Gold Price Forecast: XAU/USD clings to mild gains near $1,630 as DXY pares post-Fed gains ahead of US ISM PMI

- Gold price struggles to extend the corrective bounce off a fortnight-old support line.

- Off in Japan restrict bond moves, allowing DXY bulls to take a breather.

- Geopolitical, covid woes weigh on Asia equities, US stock futures print mild gains.

- US ISM Services PMI, NFP will be crucial for XAU/USD bears to retake control.

Gold price (XAU/USD) pares the biggest daily loss in a week around $1,638 during early Friday morning in Europe. In doing so, the bright metal cheers the US dollar’s weakness despite the risk-negative headlines. The metal’s latest rebound also pays little heed to inactive Treasury bond yields due to the holiday in Japan.

A pullback in the US Dollar Index (DXY) from a one-week high to 111.90, mainly tracing the US Treasury yields should have defended the XAU/USD buyers amid sluggish hours of Thursday. It should be noted that the US 10-year bond coupons eased to 4.096% while its two-year counterpart snaps a four-day uptrend as it drops to 4.611% at the latest.

Additionally, the Fed’s 75 bps rate hike and the language in the Rate Statement also tease DXY bears. That said, the Fed Rate Statement highlighted the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.

On the contrary, the escalating geopolitical tensions between North Korea and Japan join the risk-negative covid news from China to exert downside pressure on the sentiment. That said, North Korea’s firing of missiles and Japan’s warning to residents weigh on the market’s risk profile, which in turn weighs on the risk barometer pair. On the same line could be the coronavirus fears from China as the lockdown surrounding the area involving the world’s largest iPhone factory defied hopes of easing the dragon nation’s zero-covid policy. Additionally, Reuters quotes China’s latest National Health Commission figures to suggest an uptick in coronavirus cases. The news states, “China reported 3,372 new COVID-19 infections on Nov. 2, of which 581 were symptomatic and 2,791 were asymptomatic.”

It’s worth noting that Fed Chair Powell’s hawkish message appears the key negative catalyst for the XAU/USD prices.

Against this backdrop, the Asia-Pacific equities are down but the S&P 500 Futures print mild gains amid a lackluster session ahead of the European open.

Looking forward, the US ISM Services PMI bears the downbeat forecasts of 55.5 for October compared to 56.7 previous readings and appears important for gold traders. Following that, Friday’s US Nonfarm Payrolls (NFP) will be the key, mainly due to the strong ADP data.

Technical analysis

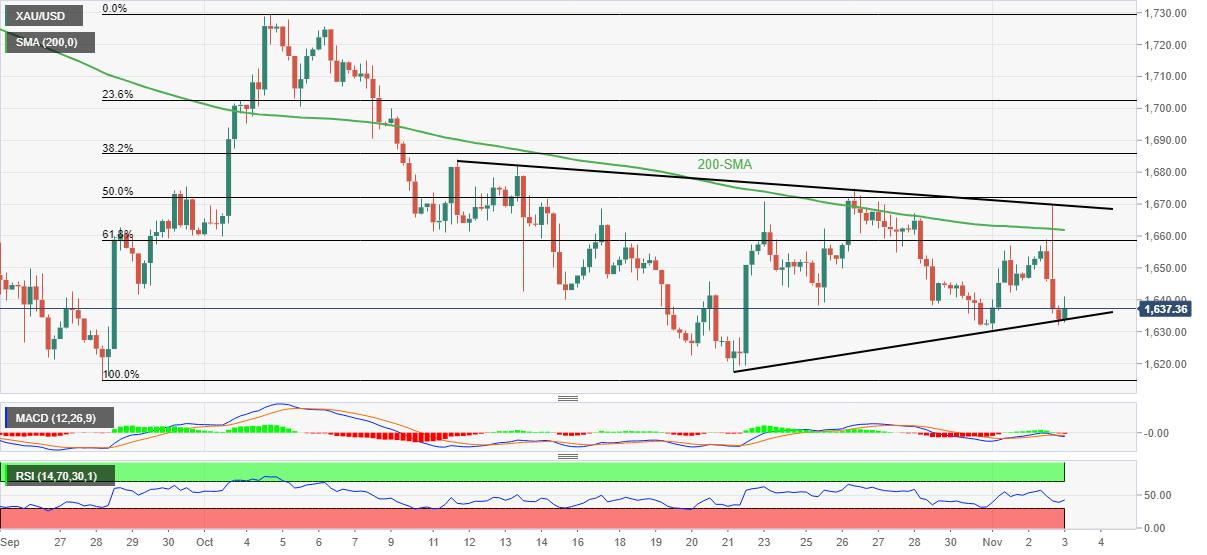

Gold price justifies the sluggish MACD and RSI (14) while flirting with the fortnight-old support line, around $1,633 by the press time.

The recovery moves, however, remain limited unless crossing a downward-sloping resistance line from October 11, close to $1,670 at the latest. That said, the 200-SMA level of $1,662 guards the quote’s immediate upside.

Alternatively, a clear downside break of the aforementioned support line figure of $1,633 could quickly drag the XAU/USD bears toward the previous monthly low near $1,617 ahead of highlighting the yearly bottom of $1,614 and the $1,600 threshold.

Overall, gold price remains on the bear’s radar even as sellers take a breather of late.

Gold: Four-hour chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.