Gold Price Forecast: XAU/USD bulls move in at key H4 support

- Gold price bulls holding the fort at a critical support area.

- Gold price bulls eye a break of $2,020 for prospects to $2,050.

- Gold price traders eye US Consumer Price Index for the next clues with regard to Federal Reserve interest rates.

Gold price finished the day on Tuesday tailing off from the New York session highs that were put in on a soft US Dollar ahead of Wednesday's US inflation report. Holiday markets made for a mixed day as traders wait in anticipation of the main event for the week making for uneven price action across the asset classes.

The Greenback gave back the bulk of Easter Monday's gains after the robust Nonfacr Payrolls report released on the Good Friday holiday cemented the notion that the Federal Reserve has one more rate hike left in its toolbox. The job numbers showed that employers added 236,000 jobs while the unemployment rate fell to 3.5%. This has led the market to believe that the Federal Reserve will hike rates by an additional 25 basis points at its May 2-3 meeting, before pausing in June. Markets are also pricing for the Fed pivot where a rate cut by year-end could be on the cards to combat the risks of a recession.

US Consumer Price Index will be key

In this regard, the March Consumer Price Index inflation data will be closely watched to see if it is near the 6% annualized rate reported in February, which would likely mean higher interest rates are coming from the central bank. However, analysts at TD Securities argued that core prices likely cooled off modestly in March, with the index still rising a strong 0.4% MoM, as they look for recent relief from goods deflation to turn into inflation this month. ´´Shelter prices likely remained the key wildcard, while slowing gas prices and softer food-price gains will likely dent non-core inflation,´´ they said. ´´Our MoM forecasts imply 5.1%/5.6% YoY for total/core prices.´´

We will also get the minutes of the Federal Open Market Committee, FOMC, on Wednesday and the analysts at TD Securities explained that the rate hike at the March FOMC meeting was widely viewed as dovish.´´ The analysts added that ´´the distribution of the March dot plot for 2023, however, suggested a more hawkish sentiment across the FOMC. With banking stress now appearing to be somewhat contained, the minutes for this meeting might emphasize this hawkish sentiment given continued elevated inflationary pressures.´´

Overall, with the June Federal Open Market Committee, FOMC, meeting remaining in play for a final 25bp rate increase, investors will have lightened their exposure to the Gold price in anticipation of profit-taking. However, as the analysts at TDS argued, ´´with Wednesday´s CPI print top of mind, the market has been unwilling to convincingly break lower, with CTAs needing to see prices below $1980/oz to further reduce length.´´

As for Federal Reserve chatter, the officials continue to stress that the central bank's policy path will depend on incoming data. For instance, Chicago Fed President Austan Goolsbee said the Fed should be cautious about raising rates in the face of recent banking stress. Meanwhile, New York Fed President John Williams explained that the prospect of the Fed raising its benchmark interest rate only once more and in a 25 basis point increment is a useful starting point.

Gold price technical analysis

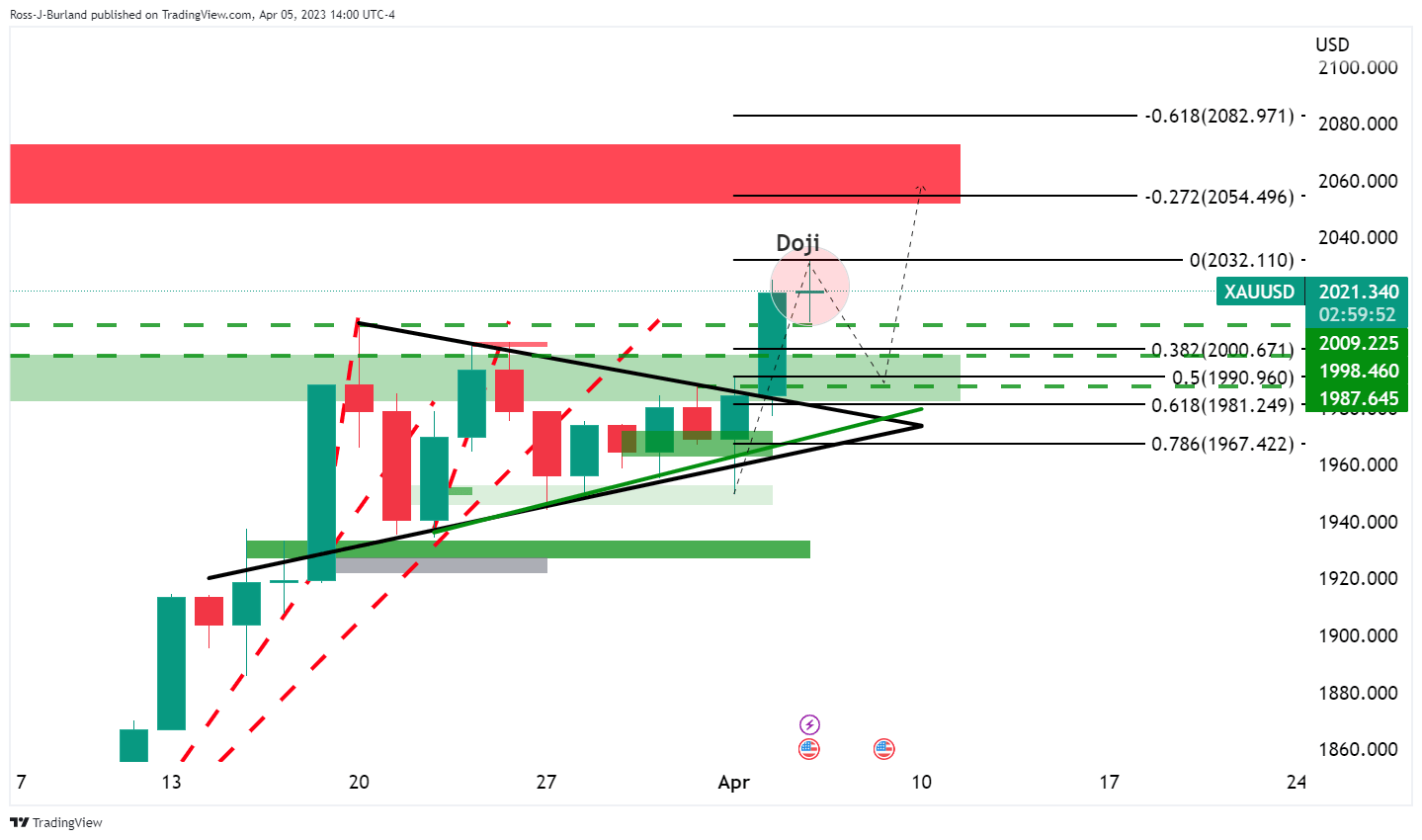

In a series of analyses for Gold price tracking the live Gold price market, it stated the following:

´´The Gold price doji is a stalling candle and it could be followed by a bearish engulfment on Thursday that could give way to the prospects of a move lower in the Gold price as the bias. However, so long as the Gold price bulls stay committed, this bullish cycle will have further to run for the Gold price.´´

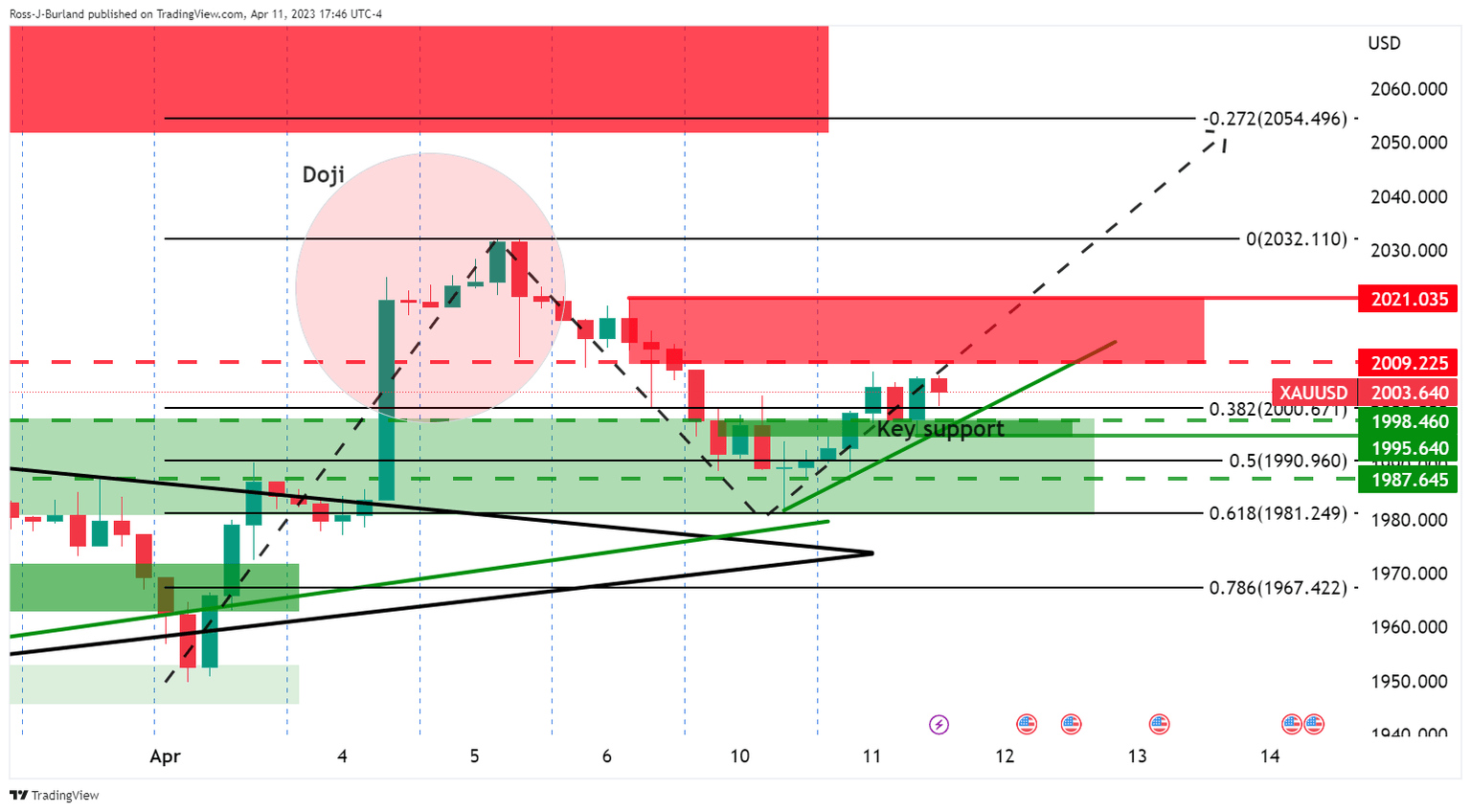

Gold price update, live chart

We are seeing the Gold price bulls commit to the support area with the $2,050s on the radar.

Gold price H4 chart

The Gold price four-hour chart shows that the bulls are holding the fort at key support with $2,010/20 now eyed as the next major Gold price resistance area guarding $2,050.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.