Gold Price Forecast: XAU/USD bulls keep the reins beyond $1,917 – Confluence Detector

- Gold price renews nine-month high while staying comfortably beyond $1,917 support confluence.

- US Dollar weakness, mixed sentiment allows XAU/USD bulls to keep the reins amid China’s off, Fed blackout.

- First readings of January’s PMI will direct intraday moves but US Q4 GDP will be more important to guidance.

Gold price (XAU/USD) refreshes a nine-month high as it picks up bids to $1,940 during the initial hour of Tuesday’s European session. In doing so, the bright metal cheers broad US Dollar weakness, as well as hopes of more demand from China, ahead of the monthly activity data. It’s worth noting that the cautious mood ahead of the key preliminary activity data from the US, Eurozone and the UK seemed to have put a floor under the Gold price of around $1,917.

Also read: Gold Price Forecast: XAU/USD eyes $1,942 and global PMIs for further upside

Gold Price: Key levels to watch

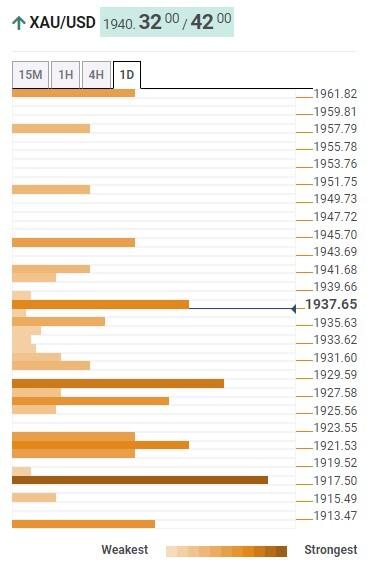

The Technical Confluence Detector shows that the Gold price grinds higher past the $1,917 support confluence including the Pivot Point one-day S1 and Pivot Point one-month R3.

That said, a convergence of the Fibonacci 23.6% on one-week, 50-HMA and the middle band of the Bollinger on the hourly play, around $1,930, appears immediate support for the Gold traders to watch.

It should be noted that a downside break of the $1,917 support confluence opens the door for Gold’s south-run towards the $1,900 threshold.

Alternatively, Pivot Point one-week R1 close to $1,945 appears the nearby hurdle for the XAU/USD bulls to aim for.

Following that, there prevails an empty road for the buyers to ride ahead of the April 2022 peak surrounding $1,966.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.