- Gold is firm into the close of the US forex session as the US dollar sheds some points.

- US yields are under pressure following the Fed and gold bulls are back in play.

At $1,756.64, gold prices continue to rise on Thursday even as the US dollar attempted a comeback. However, bond yields remain on the backfoot following the Federal Reserve's dovish tilt on Wednesday. At the time of writing, XAU/USD is 1.25% higher after climbing from a low of $1,734.18 to reach $1,757.06 the high of the day.

Bad news was good news for US stocks on Thursday stocks, which have extended their bullish recovery following disappointing US growth data that has added to the dovish sentiment surrounding the path of rate hike expectations from the Fed. US second quarter Gross Domestic Product came in weaker than expected, declining 0.9% in SAAR terms (exp: +0.4%, prev: -1.6%). However, while technically, this meets the two-quarters of negative growth definition of a recession, analysts at ANZ bank argue that the details were a little stronger than the headline number suggests.

''A lot of the weakness came from inventories which subtracted 2%pts from the headline figure. Personal consumption growth was positive, rising 1%, but still underwhelming expectations (exp: 1.2%, prev: 1.8%). Private fixed investment was weak, declining 3.9%.'' However, ''all up'', the analysts say, ''it was still a disappointing report, even when accounting for the outsized influence of the inventories number (which the Fed may be inclined to disregard as noise). This will only fuel the current concern markets have about a slowdown in US economic activity.''

Meanwhile, the analysts noted that ''Initial Claims were weaker than expected, at 256k. But that came as last week’s number was revised higher. Overall, claims are still at levels that are too low to suggest a deterioration in the labour market is imminent – a key ingredient for a fundamental recession in the US.''

The US dollar was higher following the data, although the bears moved in later in the session and the DXY is currently trading at the lows of the day. DXY has fallen from a high of 106.975 to a low of 106.059. Nevertheless, bond yields dropped, bullish for gold since it offers no interest. The US 10-year note was last seen paying as low as 2.649%, down by over 3.8%.

Meanwhile, the bar for CTA short covering in gold is declining, analysts at TD Securities argued. ''Given the slowing trend in data, Chair Powell's forward guidance tying another "unusually large" 75bp hike to data placed a high bar for another jumbo-sized hike, which gave a green light for a short squeeze in risk assets associated with pervasively negative sentiment.''

The analysts agued that ''as a short covering rally ensues across global markets, the likelihood for a CTA buying program in gold has risen, given that prices need only close north of $1780/oz to spark a change in trend signals.''

However, the analysts continue to caution that gold markets are faced with a massive amount of complacent length held by prop traders, which still hold the title as the dominant speculative force in gold.

''We have yet to see capitulation in gold, suggesting the pain trade is still to the downside and that the recent rally will ultimately fade when faced with a wall of offers.''

Gold technical analysis

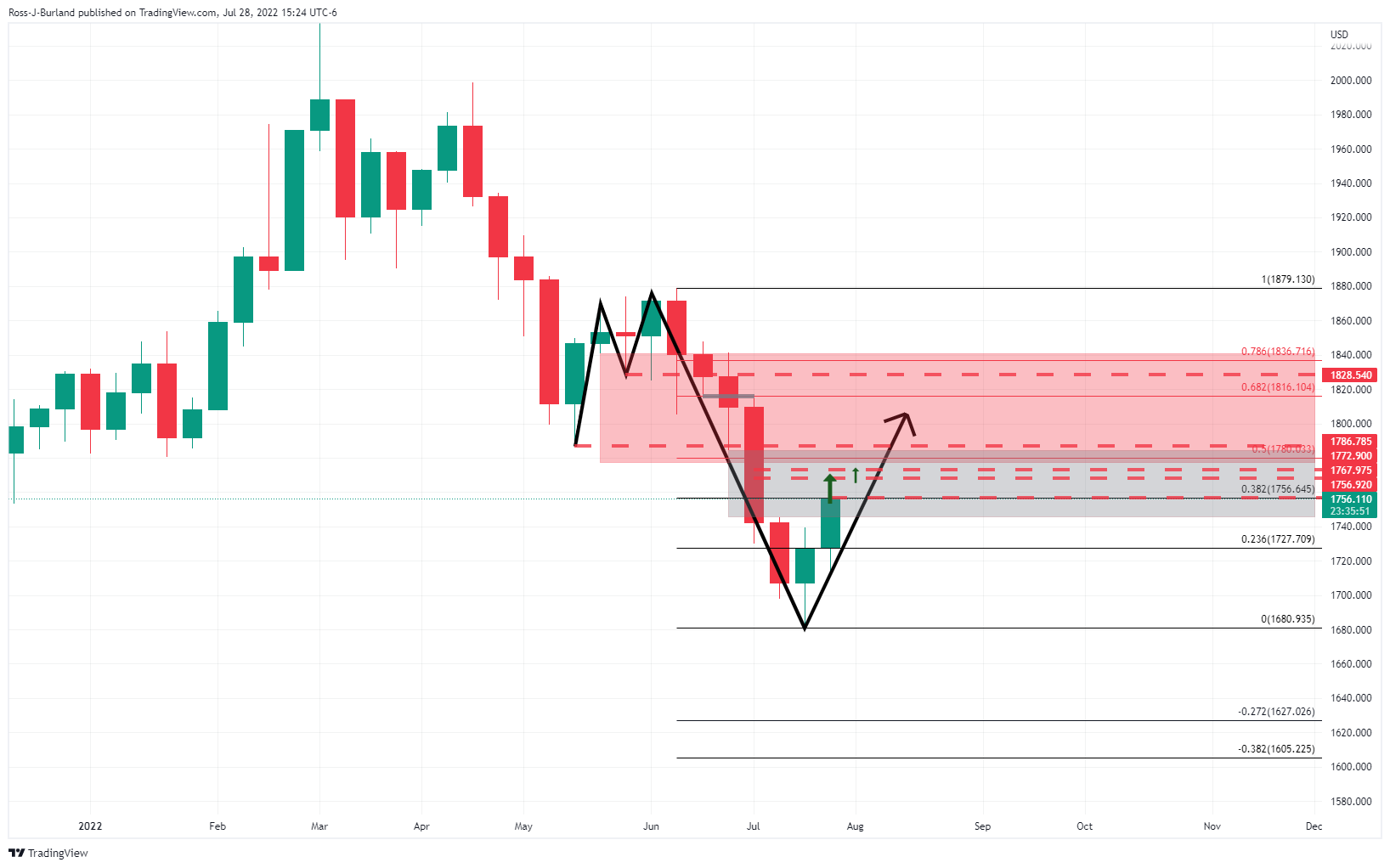

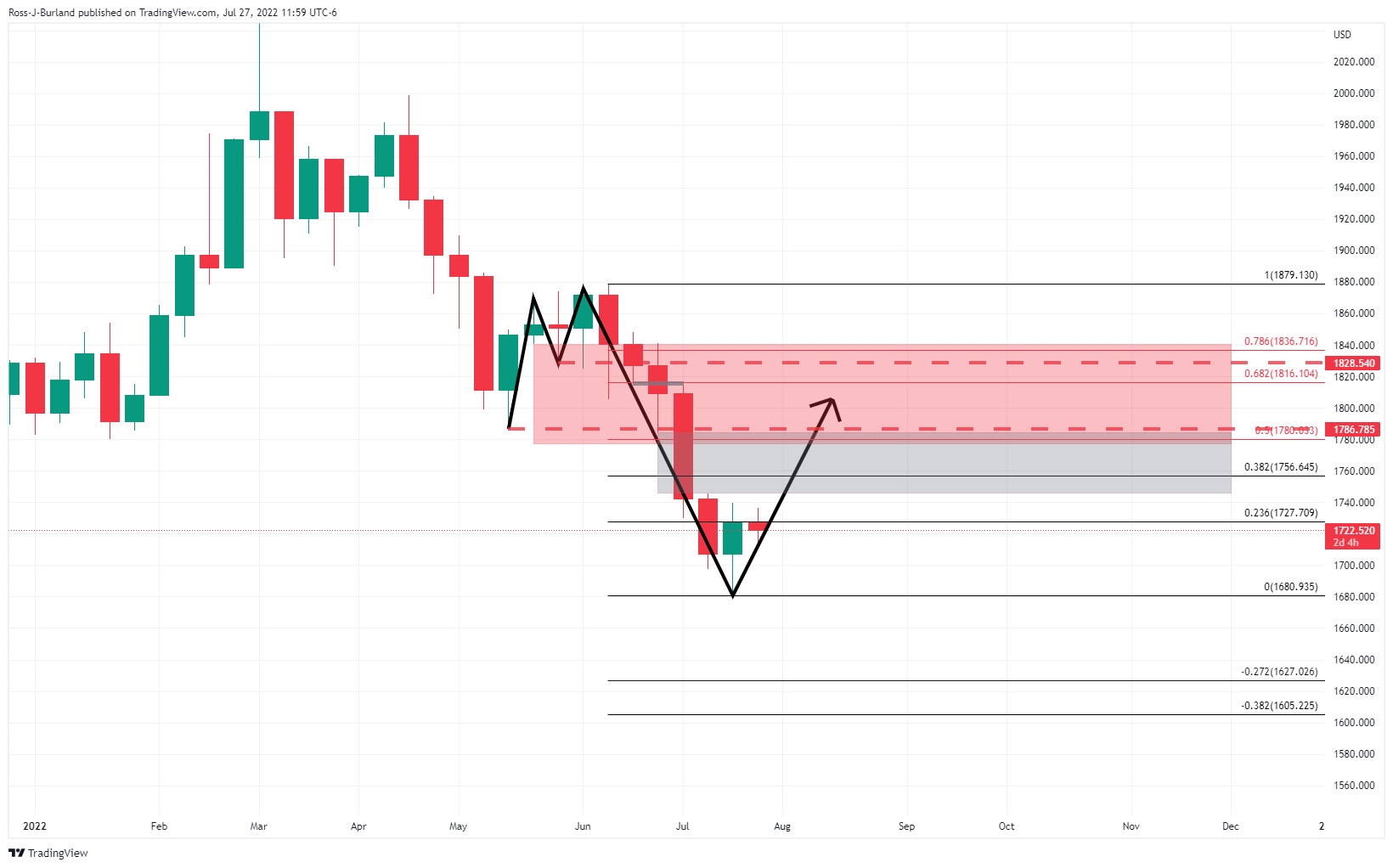

As per the pre-Fed analysis, the price of gold is running higher:

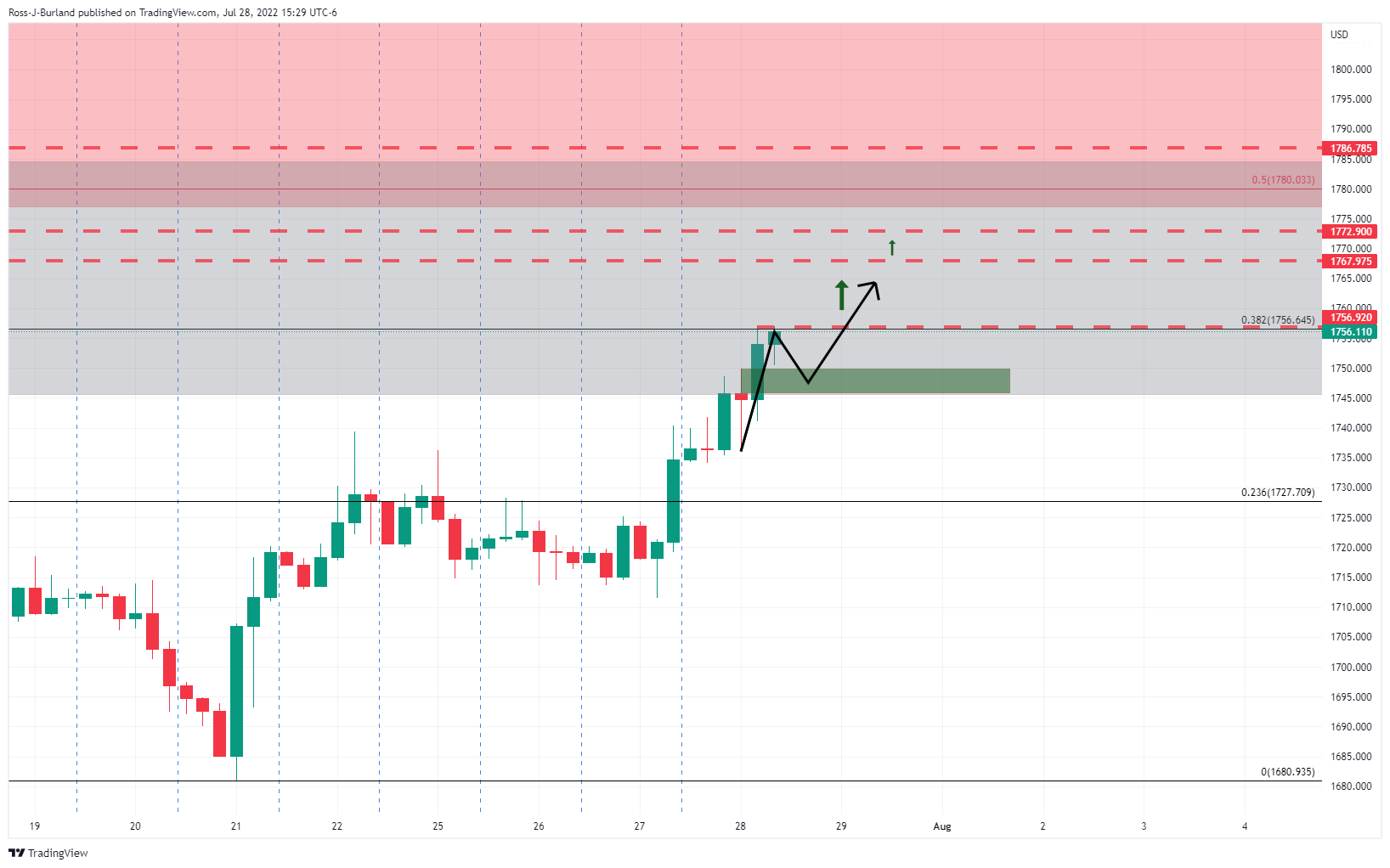

From a 4-hour perspective, the price needs to break above $1,756 for a run to $1,768 and beyond:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

Gold nears $3,400; fresh record highs and counting amid USD sell-off

Gold price closes in on $3,400 as the record rally regains strength on Easter Monday. Concerns over US-China trade war escalation and the Fed’s independence smash the US Dollar to three-year troughs. RSI stays overbought on the daily chart, with thin volumes likely to exaggerate moves in Gold price.

EUR/USD extends rally toward 1.1600 as US Dollar keeps falling

EUR/USD trades roughly 1.5% higher so far this Monday as the relentless US Dollar selling drives it toward the 1.1600 threshold - the highest level since November 2021. Growing concerns over a US economic recession and the Federal Reserve’s autonomy continue to exert downward pressure on the USD.

GBP/USD surges past 1.3400 on intense US Dollar weakness

GBP/USD continues its winning streak, recapturing 1.3400 in European trading on Monday. The extended US Dollar weakness, amid US-Sino trade war-led recession fears and heightened threat to the Fed's independence, continue to underpin the pair. Thin trading is set to extend.

How to make sense of crypto recovery – Is it a buy or fakeout

Bitcoin (BTC), Ethereum (ETH) and XRP, the top three cryptocurrencies by market capitalization, extend their last week’s recovery on Monday, even as trader sentiment is hurt by the US President Donald Trump’s tariff policy and announcements.

Five fundamentals for the week: Traders confront the trade war, important surveys, key Fed speech Premium

Will the US strike a trade deal with Japan? That would be positive progress. However, recent developments are not that positive, and there's only one certainty: headlines will dominate markets. Fresh US economic data is also of interest.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.