Gold Price Forecast: XAU/USD bulls move in as US yields slide into the close

- Gold is holding up in the face of stronger stocks despite a firm US dollar.

- US yields slide into the closing hour of the US session.

Gold prices have been pushed and pulled on Wednesday, oscillating in and out of the hands of bulls and bears. At $1,765, the yellow metal is trading between $1,754.35 and $1,772.83, trading in the green by some 0.27%.

In futures, gold for December delivery closed down US$13.30 to settle at US$1,776.40 per ounce as US bond yields rose along with the greenback. While there is some relief over geopolitical worries that have eased since US House Speaker Nancy Pelosi ended her visit to Taiwan, there remains an underbelly of risk-off in markets with the Asian power boosting military activity around Taiwan to show its displeasure with Pelosi's move.

Earlier in the day, US Treasuries continued yesterday’s sell-off as markets are digesting the comments from Federal Reserve speakers that the central bank’s job on containing inflation isn’t done yet. ''The short covering rally is running out of steam. Fed Chair Powell catalyzed a short covering rally by tying another "unusually large" 75bp hike to data, which places a high bar for another jumbo-sized hike given the slowing trend in data,'' analysts at TD Securities said.

''However, on the other hand, we see risks that Fed speakers can push back against market expectations for an early Fed pivot. In that sense, the yellow metal may be hard pressed to receive another bullish catalyst that would spark a change in momentum trend signals and see CTAs cover their shorts.''

US yields give back gains

On the day, stronger US data also helped the move in US yields, bearish for gold since it offers no interest. However, the yield on the US 10-year note was last around 2.708%, down from the highs of 2.849% which enabled the yellow metal to climb in the remaining hour of the US forex session into the roll-overs. At the same time, equities pushed higher, helped by solid earnings results and stronger data. US factory orders for June were stronger than expected, rising 2% MoM vs. the expected: 1.2% and prior 1.8%. Durable goods orders also beat expectations, rising 2% vs. the expected 1.9% and previous 0.9%. Meanwhile, US Services ISM beat expectations, rising to 56.7 vs. the expected 53.5 vs. the previous 55.3. ''Taken together, the data may unwind some of the more negative sentiment that has surrounded the outlook for the US economy of late,'' analysts at ANZ Bank said.

Meanwhile, the analysts at TD Securities argued that ''gold markets are faced with a massive amount of complacent length held by prop traders, which still hold the title as the dominant speculative force in gold. We have yet to see capitulation in gold, suggesting the pain trade is still to the downside and we expect the recent rally will ultimately fade.''

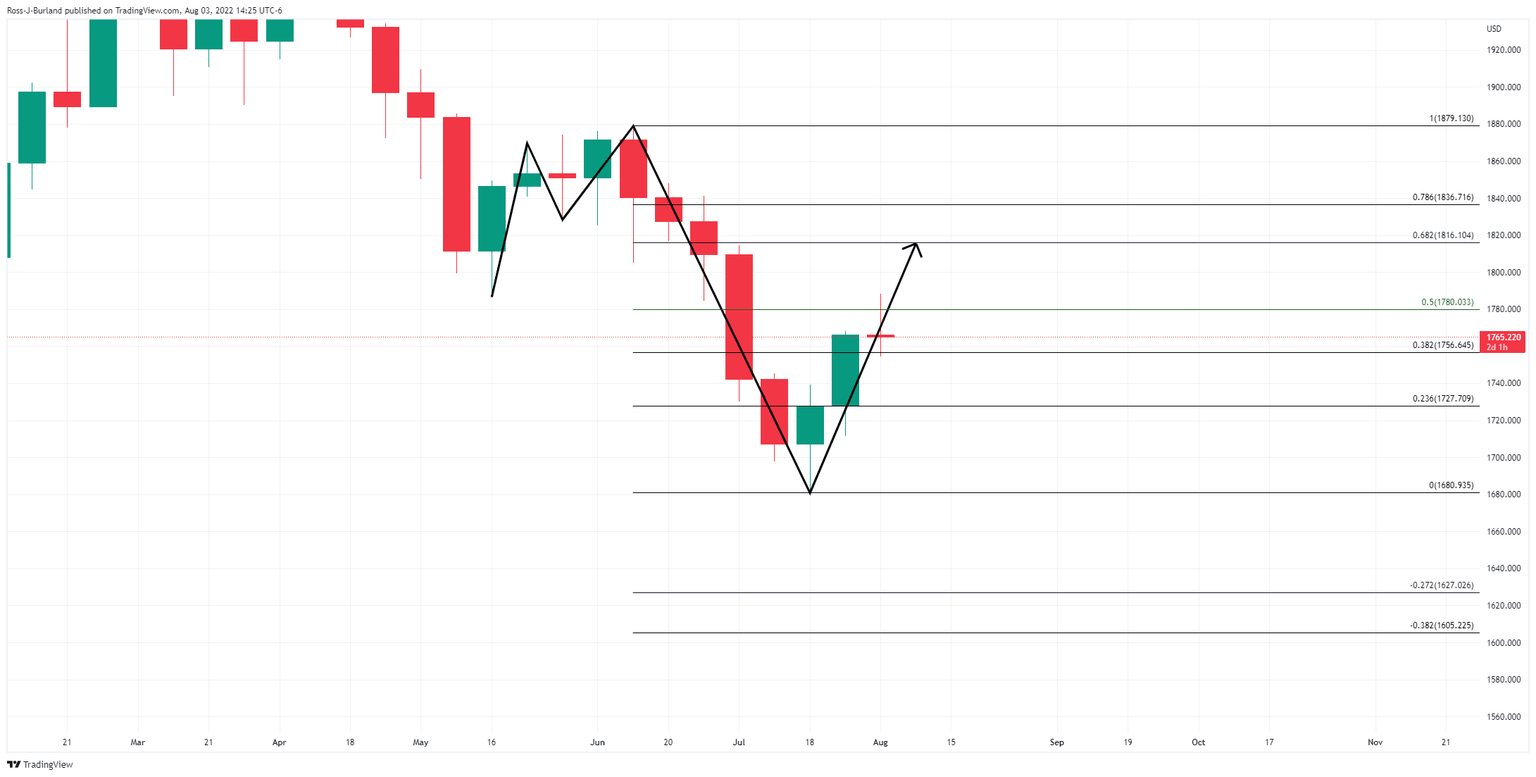

Gold technical analysis

As per the prior analysis, Gold Price Forecast: XAU/USD bulls are back in play, it was explained that the price was running higher in a correction of the weekly M-formation:

The grey area was a price imbalance that has now been mitigated by a 50% mean reversion:

There are prospects for further upside with the 68.2% Fibonacci meeting prior structure around $1,800. However, there is some mean while resistance to break on the 4-hour chart as follows:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.