- Gold price struggling to find demand amid a pause in the US Dollar downside.

- Market mood turns cautious while US Treasury yields hover near weekly troughs.

- With the Fed Minutes out of the way, all eyes remain on US employment data.

Gold price is looking to build on the previous rally above $1,850, as bulls gather pace for the next push higher. The bright metal is struggling to find fresh demand, as investors turn cautious and flock to safety in the US Dollar. Meanwhile, the US Treasury bond yields are holding near weekly lows, limiting any downside for Gold buyers. The US Dollar incurred steep losses on Wednesday, as the mixed US ISM Manufacturing PMI data and US Federal Reserve (Fed) Minutes failed to impress. Even though the Fed Minutes showed that the officials are committed to fighting inflation and expect higher interest rates to remain in place, markets continue pricing a dovish Fed pivot by the end of 2023, as recession risks amplify. Attention now turns toward the US employment data, as it will provide further insight into the Fed’s policy path this year.

Also read: XAU/USD outlook: Bulls accelerate on expectations for more dovish Fed

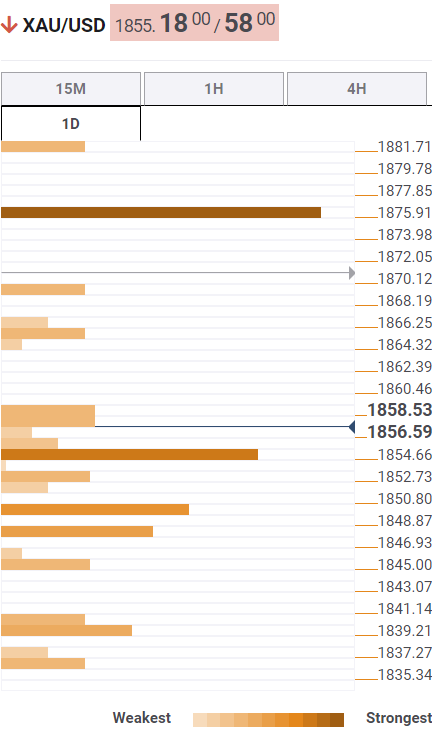

Gold Price: Key levels to watch

The Technical Confluence Detector shows that the gold price is challenging the bullish commitments at $1,854, which is the convergence of Fibonacci 38.2% one-day and pivot point one-week R2.

A firm break below the latter will call for a test of the pivot point one-month R1 at $1,850. The next immediate support is seen at the Fibonacci 61.8% one-day at $1,847.

The last line of defense for Gold buyers is placed at the Bollinger Band one-day Upper at $1,845.

Alternatively, if buyers regain momentum, then the Fibonacci 23.6% one-day at $1,857 will offer stiff resistance.

The next upside target is envisioned at the $1,860 round number, above which the previous day’s high at $1,865 will be put to test.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD extends recovery beyond 1.0400 amid Wall Street's turnaround

EUR/USD extends its recovery beyond 1.0400, helped by the better performance of Wall Street and softer-than-anticipated United States PCE inflation. Profit-taking ahead of the winter holidays also takes its toll.

GBP/USD nears 1.2600 on renewed USD weakness

GBP/USD extends its rebound from multi-month lows and approaches 1.2600. The US Dollar stays on the back foot after softer-than-expected PCE inflation data, helping the pair edge higher. Nevertheless, GBP/USD remains on track to end the week in negative territory.

Gold rises above $2,620 as US yields edge lower

Gold extends its daily rebound and trades above $2,620 on Friday. The benchmark 10-year US Treasury bond yield declines toward 4.5% following the PCE inflation data for November, helping XAU/USD stretch higher in the American session.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.