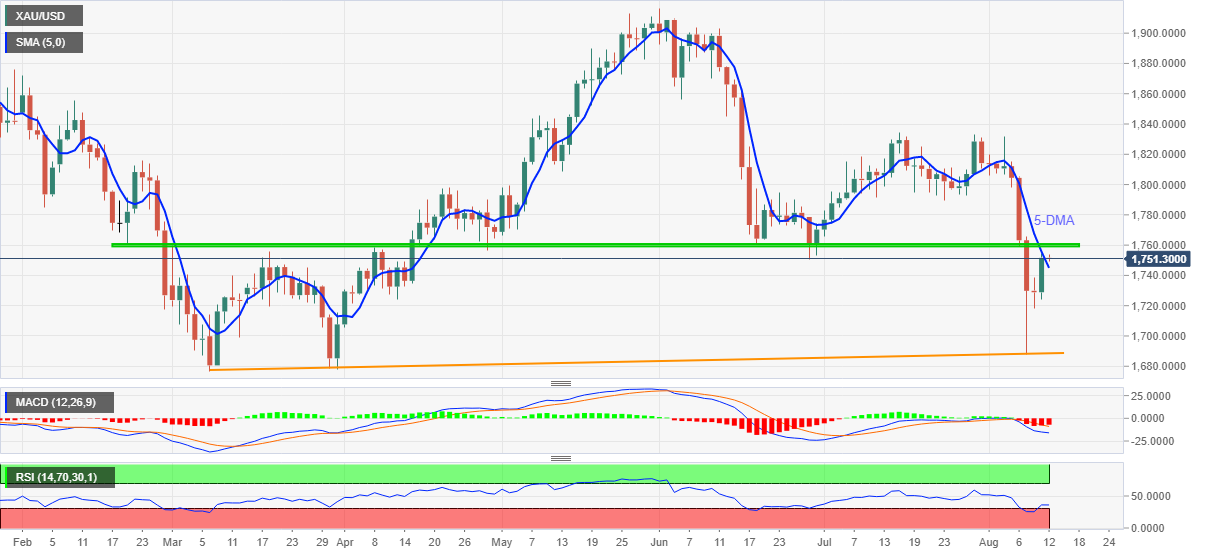

Gold trades above 5-DMA for the first time in August, backed by RSI recovery from the oversold region, which in turn suggests further recovery towards a six-month-old horizontal hurdle surrounding $1,760.

However, any further upside may linger as MACD flashes bearish signals and hence need a strong push to the north.

Meanwhile, a downside break of $1,745, comprising the stated DMA, will find multiple supports near $1,720 and the $1,700 round figure.

In a case where gold bears remain dominant past $1,700, an ascending trend line from early March and the yearly bottom, respectively around $1,688 and $1,676, will be in focus.

Gold: Daily chart

Trend: Further recovery expected

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD stays firm near 0.6300 amid modest risk appetite

AUD/USD is posting small gains near 0.6300 in early Asian trades on Monday, opening the week on the front foot. Risk sentiment remains in a sweeter spot following the weekend's news of lower US tariffs on Chinese electronic supply chain. Tariffs talks will remain on the radar.

USD/JPY faces intense supply, falls back to 142.50

USD/JPY has erased early gains to trade deep in the red near 142.50 in Monday's Asian trading. The US Dollar resumes its downside toward multi-year troughs, digesting Trump's tariff news from the weekend. The Fed-BoJ policy divergence expectations underpin the Japanese Yen, weighing on the pair.

Gold retreats from record highs of $3,245 as US Dollar finds its feet

Gold is rereating from record highs of $3,245 early Monday, extending Friday's late pullback. Reducded demand for safe-havens and a broad US Dollar rebound undermine the yellow metal amid the news of not-so-steep US tariffs on China's semiconductors and electronics.

Week ahead: ECB set to cut, BoC might pause as Trump U-turns on tariffs

ECB is expected to trim rates, but the BoC might pause this time. CPI data also in the spotlight; due in UK, Canada, New Zealand and Japan. Retail sales the main release in the United States. China GDP eyed as Beijing not spared by Trump.

Is a recession looming?

Wall Street skyrockets after Trump announces tariff delay. But gains remain limited as Trade War with China continues. Recession odds have eased, but investors remain fearful. The worst may not be over, deeper market wounds still possible.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.