- Gold price meets major trendline support in blow-off move on Thursday.

- The Federal Reserve theme is alive and kicking, weighing on the Gold price.

- US Treasury yields and US Dollar benefitted from sold Weekly Jobless Claims.

The Gold price has dumped to a critical area on the daily charts, as shown below, losing some 1.5% on Thursday. The yellow metal is back below the psychological $1,800 area as the Gold price continues to face resistance in attempts to break out to the upside. Most prevalent in the fundamentals surrounding the Gold price has been the sentiment in markets for a hawkish Federal Reserve (Fed) in 2023.

US Treasury yields rally, weighing on Gold price

US Treasury yields are higher following the data on Thursday showed Weekly Jobless Claims in the US rose less than expected. The US 10-year Treasury yield is up 0.14% at the time of writing, but it rose to a high of 3.692% earlier in the day, bearish for the Gold price as the shiny metal offers no interest.

The US Dollar and Gold price took their cues when the Department of Labor said seasonally adjusted numbers of initial unemployment claims rose by 2,000 to 216,000 in the week ended Dec. 17. The consensus on Econoday was for a 225,000 print. The previous week's level was revised up by 3,000 to 214,000. The four-week moving average tallied 221,750, sliding by 6,250 from the previous week's revised average of 228,000. Unadjusted claims declined by 4,064 on a weekly basis to 247,867.

US Dollar in demand

The US Dollar was in demand following the numbers as these are the type of data that could keep the Federal Reserve (Fed) hawkish for longer. The Fed last week projected at least an additional 75 basis points of increases in borrowing costs by the end of 2023. DXY, an index that measures the US Dollar against a basket of currencies rallied into the 104.50s from a low of 103.75. The US Dollar, however, remains well below the highs for the month near 107.20 and the Gold price has been able to capitalize on the slide over recent weeks.

Meanwhile, analysts at Brown Brothers Harriman noted that the current consensus for Nonfarm Payrolls (NFP) stands at 208k vs. 263k in November, with the Unemployment Rate seen steady at 3.7% and average hourly earnings falling a tick to 5.0% YoY. ''While job growth is clearly slowing, it’s not by enough to materially impact unemployment and so we continue to believe that the Fed will have to do more than the market is expecting.''

Gold price technical analysis

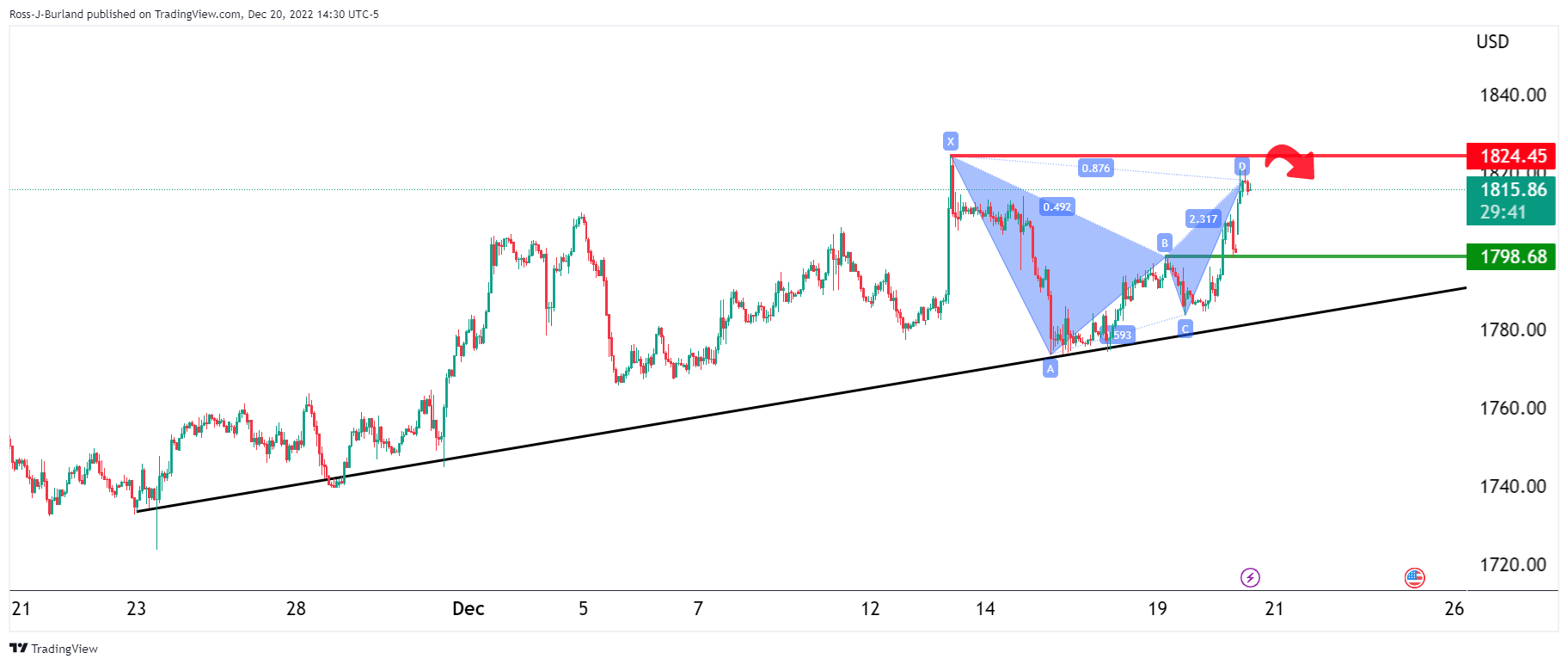

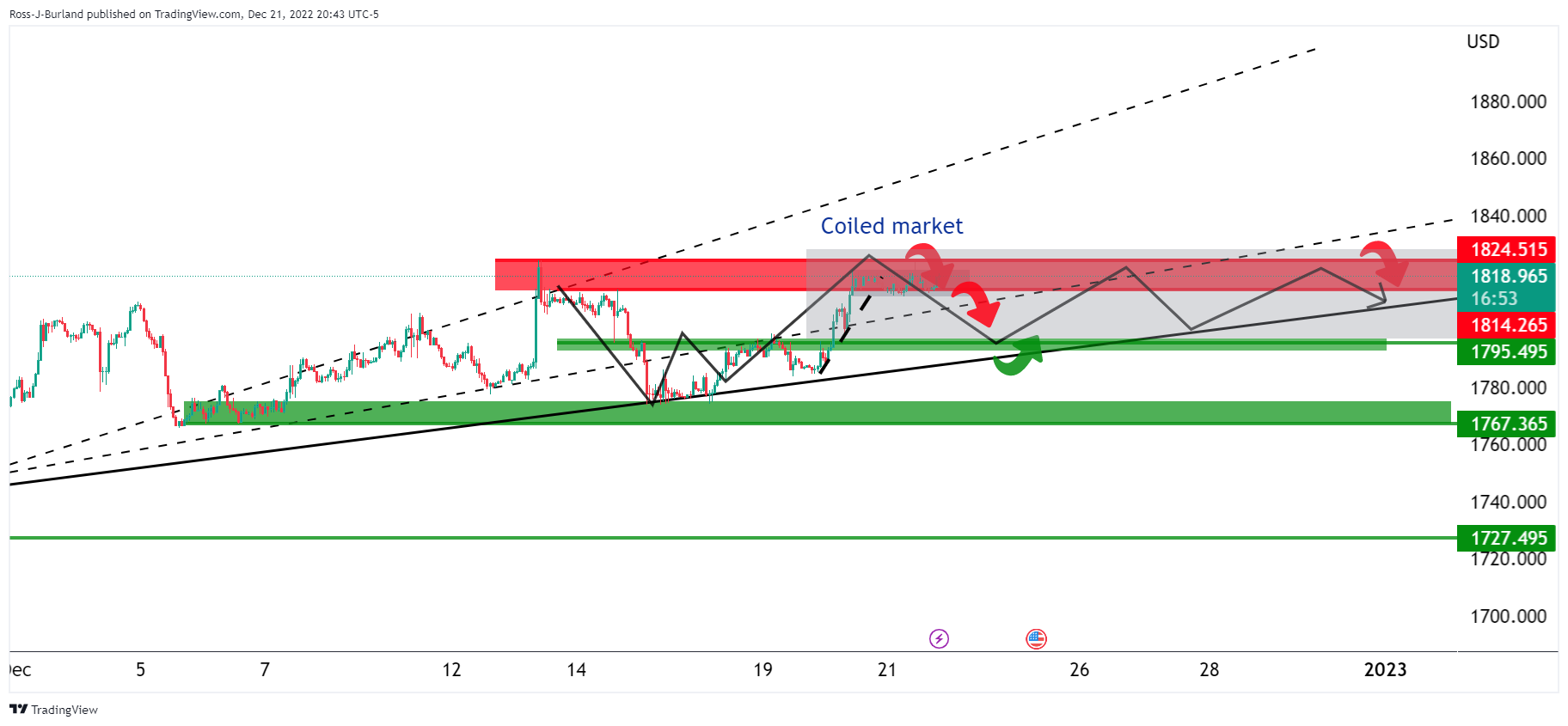

In a series of prior analyses, it was stated that the Gold price 1-hour picture was bearish while below the resistance near $1,825 and on the backside of the micro trendline and there are eyes on eyes on $1,795.

Gold price, prior analysis

The Gold price 1-hour picture is bearish while below the resistance near $1,825 but not until the Gold price moves to the backside of the micro trend line:

On the 15-minute chart for the Gold price, we drew the extensions to the downside based on the presumed sideways consolidation box that had been forming over the prior sessions/days.

Gold price, update

As illustrated, the Gold price dropped to the targetted area and exceeded it into the $1,784s for a 300% measured move and to where the prior micro trend started off at.

At this juncture, a correction in the Gold price would be expected, respecting the bullish trend:

Failing this, then an even deeper move in Gold price would be on the cards for the days ahead, making the case for a significant downside correction with $1,775 eyed.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD trades sideways slightly above 0.6200 as US PCE inflation takes centre stage

AUD/USD consolidates around 0.6200 as the US PCE inflation data for November is on the horizon.The Fed is expected to keep interest rates steady in the first policy meeting of 2025. Investors await the RBA minutes for fresh interest rate guidance.

EUR/USD: Sellers seeking for lower lows

The EUR/USD pair trades around 1.0360 in the mid-American session, retreating from an intraday peak of 1.0421. The US Dollar shed some ground throughout the first half of the day after reaching extreme overbought conditions following the Federal Reserve's monetary policy decision on Wednesday.

Gold: Is another record-setting year in the books in 2025?

Gold benefited from escalating geopolitical tensions and the global shift toward a looser monetary policy environment throughout 2024, setting a new all-time high at $2,790 and rising around 25% for the year.

Week ahead – No festive cheer for the markets after hawkish Fed

US and Japanese data in focus as markets wind down for Christmas. Gold and stocks bruised by Fed, but can the US dollar extend its gains? Risk of volatility amid thin trading and Treasury auctions.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.