- Gold price is expected to continue its downside journey toward $1,920.00 amid a solid USD Index.

- The Fed is expected to announce a smaller interest rate hike as US inflation is in a downtrend.

- The US labor market has remained extremely tight in CY2022 but the continuation of rate hikes is denting producers’ optimism.

Gold price (XAU/USD) is scaling downside towards the immediate support of $1,920.00 in the Asian session. The precious metal has been displaying a topsy-turvy move amid rising traction for the US Dollar Index (DXY) ahead of the interest rate decision by the Federal Reserve (Fed), which is scheduled for Wednesday. The Gold price is auctioning in a $1,922-1,933 range and is expected to remain on tenterhooks ahead.

S&P500 futures have added some gains after a sheer sell-off on Monday, portraying that optimism is stemming as the Fed is expected to slow down the pace of hiking interest rates. The USD Index is looking to extend its breakout above the 101.80 resistance to near 102.00 amid overall pessimism in the market. Also, the risk-aversion theme underpinned by the market participants is supporting the 10-year US Treasury yields, which have shifted above 3.54%.

In addition to the Fed’s interest rate policy, the release of the United States Automatic Data Processing (ADP) Employment data will keep volatility at its peak. According to the estimates, the economic data is seen at 170K, lower than the former release of 235K.

The US labor market has remained extremely tight in CY2022 but the continuation of interest rate hikes by Fed chair Jerome Powell is denting the expression of optimism in producers. Firms are aiming to optimally use their current labor force to handle operations and have paused the recruitment process due to the dismal economic outlook.

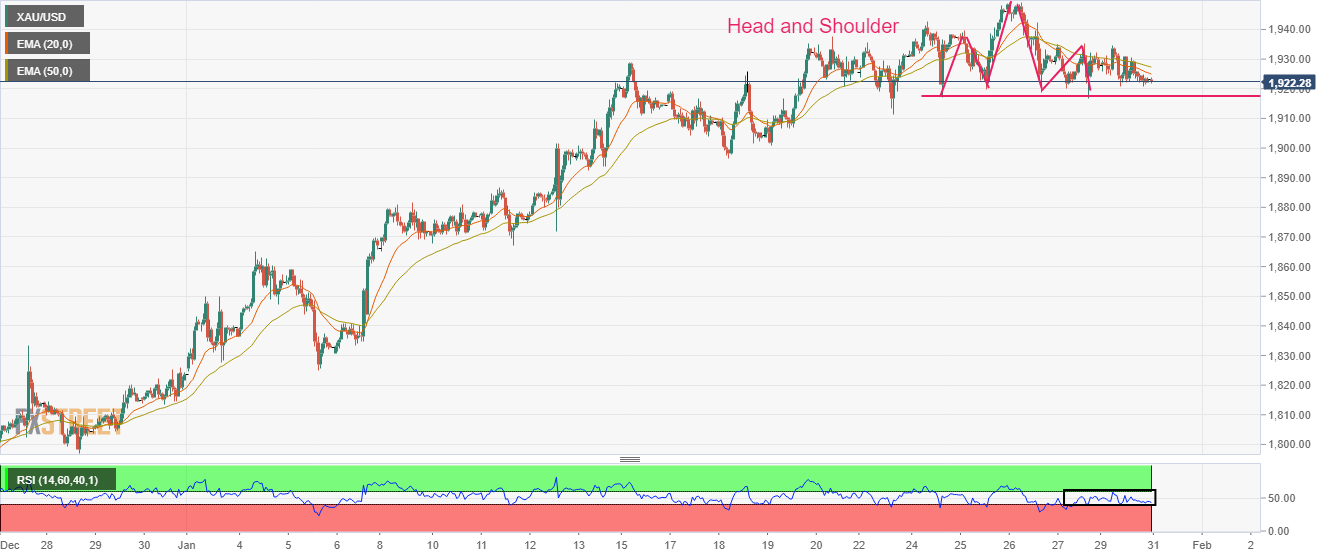

Gold technical analysis

Gold price has formed a Head and Shoulder chart pattern on an hourly scale, which indicates a prolonged consolidation. The precious metal might demonstrate a bearish reversal after a breakdown below the neckline plotted from January 24 low at $1,917.20.

A bear cross, represented by the 20-and 50-period Exponential Moving Average (EMAs), adds to the downside filters.

The Relative Strength Index (RSI) (14) has yet not surrendered the 40.00-60.00 range. A breakdown into the 20.00-40.00 range will trigger the downside momentum.

Gold hourly chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds on to intraday gains after upbeat US data

EUR/USD remains in positive ground on Friday, as profit-taking hit the US Dollar ahead of the weekend. Still, Powell's hawkish shift and upbeat United States data keeps the Greenback on the bullish path.

GBP/USD pressured near weekly lows

GBP/USD failed to retain UK data-inspired gains and trades near its weekly low of 1.2629 heading into the weekend. The US Dollar resumes its advance after correcting extreme overbought conditions against major rivals.

Gold stabilizes after bouncing off 100-day moving average

Gold trades little changed on Friday, holding steady in the $2,560s after making a slight recovery from the two-month lows reached on the previous day. A stronger US Dollar continues to put pressure on Gold since it is mainly priced and traded in the US currency.

Bitcoin to 100k or pullback to 78k?

Bitcoin and Ethereum showed a modest recovery on Friday following Thursday's downturn, yet momentum indicators suggest continuing the decline as signs of bull exhaustion emerge. Ripple is approaching a key resistance level, with a potential rejection likely leading to a decline ahead.

Week ahead: Preliminary November PMIs to catch the market’s attention

With the dust from the US elections slowly settling down, the week is about to reach its end and we have a look at what next week’s calendar has in store for the markets. On the monetary front, a number of policymakers from various central banks are scheduled to speak.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.