- The FOMC minutes failed to underpin the greenback and the gold price is attempting to rally.

- The gold price is breaking out of the correction's dynamic resistance and bulls eye the prior highs near $1,865 for the sessions ahead.

- Breaking: FOMC Minutes sink the US dollar a touch despite inflation risk skewed to the upside

At $1,851, the price of gold is down around 0.8% on the day as the US dollar breaks higher from a two-day losing streak on Wednesday. The yellow metal has slid from a low of $1,841.60 to a high of $1,868.11 so far on the day but has found some solace on the basis that there has been no mention of larger rate increases within the Federal Open Market Committee minutes of the May meeting.

The minutes that came out at 2 p.m. EDT (1800 GMT) failed to support the US dollar any higher on the day so far. The greenback slid on the release within a 102.449 and 101.728 range for the day. In his most hawkish of questions and answers, the US Federal Reserve Chair Jerome Powell told the Wall Street Journal that he was adamant that the central bank would continue hiking rates until there is clear and convincing evidence that inflation is under control.

"In particular, Chair Powell has reiterated on several occasions the Fed's guidance of implementing additional 50bp rate hikes at the June and July FOMC meetings, and we expect the May meeting minutes to provide further colour about those plans," strategists from TD Securities explained.

However, the minutes lacked any mention of a faster pace of larger rate increases which has given risk appetite a boost in the late New York session. All three major US stock indexes fluctuated earlier in the session amid concerns about a cooling economy, but in recent trade, the benchmarks are tracking higher on the day to session highs. The S&P 500 is now over 1% in the green while the Dow is up around 0.7% with the NASDAQ printing 1.41% higher. US 10-year Treasury yields, which hit 3-1/2-year highs earlier in May, have since fallen back towards the six-week lows printed earlier on Wednesday after data showed new orders for US-made capital goods rose less than expected in April.

The dollar was already under pressure prior to Wednesday's recovery due to the European Central Bank chief Christine Lagarde flagging an end to negative interest rates in the eurozone in the third quarter. Her comments have implied an increase of at least 50 basis points in the deposit rate and fueled speculation of bigger hikes this summer. This too is giving the gold bugs some relief.

Analysts at TD Securities, however, warn that ''the recovery in the yellow metal remains on shaky ground as Fed Chair Powell signalled a willingness to sacrifice some economic growth in an effort to tame inflation, suggesting the Fed is comfortable with more pain before taking the foot off the brake, which should ultimately still weigh on precious metals.''

''In the midst of the latest bounce, the number of traders long the yellow metal remains elevated, while the breadth of traders short has just started to rise from near-record lows, highlighting there is still plenty of positioning to be unwound should the Fed remain steadfastly hawkish.''

Gold technical analysis

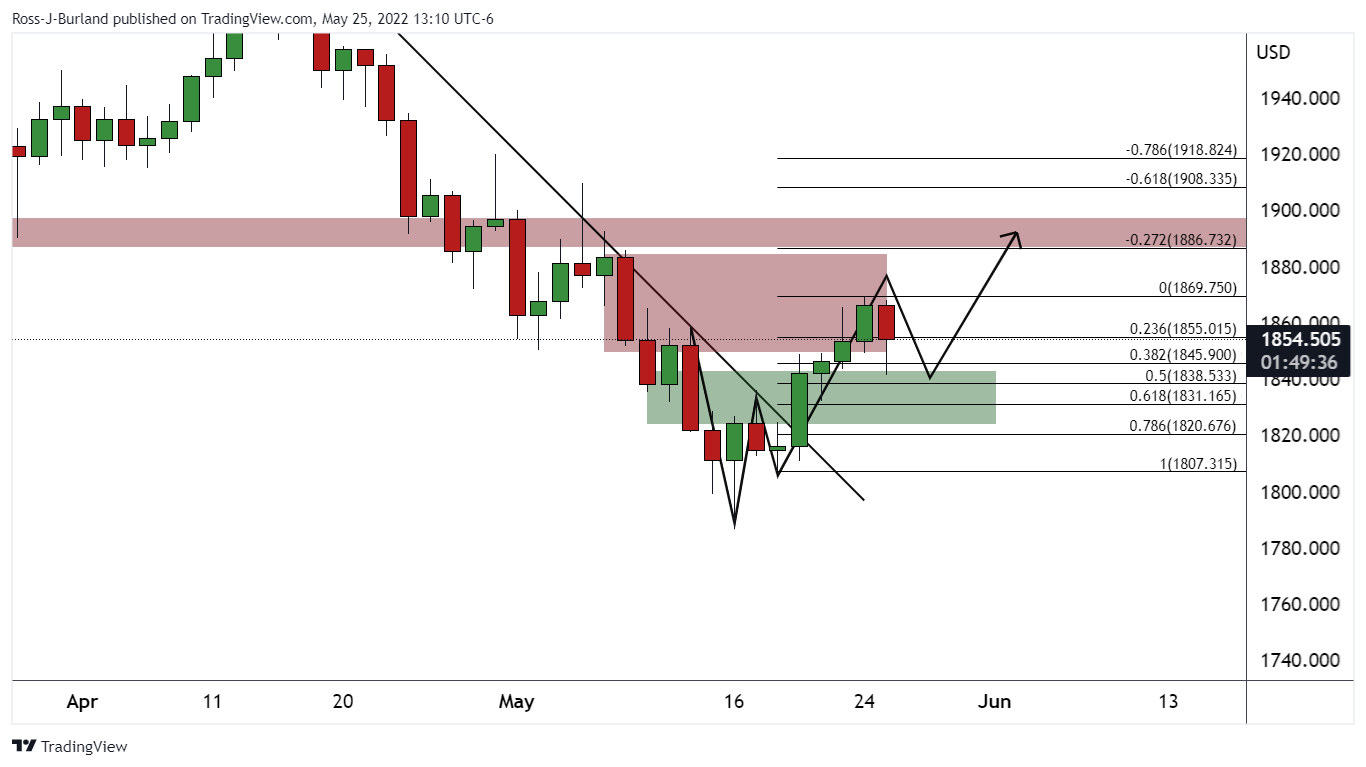

As per the prior analysis, Gold Price Forecast: XAU/USD bulls stay on top, but bears lurking at daily resistance, the price has moved in towards the daily support as follows:

Gold daily chart, prior analysis

It was stated that ''gold is trapped between daily support and resistance still but is making headway. However, the W-formation is a reversion pattern that could leave the price trapped in the sideways channel for the days ahead. If, however, there is a break one way or the other, of the current support and resistance, then the price imbalances to $1,883 on the upside and $1,780 to the downside could be mitigated.''

Gold live market

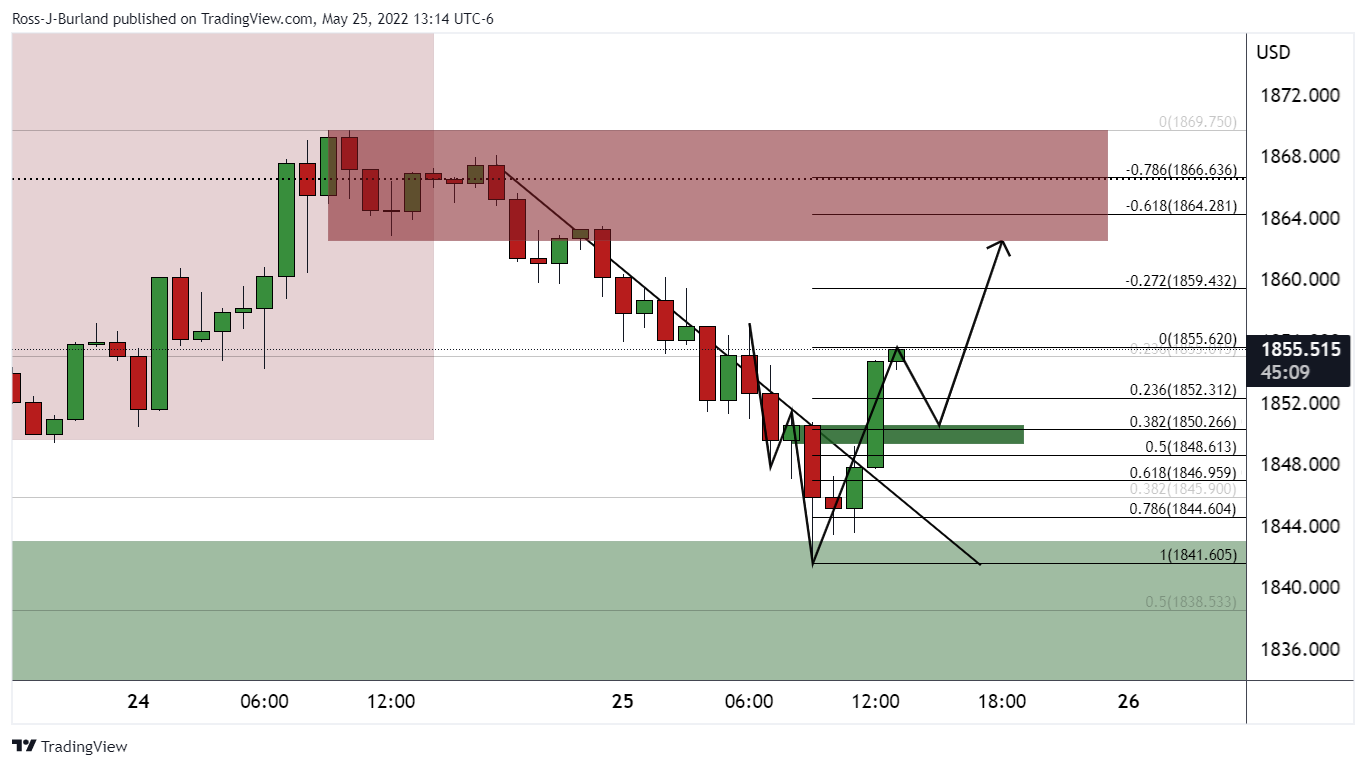

As illustrated, the price has moved in on the support in a 38.2% Fibonacci retracement. At this juncture, the lower time frames can be monitored for signs of a deceleration of the bearish correction:

As per the hourly chart, the price is breaking out of the correction's dynamic resistance and a restest of the W-formation's neckline could result in the bulls claiming a discount for a move higher towards the prior highs near $1,865 for the sessions ahead.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD trades sideways below 1.0450 amid quiet markets

EUR/USD defends gains below 1.0450 in European trading on Monday. Thin trading heading into the Xmas holiday and a modest US Dollar rebound leaves the pair in a familiar range. Meanwhile, ECB President Lagarde's comments fail to impress the Euro.

GBP/USD stays defensive below 1.2600 after UK Q3 GDP revision

GBP/USD trades on the defensive below 1.2600 in the European session on Monday. The pair holds lower ground following the downward revision to the third-quarter UK GDP data, which weighs negatively on the Pound Sterling amid a broad US Dollar uptick.

Gold price sticks to modest gains; upside seems limited amid USD dip-buying

Gold price attracts some follow-through buying at the start of a new week and looks to build on its recovery from a one-month low touched last Thursday. Geopolitical risks stemming from the protracted Russia-Ukraine war and tensions in the Middle East, along with trade war fears, turn out to be key factors benefiting the safe-haven precious metal.

Bitcoin fails to recover as Metaplanet buys the dip

Bitcoin hovers around $95,000 on Monday after losing the progress made during Friday’s relief rally. The largest cryptocurrency hit a new all-time high at $108,353 on Tuesday but this was followed by a steep correction after the US Fed signaled fewer interest-rate cuts than previously anticipated for 2025.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.