- Gold price has faltered on its previous rebound as the US dollar makes a comeback.

- Cooling aggressive Fed rate hike calls, China concerns and dismal US tech earnings weigh on risk sentiment.

- XAU/USD sees range play amid battle lines well-defined ahead of critical US events.

Gold price is treading water in a familiar range around the $1,650 psychological level, lacking a follow-through upside bias amid a modest comeback staged by the US dollar across the board. The risk-off flows have returned to markets, as disappointing earnings from the US tech giants, Microsoft and Google, revived recession fears and revived the dollar’s safe-haven appeal. However, the risk-aversion-driven weakness in the Treasury yields combined with easing aggressive Fed rate hike expectations keep the downside cushioned in the bright metal. Investors also refrain from placing big bets on the bullion ahead of the critical event risks, including the ECB rate hike decision and the US advance Q3 GDP, scheduled later this week. The US corporate earnings reports and China’s covid updates will be closely followed for any impact on the risk sentiment, which will be pivotal for fresh dollar and gold valuations.

Also read: Markets steady as investors eye earnings and ECB

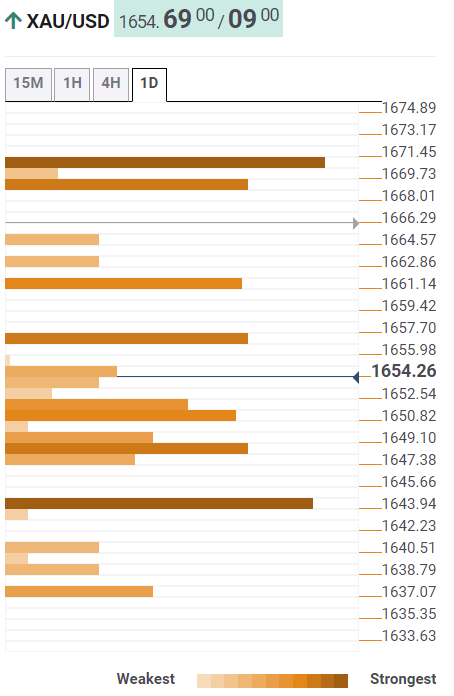

Gold Price: Key levels to watch

The Technical Confluence Detector shows that the gold price is flirting with a bunch of healthy support levels at around $1,650, the convergence of the SMA50 one-hour, SMA10 one-day and the previous low four-hour.

The next cushion is placed at $1,648, where the Fibonacci 61.8% one-day meets with the Fibonacci 38.2% one-week.

The last line of defense for XAU buyers is envisioned at $1,644, the intersection of the SMA5 one-day and Fibonacci 23.6% one-month.

Alternatively, gold price needs to clear the convergence of the Fibonacci 23.6% one-week and one-day at $1,657. A firm break above the latter will trigger a fresh upswing towards the Fibonacci 38.2% one-month at $1,660.

The previous day’s high at $1,662 will be next on buyers’ radars.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD appreciates as US Dollar remains subdued after a softer inflation report

The Australian Dollar steadies following two days of gains on Monday as the US Dollar remains subdued following the Personal Consumption Expenditures Price Index data from the United States released on Friday.

USD/JPY consolidates around 156.50 area; bullish bias remains

USD/JPY holds steady around the mid-156.00s at the start of a new week and for now, seems to have stalled a modest pullback from the 158.00 neighborhood, or over a five-month top touched on Friday. Doubts over when the BoJ could hike rates again and a positive risk tone undermine the safe-haven JPY.

Gold downside bias remains intact while below $2,645

Gold price is looking to extend its recovery from monthly lows into a third day on Monday as buyers hold their grip above the $2,600 mark. However, the further upside appears elusive amid a broad US Dollar bounce and a pause in the decline of US Treasury bond yields.

Week ahead: No festive cheer for the markets after hawkish Fed

US and Japanese data in focus as markets wind down for Christmas. Gold and stocks bruised by Fed, but can the US dollar extend its gains? Risk of volatility amid thin trading and Treasury auctions.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.