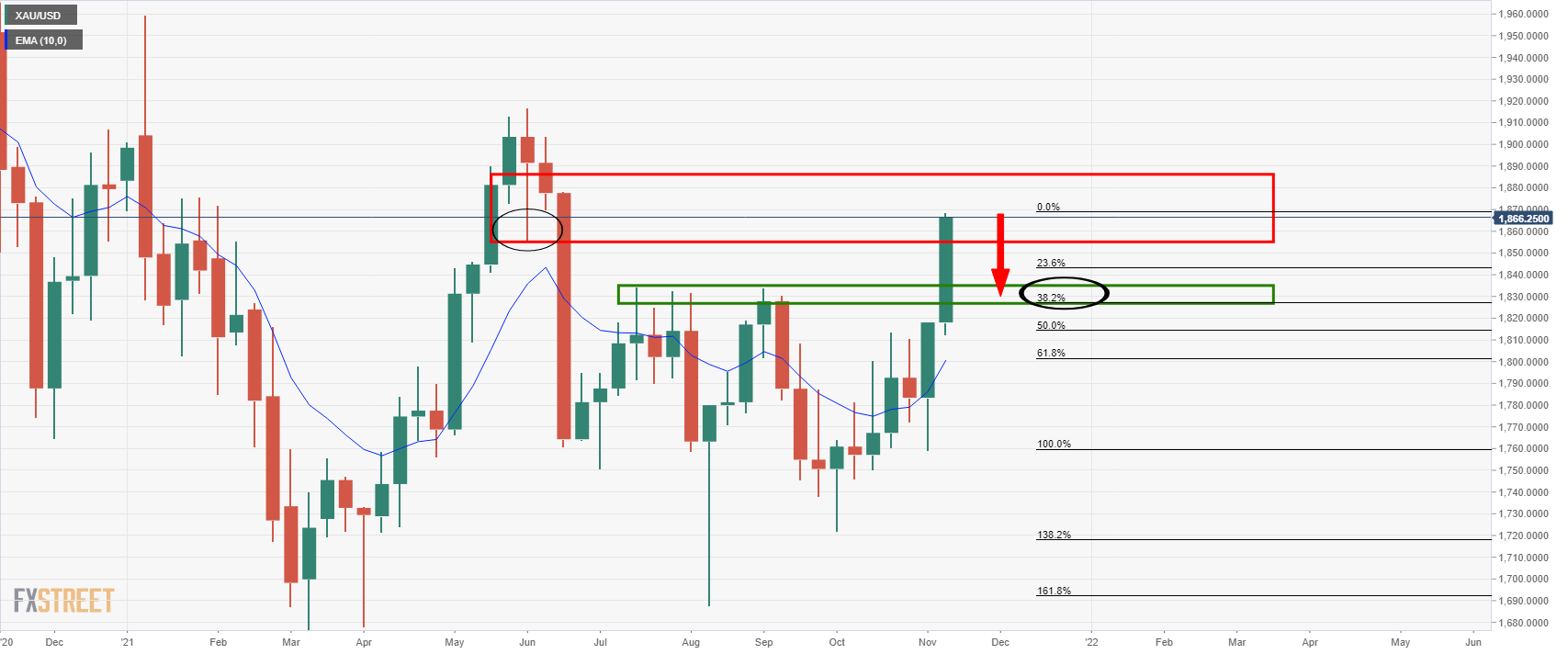

- Gold is on the verge of a 38.2% Fibonacci correction to test prior daily highs.

- The US dollar is on fire as US data impress and Fed rate hike expectations resurface.

Update: Gold (XAU/USD) treads water around $1,850 amid Wednesday’s Asian session. The yellow metal marked heavy volatility the previous day as it initially refreshed a five-month high before posting the heaviest daily fall since November 3.

That said, the early Tuesday’s run-up could be linked to the Fedspeak trying to tame the reflation fears and the start of the virtual meeting between US President Joe Biden and his Chinese counterpart Xi Jinping.

However, strong US Retail Sales, Industrial Production and housing market data joined hawkish comments from St. Louis Fed President James Bullard, ex-US Treasury Secretary and former New York Fed President, Lawrence Summers and Bill Dudley respectively, to weigh on the gold price.

On the contrary, San Francisco Federal Reserve Bank President Mary Daly’s attempts to placate bond bears seem to offer the latest pause in the downtrend.

It’s worth noting that the Fedspeak will be the key for gold traders to watch going forward amid a light calendar day.

End of update.

The price of gold sank by over 0.6% on Tuesday and printed a low of $1,849.77, following a big move in the US dollar. XAU/USD fell from a high of $1,877.14 after the greenback rallied to the highest levels since June 2020, reaching as high as 95.899.

The US dollar rallied to a fresh 16-month high as US yields took off on the back of impressive data and hawkish Federal Reserve speakers. US data showed US consumers looked past rising prices and drove Retail Sales higher than expected last month. US Retail Sales rose 1.7% in October, topping consensus expectations of a 1.4% rise.

The US dollar has been better bid ever since US inflation data last week surprised to the upside and showed consumer prices surged to their highest rate since 1990. Investors expects that the Federal Reserve will taper their QE programme at a faster pace. More hawkishly, some observers even expect that the Fed could potentially hike interest rates sooner than first anticipated.

Fed speakers spur on the USD bulls

Also spurring up-the US dollar bulls was the well-known hawk, St. Louis Federal Reserve bank president James Bullard. "If inflation happens to go away we are in great shape for that. If inflation doesn't go away as quickly as many are currently anticipating it is going to be up to the (Federal Open Market Committee) to keep inflation under control," Bullard said on Bloomberg Television.

"The inflation rate is quite high," Bullard said. "It behooves the committee to tack in a more hawkish direction in the next couple of meetings so that we are managing the risk of inflation appropriately."

He also said that the Fed could also play up the idea that it does not have to wait to end the taper in order to raise rates.

This follows previous comments from Bill Dudley – former New York Fed President – who said: “they’re going to have to get the taper done quicker”. The Fed has already said it could change the pace of tapering if warranted and thus far the inflation data supports the need to slow stimulus.

US stocks cheer positive data

Meanwhile, US stocks were boosted by the strong Retail Sales data, also alongside strong manufacturing and home-build data. However, US equity markets took little notice of comments from Federal Reserve members that monetary stimulus should be curbed more quickly to combat inflation. The S&P 500 lifted 0.6% into the close on Wall Street.

Overall, it was a setback for the price of gold despite the prospects of higher inflation and lower real US yields. Analysts at TD Securities' have forecasted slowing growth and inflation next year and that to them suggests that market pricing remains far too hawkish. However, they note that gold prices have managed to break out nonetheless as global markets scour for inflation hedges. This leaves a bullish bias on the fundamental side, but there could be a meanwhile correction left to play out still as follows:

Gold technical analysis

As per the prior analysis, Gold Price Forecast: Bulls could be throwing in the towel here, the price is correcting from a weekly resistance that was illustrated as follows:

The following is an update with the price action and market structure drawn on the daily chart in confluence with the above prior analysis:

The bears could be on the verge of a test of prior resistance structure in the $1,830s.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD recovers above 0.6250 amid China's stimulus-led optimism

AUD/USD is recovering ground above 0.6250 early Monday, moving away from multi-month lows of 0.6199 set last week. The pair finds support from renewed optimism linked to reports surrounding more Chinese stimulus even as the US Dollar rebounds at the start of the Christmas week.

USD/JPY: Buyers stay directed toward 157.00

USD/JPY holds firm above mid-156.00s at the start of a new week on Monday. Doubts over when the BoJ could hike rates again and a positive risk tone undermine the safe-haven Japanese Yen while the US Dollar regains its footing after Friday's profit-taking slide.

Gold downside bias remains intact while below $2,645

Gold price is looking to extend its recovery from monthly lows into a third day on Monday as buyers hold their grip above the $2,600 mark. However, the further upside appears elusive amid a broad US Dollar bounce and a pause in the decline of US Treasury bond yields.

The US Dollar ends the year on a strong note

The US Dollar ends the year on a strong note, hitting two-year highs at 108.45. The Fed expects a 50-point rate cut for the full year 2025 versus 4 cuts one quarter earlier, citing higher inflation forecasts and a stubbornly strong labour market.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.