Gold Price Forecast: XAU/USD bulls move back in, market remains coiled

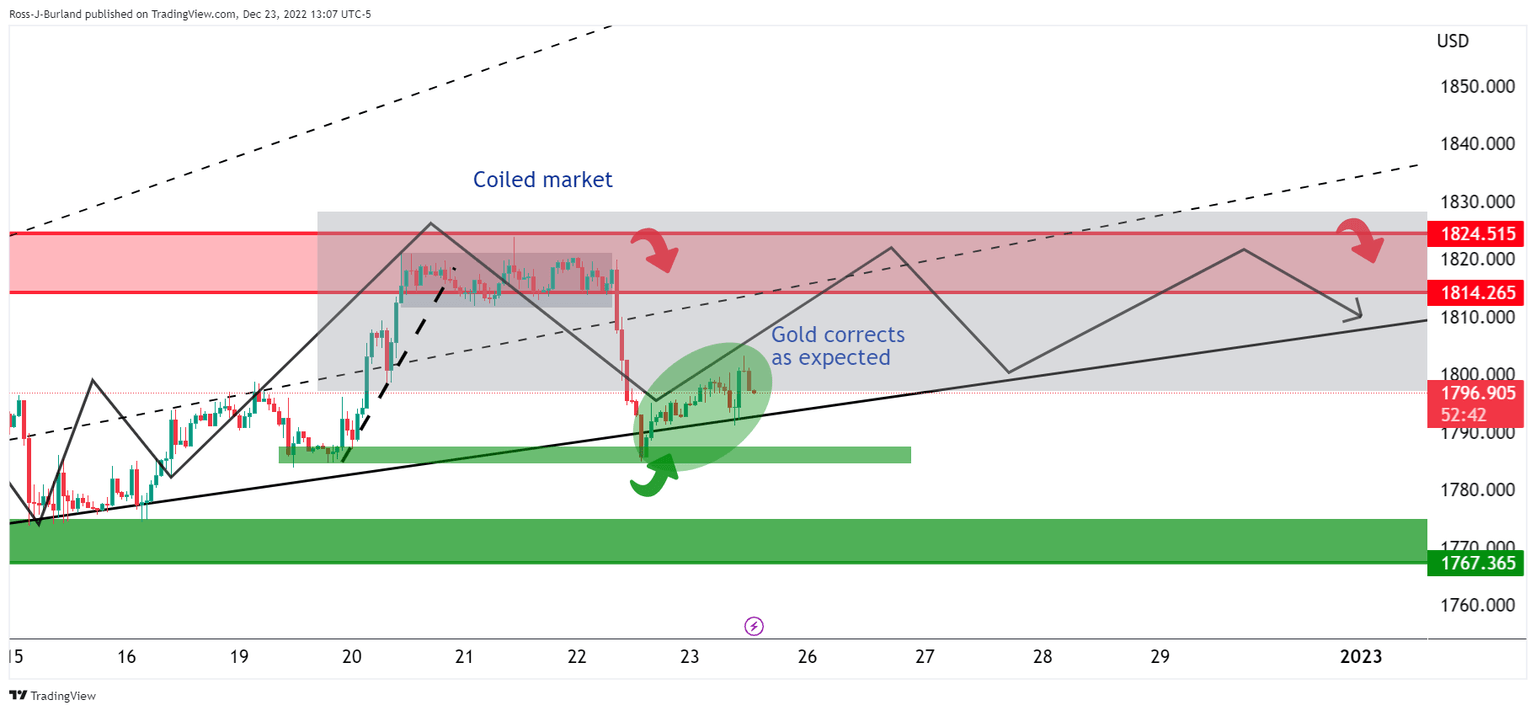

- The Gold price is back in line with the coil and would be expected to continue higher or at least stay sideways.

- Failing this, then an even deeper move in Gold price would be on the cards for the days ahead with $1,775 eyed.

As per the prior day's analysis, Gold Price Forecast: XAU/USD bulls need to commit at key trendline support, the Gold price has found demand at the said support area and has moved back into line with the broader bullish trend. Gold price edged up on Friday ahead of the Christmas holidays and long weekend and was supported by cooling inflation data in Friday's data storm.

US consumer spending glided 0.1% higher in November after climbing 0.4% in October, in a sign that inflation is cooling, although not as much as markets need to see to start to expect a pivot from the Federal Reserve or a slowdown in their rate-hike path. Year-over-year, (YoY), the Personal consumption expenditures index, (PCE), landed at 5.5%, a half-percent cool-down from October. Stripping away volatile food and energy prices, the index was up on monthly and annual bases by 0.2% and 4.7%, respectively, in-line with consensus. The bad news for Gold price is that the October PCE inflation data was upwardly revised.

US Gross Domestic Product data on Thursday and Jobless Claims also highlighted the country's economy rebounded faster than previously estimated and that the jobs market remains very tight. All in all, the slew of data does little to turn the tables with regard to speculation that the Fed will stay the course to fight inflation in 2023. Such rate hikes to tame price pressure weigh on the non-yielding asset that pays no interest which is now on track for a second consecutive yearly decline.

Fed will have to do more

Analysts at Brown Brothers Harriman said markets still don't believe the Fed. ''After rising as high as 5.5% after the most recent FOMC meeting, the terminal rate as seen by the swaps market has fallen back to around 5.0%,'' the analysts explained. ''Similarly, WIRP suggests a 50 bp hike February 1 is only 33% priced in, followed by a final 25 bp hike March 22. We cannot understand why the markets continue to fight the Fed. With the exception of some communications missteps here and there, chair Jerome Powell and company have been resolute about the need to take rates higher for longer. Recent US data confirm that the labor market remains strong and that the Fed will have to do more.''

Gold price technical analysis

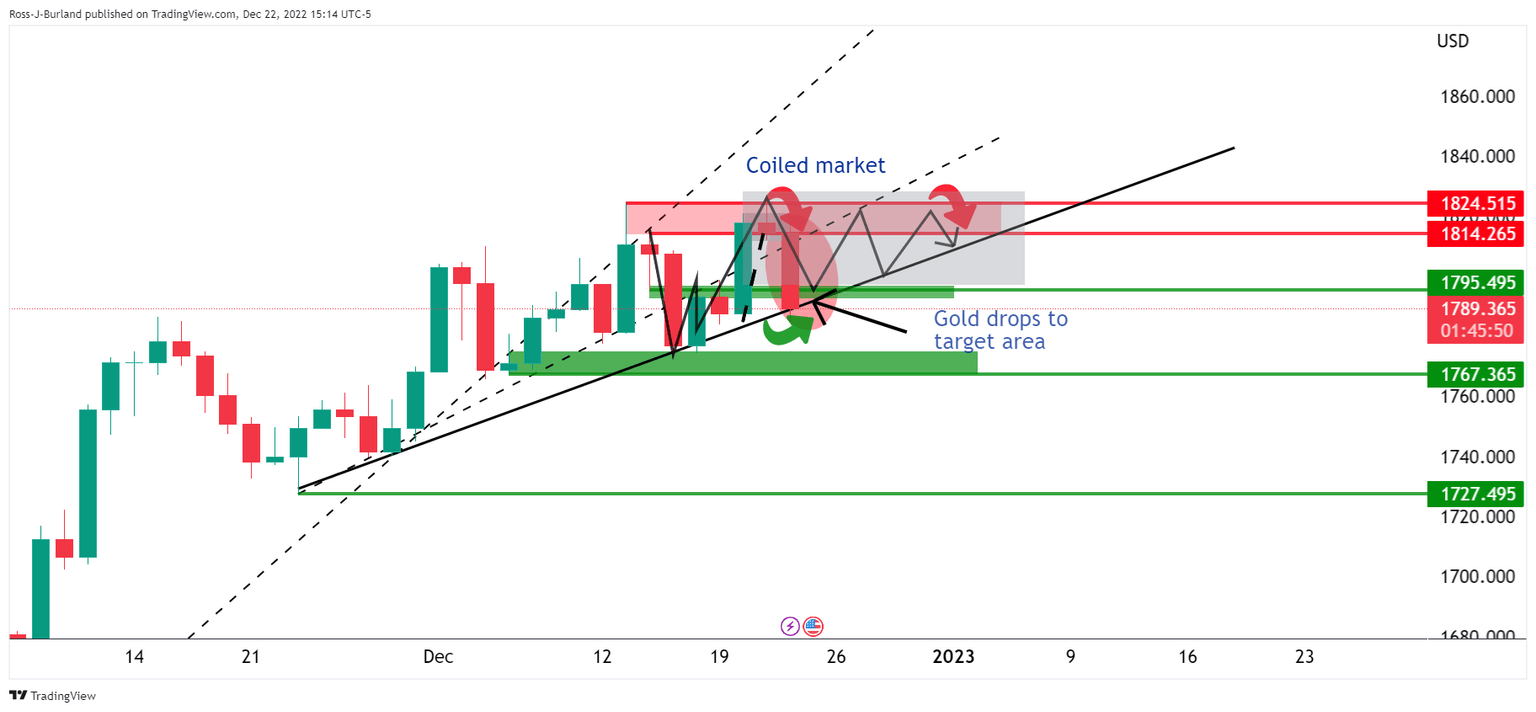

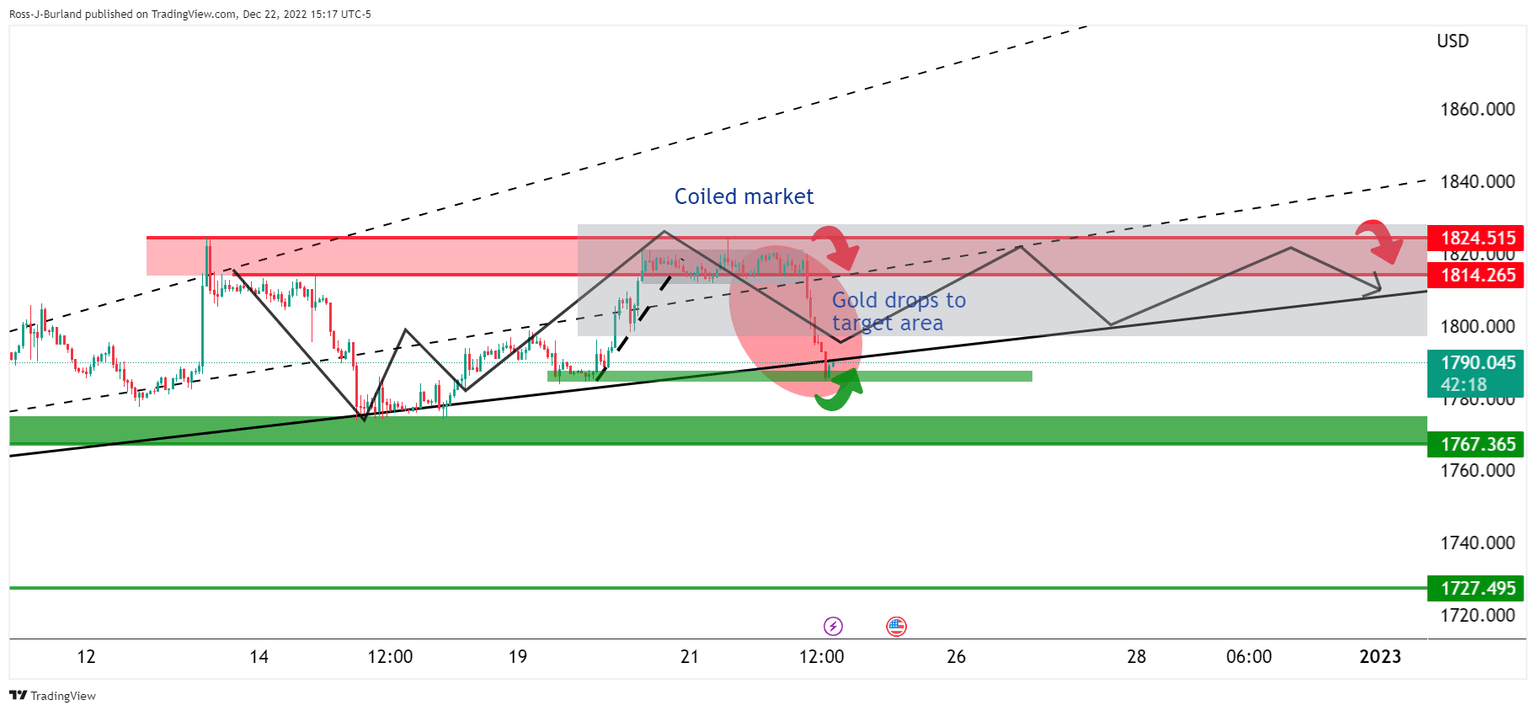

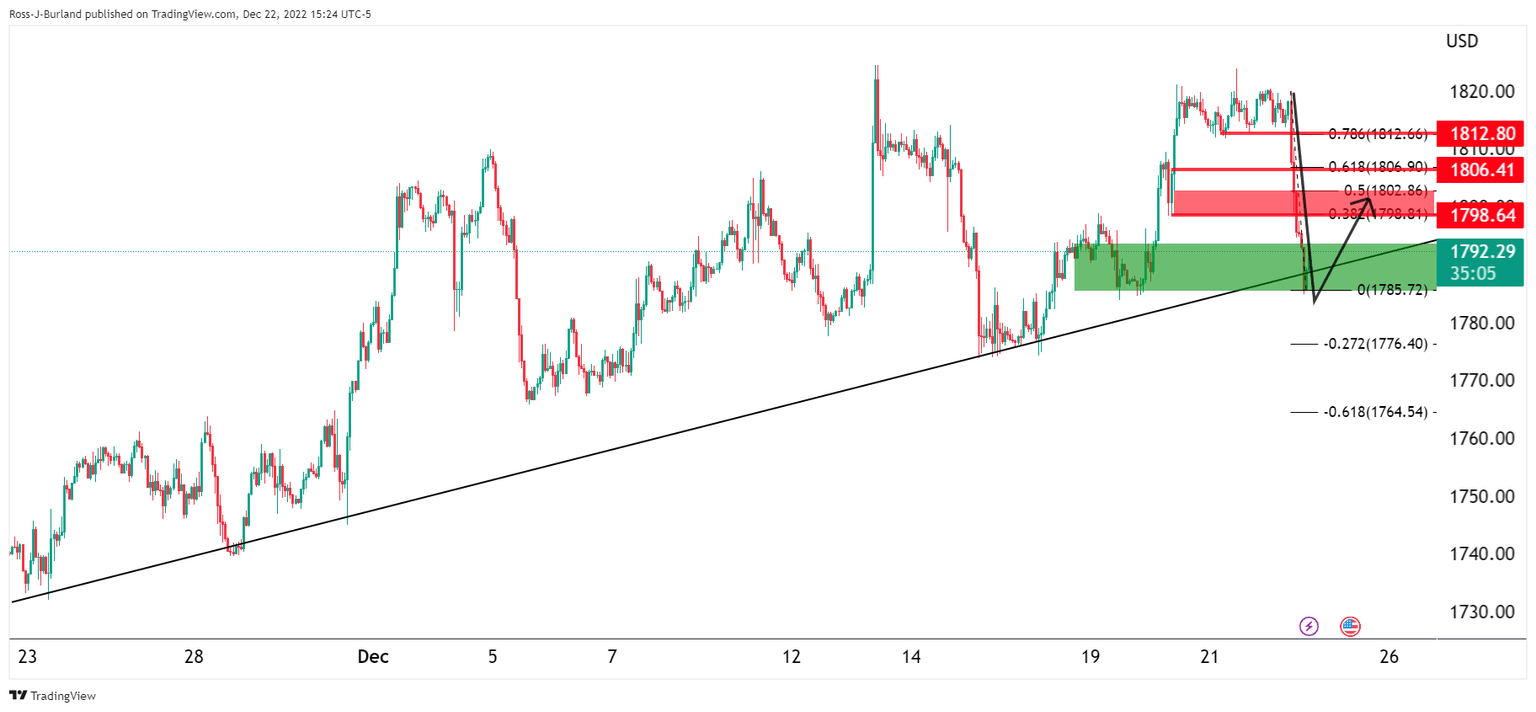

In the prior analysis, the Gold price dropped to the targetted area and exceeded it into the $1,784s for a 300% measured move and to where the prior micro trend started off at:

It was stated that a correction in the Gold price would be expected, respecting the bullish trend:

Gold price update

The Gold price is back in line with the coil and would be expected to continue higher or at least stay sideways. Failing this, then an even deeper move in Gold price would be on the cards for the days ahead, making the case for a significant downside correction with $1,775 eyed.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.